UK

Commercial

Property

Monitor

Q4 2023

ECONOMICS

ECONOMICS

Occupier and investor demand still subdued although

forward-looking sentiment improves marginally

The Q4 2023 RICS UK Commercial Property Monitor results

continue to portray a market struggling for momentum,

even if most of the indicators tracked in the survey have

improved slightly (or turned less negative) relative to the

previous report. In keeping with this, although views remain

mixed, the largest share of respondents (33%) now sense the

market has reached the bottom of the current cycle, which

represents modest increase on the 24% who were of this

opinion last quarter.

Occupier Market

The all-property aggregate measure of occupier demand

posted a net balance reading of -7% in Q4. Although slightly

less negative than fi gures of -12% and -10% seen in Q3 and

Q2 respectively, the latest feedback remains consistent with a

generally subdued trend in headline tenant demand. Looking

at the sector breakdown, both the offi ce and retail segments

remain relatively weak, returning net balance readings of

-12% and -18% (albeit these are a little less downcast than

values of -19% and -25% seen beforehand). Meanwhile,

industrial demand edged up according to a net balance of

+6% of respondents (+3% last time). That said, the Q4 reading

is still relatively soft compared to recent years.

Alongside this, space available for occupancy continued to

increase with regards to both the offi ce and retail sectors.

At the same time, industrial vacancies held broadly steady

this quarter. Nevertheless, the value of incentive packages

on off er to tenants continued to rise right across the board,

albeit this pick-up was more pronounced within the offi ce

and retail sectors and only modest for industrials.

Looking ahead, near-term rental growth expectations remain

more or less fl at at the all-sector level, posting a net balance

of -2% in Q4 compared to a reading of -4% in Q3. Likewise,

headline rental growth projections for the year ahead are

also fl at (net balance zero), albeit this aggregate fi gure masks

continued divergence across the various sub-sectors. Indeed,

rents for Industrial space are still anticipated moving higher

over the course of the next twelve months, with respondents’

views largely unchanged from the previous results (net

balance +48% for prime industrials and +14% for secondary).

Conversely, secondary retail rental expectations remain

entrenched in negative territory, returning a net balance

of -41% compared to a reading of -50% last time around.

That said, the outlook for prime retail rents appears to have

stabilised, with the twelve-month expectations net balance

moving to -4% from a value of -13% previously. In fact, this

reading marks the least negative view on prime retail rents

since Q1 2018. In parallel with this, the offi ce sector appears

even more polarised, as rental expectations moved further

• Occupier and investor demand metrics remain downbeat away from the industrial sector

• The gap between prime and secondary offi ce rental expectations continues to widen

• The largest share of respondents now feel the market has reached the bottom of the

current cycle

rics.org/economics

into positive territory for prime space during Q4 (net balance

+30% vs +21% in Q3), but remained fi rmly negative for

secondary offi ce rents (net balance -44%).

When looking at the regional results, the national picture is

largely mirrored throughout most parts of the country. For

London however, the prime offi ce and retail markets stand

out as exhibiting stronger rental expectations than the UK-

wide averages (while secondary offi ce space appears to be

under even greater pressure across the capital).

Investment market

Overall investment demand remains relatively soft at

present, evidenced by the all-property investment enquiries

indicator posting a net balance reading of -19%. This is only

marginally less negative than the fi gure of -21% in Q3, with

the offi ce and retail sectors continuing to weigh most heavily

on the aggregate picture. Similarly, overseas investment

enquiries also continue to slip, with all sectors seeing a

decline (to a greater of lesser degree) in Q4.

On a slightly more encouraging note, the net balance for the

credit conditions measure came in at -5% in Q4, marking a

signifi cant easing in negativity relative to readings of -44%

and -75% seen in Q3 and Q2 respectively. As such, this

represents the least negative reading going back to Q1 2022,

while the prospect of a loosening in the lending climate

has the potential to stimulate something of a recovery in

investment activity as the year progresses.

With respect to capital values, only the prime industrial

sector displays clearly positive expectations for the year

to come, posting a net balance of +36% compared to last

quarter’s reading of +24%. On the same basis, respondents

do foresee a modest uplift in prime offi ce values (net balance

+11%), although the outlook remains fi rmly negative for their

secondary counterparts (net balance -46%). At the same

time, secondary industrial and prime retail values are seen

holding broadly steady over the next twelve months, while

secondary retail units are expected to see further capital

value declines.

By way of contrast, several of the more alternative sectors

tracked display a positive assessment for capital value

growth prospects over 2024. Leading the way, data centres,

life sciences, aged care facilities and student housing all

returned net balances in excess of +40% for capital value

expectations, while multifamily residential expectations

were not far behind at +39%. In each instance, twelve-month

projections were upgraded from last quarter. At the other

end of the spectrum, the outlook is only marginally positive

for hotels, while leisure values are seen falling slightly.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

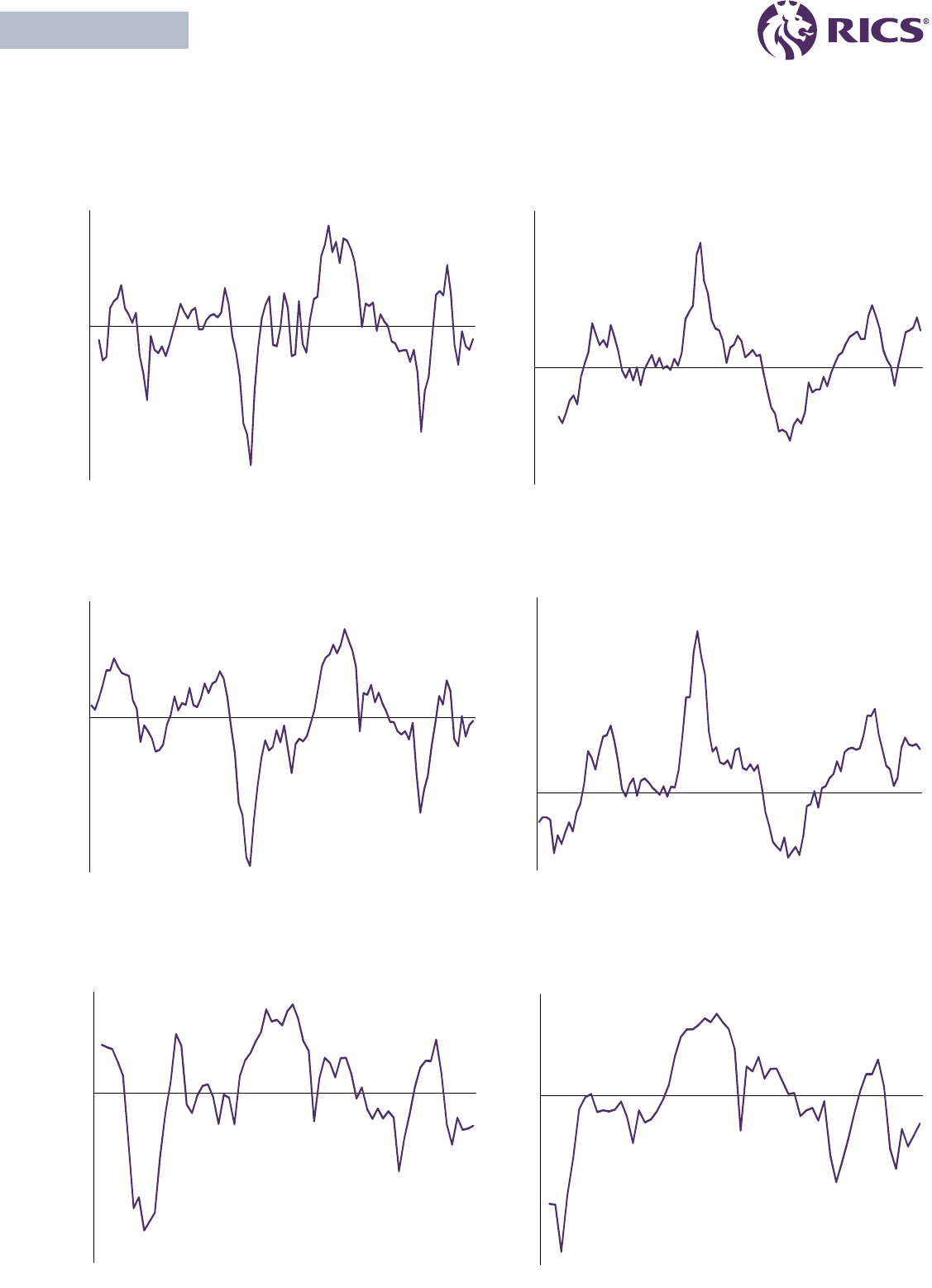

Commercial property all-sector average

-80

-60

-40

-20

0

20

40

60

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

-60

-40

-20

0

20

40

60

80

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

-80

-60

-40

-20

0

20

40

60

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

-40

-20

0

20

40

60

80

100

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

Occupier demand Availability

Rent expectations

Inducements

-100

-80

-60

-40

-20

0

20

40

60

2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

-100

-80

-60

-40

-20

0

20

40

60

2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

Investment enquiries Capital value expectations

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

-100

-80

-60

-40

-20

0

20

40

60

80

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

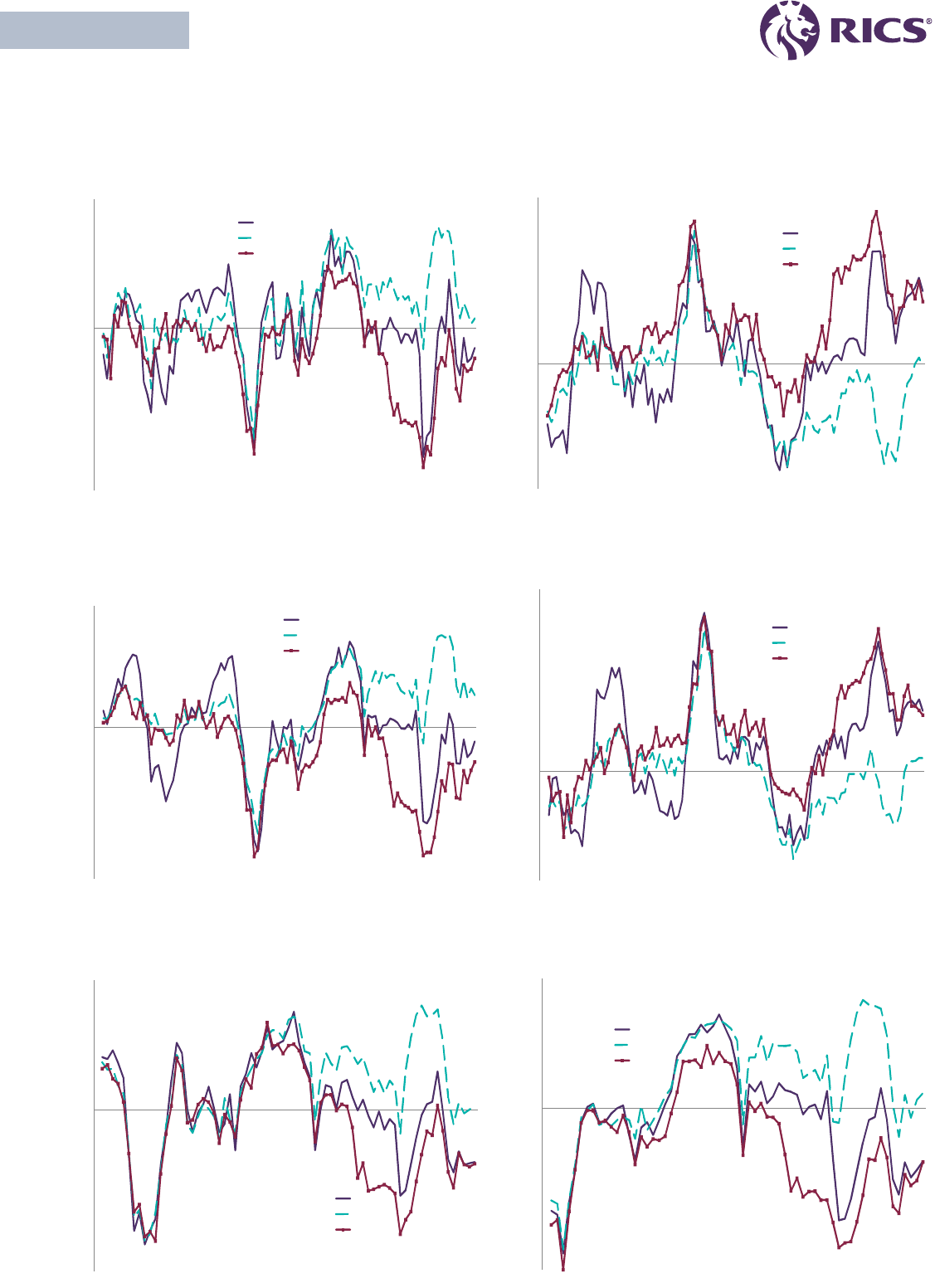

Office

Industrial

Retail

Net balance %

-60

-40

-20

0

20

40

60

80

1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 2023

Office

Industrial

Retail

Net balance %

Occupier demand

Availability

Commercial property - sector breakdown

-100

-80

-60

-40

-20

0

20

40

60

80

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

Rent Expectations by Sector

-60

-40

-20

0

20

40

60

80

100

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

-100

-80

-60

-40

-20

0

20

40

60

80

2006 2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

-100

-80

-60

-40

-20

0

20

40

60

80

2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

Rent expectations Inducements

Investment enquiries

Capital value expectations

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

-100

-85

-70

-55

-40

-25

-10

5

20

35

50

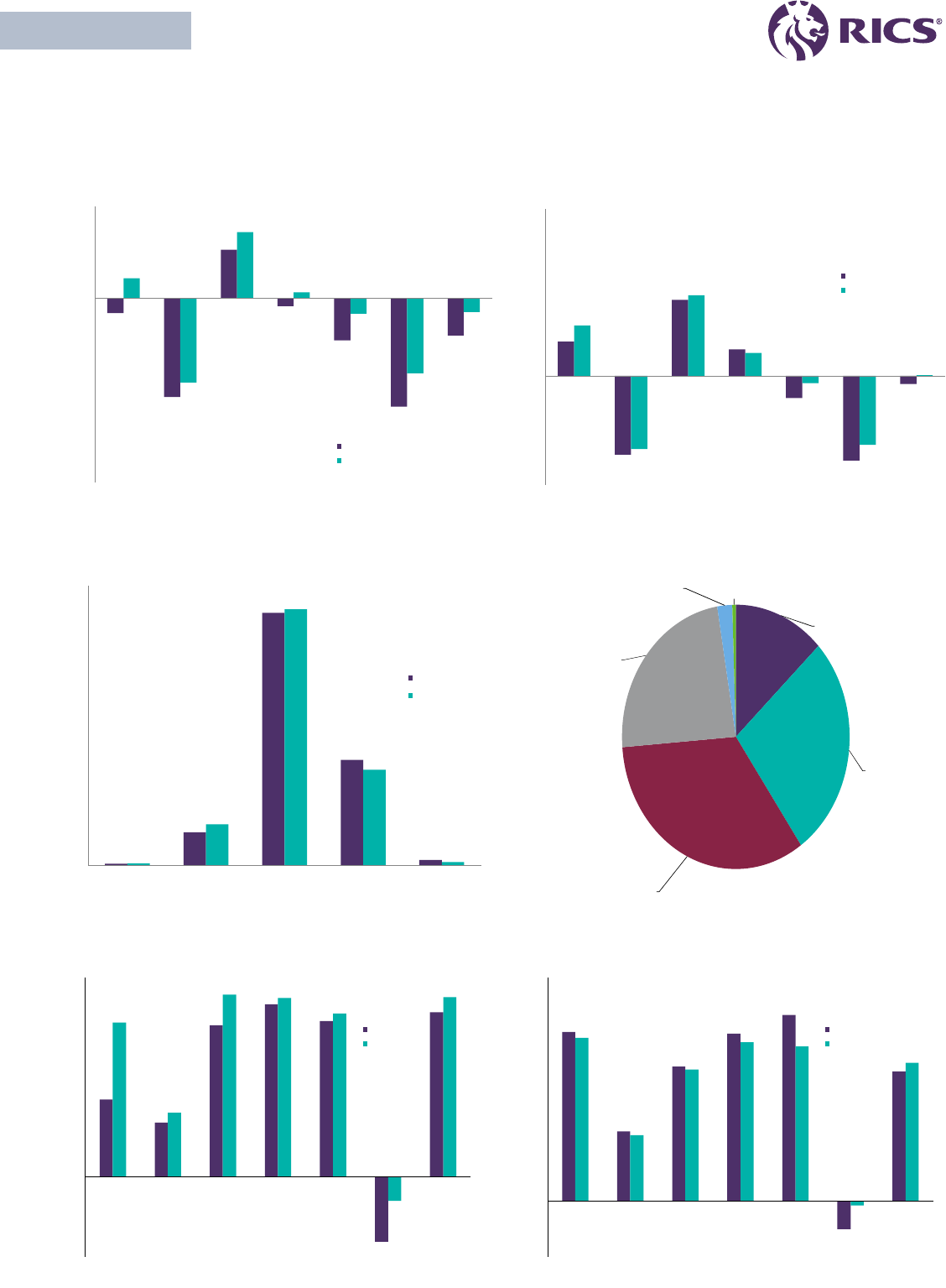

Prime Office Secondary

Office

Prime

Industrial

Secondary

Industrial

Prime Retail Secondary

Retail

Average

Q3 2023

Q4 2023

Net balance %

-65

-50

-35

-20

-5

10

25

40

55

70

85

100

Prime Office Secondary

Office

Prime

Industrial

Secondary

Industrial

Prime Retail Secondary

Retail

Average

Q3 2023

Q4 2023

Net balance %

0

10

20

30

40

50

60

70

Very Cheap Cheap Fair Value Expensive Very Expensive

Q3 2023

Q4 2023

% of Respondents

Early Downturn, 13%

Mid-Downturn, 27%

Bottom, 33%

Early Upturn, 24%

Mid-Upturn, 2%

Peak, 1%

% of Respondents

12-month capital value expectations

12-month rent expectations

Market valuations

Property cycle

Commercial property - additional charts

-20

-10

0

10

20

30

40

50

Multifamily Hotels Data centres Aged care

facilities

Student

housing

Leisure Life Sciences

Q3 2023

Q4 2023

Net balance %

12-month capital value expecations alternatives 12-month Rental expecations alternatives

-20

-10

0

10

20

30

40

50

60

70

80

Multifamily Hotels Data centres Aged care

facilities

Student

housing

Leisure Life Sciences

Q3 2023

Q4 2023

Net balance %

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

East Midlands

Alastair Fearn, Nottingham, FHP, alastair@fhp.co.uk - Whilst supply

remains low, values will continue to rise despite demand being low

relative to 2021/22.

Aman Verma, Leicester, Phillips Sutton Associates, averma7.av@

googlemail.com - Demand for freehold development opportunities

has gone down due to construction costs and cost of borrowing.

Industrial demand still high.

Brendan Bruder, Northampton, , brendan.bruder@gmail.com - 2024

will be tough particularly with attention turning to politics, planning

reform and debt markets.

David Collett, Nottingham, Altus Group, david.collett@altusgroup.

com - Industrial rents continue to increase, but at a much slower

pace than the peak of Q1-2 2021. Lack of supply in some areas can

hinder true market rents being achieved, but industrial rents appear

to have continued to increase through 2023. Incentives are lower

to non-existent - depending on the product. The main growth area

appears to be life science/R&D offi ce space in the main centres of

Oxford, Cambridge and London.

David Smith, Northampton, Drake & Partners, dsmith@

drakeandpartners.co.uk - Demand is sticky but values are remaining

robust due to a lack of supply which is further restricted by a

polarised development sector and a broken planning system.

Ian Mcrae, Northampton, Chadwick McRae, icm@cmcre.co.uk - The

credit crisis and turgid planning system will continue to infl uence the

offi ce and industrial property markets.

Nigel Carnall, Sutton In Ashfi eld, W.A.Barnes LLP, njbc@wabarnes.

co.uk - The number of retail units available has increased as traders

retire. The demand for offi ces has reduced in our area.

Peter John Castle, Northampton, Hadlands, pjc@hadlands.co.uk -

Slightly improved outlook since infl ation has eased.

Roger Smalley, Nottingham, LSH, rsmalley@lsh.co.uk - Working in

valuation we have seen a drop off in the number of enquiries over

the last 12 months.

S Robson, Nottingham, Leicestershire County Council, steven.

robson@leics.gov.uk - Still mixed messages - some tenants

struggling others putting a more positive approach on.

Sam Spencer, Nottingham, Bruton Knowles, sam.spencer@

brutonknowles.co.uk - East Midlands markets are variable;

industrials and logistics continue to experience good occupier and

investment demand. Much offi ce slack has gone to alternative use

(particularly residential) so there is less stock available, which has

driven rents and capital values. Retail is still ‘patchy’ and moribund

areas with limited variety suff er declining demand and values. Hotels

and care are performing well generally, with performance and values

more infl uenced by operational cost infl ation.

Stephen Musson, Nottingham, Musson Liggins, sam@

mussonliggins.co.uk - Property owners are misreading the point

in the economic cycle and are expecting values to keep rising.

They mistake quoted prices for value and are often attempting to

borrow too much against property values. Whilst demand overall is

low at present, there is still good demand in this area for Freehold

Industrial Property with land.

Tim Bradford, Lincoln, Eddisons, tim.bradford@eddisons.com -

Diffi cult 2023 cross all sectors - forecasting a slow start to 2024 with

a gradual improvement from Q3 2024.

Eastern

Giles Ferris, Bedford, Stimpsons Eves, giles.ferris@stimpsonseves.

co.uk - We are at an interesting point in the market which will be

eff ected by how retailers trade over the Christmas period and will

determine the level of confi dence in the market in the New Year.

Jeff Fuller, Norwich, OA Chapman & Son Ltd, jeff dfuller@hotmail.

com - Offi ce and retail sectors continue to decline as does leisure

mostly due to business rates. I suspect leisure and retail decline will

continue until meaningful reform takes place although with general

macroeconomic factors it may already be too late.

Joe Darrell, Norwich, Claverhouse Limited, dudleybro@aol.com -

Secondary shops off er good value if they have a residential angle

and are in the right sort of town. Bigger centres are less attractive.

John Russell Spacey, Maidstone, Cobbs Consultancy, jrspacey@

hotmail.co.uk - Slow lacking in confi dence.

Jonathan Lloyd, Bury St Edmunds, Hazells Chartered Surveyors,

jonathan@hazells.co.uk - It is diffi cult to enthuse about the general

property market with uncertainty still prevailing over demand, the

general economy and the appetite for businesses to take on new

projects and risk. The offi ce market remains fragile and it, along with

a general sense of a drive towards wider economic effi ciency, would

be helped by a wholesale return of public sector offi ce workers to

their offi ces.

Mark Kohler, Bury Saint Edmunds, Merrifi elds, mark@merrifi elds.

co.uk - Some resurgence in offi ce requirements. Lack of availability

in secondary industrial market. Retail transactions continuing in

affl uent Suff olk towns.

Michael Lawton, Flitwick, , michael@trinitysolutions.org.uk - Greedy

landlords, promoted by greedy surveyors, keep trying to hold

rents at unrealistic levels thus driving unrealistic capital values. A

reset is needed across all sectors so that, whether it is domestic

or commercial, interested tenants and investors can actually

realistically consider taking on a lease, loan, or mortgage.

Mike Ayton, Cambridge, DTRE, mike.ayton@dtre.com - Most of the

focus on the Cambridge commercial market is on the life sciences

sector where increased supply is just starting to appear following

the last 2 years of virtual nil supply. As new schemes start, there is

still signifi cant occupier demand generating early interest.

Phil Gadd, Norwich, Regional & City Airports Ltd, phil.gadd@rca.aero

- New starts limited based on costs of construction outpacing rental

growth and return. New builds largely unaff ordable.

Sam Kingston, Norwich, Roche Chartered Surveyors, samk@

rochecs.co.uk - The market has remained resilient. Lack of supply

continues to prevail across the industrial sector and accordingly

rents are rising. The offi ce market remains subdued, with demand

generally for Grade A space. The investment market has seen too

little activity to show a pattern on pricing. Freeholds retain their

value.

London

Adrian James Peachey, London United Kingdom, Montagu Evans,

adrian.peachey@montagu-evans.co.uk - I operate across the

UK in the retail and town centre regeneration fi eld. Regional

transformation is of great interest.

Adrian Tutchings, London, Linays Commercial Limited,

commercialproperty@linays.co.uk - It will be a diffi cult run-in to the

New Year.

Andre James, London, Oakmount Real Estate, offi ce@

oakmountrealestate.com - Worst of the down cycle considered to be

over. Cost of borrowing easing but LTS still high. Confi dence will be

muted in 2024 exacerbated by election. ‘Try and survive to 2025!’

Andrew Cohen, Central London, Amsprop Estates Limited, andrew.

cohen61@btinternet.com - Generally subdued but improving

slightly.

Chartered surveyor comments

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

Antony Milton, London, Between jobs, tonymiltonplease@gmail.

com - Economy looking bad, particularly after today’s news that an

election is likely sooner than 12 months. Political (and economic

- domestic and regional) chaos reigns. Bitcoin fl ying high, for

now, maybe overdue. London residential good, until a Labour

government anyway.

Ben Preko, London, Salter Rex LLP, bp@salter-rex.co.uk - Market is

unpredictable at the moment but we believe the commercial sector

may benefi t from movement of investment from the residential

sector (with residential landlords struggling to cope with various

changes in legislation).

Charles Kerr, London, Abodus, charles.kerr2@btinternet.com -

Huge uncertainty in all markets with student housing seeing an

outstanding performance due to supply issues.

Chris Adams, London, CBGA Limited, cadams@cbgarobson.com

- There is no true refl ection of the state of the market. Valuations

are based on assumptions and do not refl ect mark to market

values. There is limited distress as the lenders are not foreclosing.

Transactional evidence is scarce and we will not know the totality of

the downturn until we see forced sales. Money rates will not fall until

2025 and until they do, the sector looks risky and unattractive.

Chris Vane-Tempest, London, Vane-Tempest Private Offi ce LLP,

chris@vane-tempest.com - We face a challenging climate as fi xed

term fi nancing deals come to an end and landlords look to refi nance

/ reposition their portfolios. I think Q1:Q2 2024 will be an interesting

time for opportunities across all sectors.

Christopher Lacey, London, SRSL, christopher@srsl.co.uk - I

expect the current diff erence between sellers and buyers to erode

downward towards the buyers refl ecting lower long dated gilt yields

and to refl ect in lower values and hence valuations.

Edwin Luckham-Down, London, Lookout Development Partnership,

info@lookoutdevelopment.com - I have been told by real estate

solicitors that they are seeing the market dry up and funding

becoming ever more diffi cult.

Gareth Jones, London, Jones Granville, gareth.jones@jonesgranville.

com - Interest rate increases yet to have the major impact on values,

but this may come in 2024.

Geoff rey Davies, London, Harbert Management Corporation,

hdavies@harbert.net - Lack of activity refl ects the uncertainty in the

market.

Graham Marks, London, graham marks, graham@grahammarks.

co.uk - Very quiet locally in South-West London.

Hedley Merriman Frics, London, Pater Johnson merriman, hedley@

pjmsurveyors.com - There is still a reasonable demand for new

developments of plus 50,000sq ft in the areas of the northern

part of the city of London and Clerkenwell . This is for offi ce

accommodation. However, secondary offi ces are very hard to let

with rents and incentives refl ecting this. Generally in north London

industrial rents are still holding reasonably well but the market is

slowing and rents for new/modern warehousing is static/falling

slightly.

James Andrews, London, Kitchen la Frenais Morgan LLP, jandrews@

klm-re.com - Demand strengthening for primest London streets and

most affl uent London village locations - having a positive knock-on

for more secondary locations.

James Smith, London, Service Charge Associates Ltd, james@

scalimited.co.uk - Low demand.

Jamie Gordon, London, Lothbury Investment Management, jamie.

gordon@lothburyim.com - Feels like there is still further pain to

come across all sectors.

Jamie Naughton, London, ESH LLP, jamie@eshp.com - My

comments are specifi cally in relation to retail warehousing, the

area we specialise in. Valuations are nowhere near market pricing.

Occupationally, the sector is robust. But, investment is seeing lower

volumes. This is generally structural and not necessarily sentiment

in my opinion. Rates moved 125 bpts from March 23 to today, but

the RWH valuations moved around 25 basis points.

Jason Dowding, London, Fleurets, jasonwdowding@gmail.com -

Whilst the market remains fragile, there are some positive signs with

infl ation coming down and BoE rates stabilising. An election in 2025

could have an impact but I do not think either party will want to

destabilise the current economic position which remains delicate.

John Graham, London, Douglas Advisory Ltd, j.graham12@icloud.

com - Infl ation & interest rates have a negative impact. Upcoming UK

& USA general election also having a negative impact.

John King, L.B.Merton, Andrew Scott Robertson, jking@as-r.co.uk

- There are signs that the offi ce market in South London is waking

up, as tenants begin to return to the offi ce in greater numbers.

Greater incentives to potential tenants are being off ered, off set

with headline rents to accommodate capital values. The bounce

back has come from the leisure and retail sector. Centre Court in

Wimbledon comprising 320,000 sq ft renamed Wimbledon Quarter

now providing a mix of leisure and offi ce space with a hint of services

offi ces available in Spring 2024 is a start.

Johnny Huxley, London, Hux-RE, johnny@hux-re.com - Both investor

confi dence and momentum in the capital markets will improve

across the board when the Bank of England base rate decreases,

and infl ation is reduced.

Jon Andreas Pishiri, London, Jon Christopher Ltd, jon@

jonchristopher.com - Currently very tough. In fact, the toughest

conditions I can recall since the early 1990’s when I was a graduate.

Jonathan Knight, London Edinburgh, Corona Real Estate Partners

Limited, jonathanknight@coronarep.com - Equity for investments

remains readily available for the right assets but the lack of debt

funding is restricting the market.

Kamil Chowdhury, London, Petrichor Property Consulting, kamil@

petrichorproperty.co.uk - Landlords expectations on price still too

high.

Mac, London, macneel, lal - Uncertainly and more of the same.

Mark Belsham, London, Eddisons, mark.belsham@eddisons.com -

More interest from smaller offi ce occupiers leaving serviced offi ces

and taking lease for own space, albeit on fl exible terms. Secondary

retail strong demand up to £50,000 pa. Secondary industrial strong

with demand from traditional occupiers. Last minute delivery much

quieter.

Martin Kidd, Bracknell, Vokins, martin.kidd1@btinternet.com -

Landlords not appreciating the impact of rental increases to tenants

post the pandemic.

Mike Greensmith, London And South England, Sidican, mike@

sidican.com - Reaching an agreement on sales or leases is taking

longer to fi nish. There is a lot of nervousness to commit, and

cases of developers seeking to chip prices once agreed are far

more common. Obtaining planning decisions for the simplest of

applications is taking too long, and being able to discuss planning

matters with an offi cer is now rare.

Mr Mathew Jackson, London, EiA Real Estate, mathew.jackson@

eia-re.co.uk - The gap will continue to widen between prime and

secondary propoerty.

Nick Christoforou, London, NC Real Estate, nick@ncre.co.uk - Q2

onward next year all London real estate to go up.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

Simon Tuddenham, London, Lipton Rogers Developments,

tuddenham@liptonrogers.com - Market is near the bottom and

rents we expect to continue to grow as schemes will simply not be

deliverable, while capital values we expect to pick up by the end of

next year as interest rates start to drop.

Simon Wainwright, London, JPW Real Estate, sw@jpwrealestate.

co.uk - Market polarisation is clearly apparent with demand focused

on best assets, whilst for others there is little or no demand.

Construction cost increases have moderated but development

fi nance has become harder with several lenders withdrawing from

the market. Central London offi ce demand holding up well with

plenty of activity.

Stuart Beevor, London, Beevor Consulting Ltd, stuart.beevor@

yahoo.co.uk - Interest rates are falling in response to lower infl ation,

but the economy remains sluggish. Occupiers will demand best

quality space and the bifurcation of property between demand

for best and worst quality will continue. Investors will follow

accordlingly.

Tim Butler, London, South Kensington Estates, tbutler@ske.org -

Market is warming up - optimistic.

Tim Edghill, London, Space Asset Services Limited, tedghill@

spacedevelopments.org.uk - Q4 has felt relatively fl at and paused as

investors wait to see better value in the market. Recent economic

data will add confi dence that we are at the bottom, but recessionary

markers will quell this turning into any form of signifi cant uptick in

Q1 activity next year. There is a market sentiment that more distress

is on the way and capital will in the main remain cautious.

Tony Parrack, London, TP Consult, tonyparrack@tpconsult.co.uk -

There is still a noticeable shortage of larger fl oors (say 10-20k plus)

in core West End locations which were typically Mayfair and St

James’s. As a result, adjacent areas such as Soho and Marylebone

which were already popular are seeing great levels of demand and

rental increase. At the top end, requirements for ‘green’ buildings

is a given, at the bottom end the cost is paramount. We need, as an

Industry, to diff erentiate between ESG and green - they are far apart

and quite diff erent issues.

Tristram Frost, London And Western Europe, Atlas Property Advisors

Limited, twtfrost@googlemail.com - Probably nearing the bottom

of the current cycle thought not quite there yet...unless there are

more Black Swan events. Diff erent countries across Europe seem to

be in slightly diff erent phases. Many leading investors are out of the

markets untill possibly Q2 2024.

William Spencer, London, Vectis Property Group, william_spencer@

live.com - Distressed buyers looking to reduce overall debt is

starting to fl ood the market in all sectors.

Wlliam Nicol-Gent, South West London, Killochan & Co, louanna@

blueyonder.co.uk - Uncertainty prevails, the “excess” of “Health

outlets” is probably unsustainable. The eff ect (& complexity) of

Net Zero demands has yet to impact on Residential assessed

below B and D but will - severely - damage (undermine) occupancy

compliance.

North East

Alison Wright, Leeds, EY, alison.wright@uk.ey.com - Challenging due

to cost of debt fi nance but early shoots evident.

Barry Nelson, Newcastle Upon Tyne, Northern Trust Company

Limited, barrynelson@northerntrust.co.uk - The rental market

for smaller secondary offi ces remains challenging with enquiries

sporadic and take up of space slow. The smaller unit industrial

rental market within the north east is still achieving a good level of

enquiries and conversion rates to lettings are holding up, despite

the continuing economic backdrop of higher interest rates, high

power costs and supply chain price increases.

Nick Pemberton, London, Allsop LLP, nick.pemberton@allsop.co.uk

- Central London commercial investment volumes are likely to fi nish

the year at £6.0Bn – with long term average annual volumes around

£15Bn. This is even slightly lower than the 2009 GFC Central london

volumes - this time around we have buyers and we have sellers,

but the bid ask spread is still too wide, causing the historic low in

market volumes. Sellers are not yet refl ecting the rapid change in

the cost of debt into their pricing and buyers are extremely cautious,

particularly £50M+ lot size.

Nigel Biggs, London, CBRE, nb@nigelbiggs.co.uk - Conditions are

now right for some well priced purchasing.

Nigel Harrison, London, harrison leggett, nh@harrisonleggett.

co.uk - Prime offi ces remain in short supply and are generating ever

increasing levels of rent. Secondary offi ces continue to experience

lack of demand across Central London. The fl exi offi ce market is

reaching saturation point in my opinion.

Omur Payne, London, Day and Bell Surveyors Ltd, omur.payne@

dayandbell.co.uk - We have mix portfolio in/around London, and

in Devon. We have a large portfolio of secondary retail parades/

neighbourhood centres. We focus on tenant mix being right. We

have hardly any vacant units, and rents increased approx 20%

over the last 3 years. Industrial similar. Offi ces attractive for resi

developers, all our offi ces occupied. We are buying more sites

through development funding agreements. We work bridging the

gap between the landlords and tenants. Hope to see more of that

happening.

Phil Weller, London, Gerald Eve LLP, pweller@geraldeve.com - I

advise occupier clients across the UK with a recent focus in central

London offi ces. The most recent transaction I have advised on was a

90,000 sqft offi ce subletting in Stratford. I think there are diverging

rent and incentive packages between prime/secondary stock which

is being accentuated by signifi cant capex requirements required to

reach sustainability targets on secondary stock.

Professor Graham F Chase, London, Chase Sinclair Clark LLP, gfc@

chasesinclairclark.co.uk - Global events creating uncertainty with

fl ight to security and few good quality properties becoming available

but an increase in secondary and non compliant with environmental

criteria space. Much of the development market is struggling with

signifi cant increases in cost of materials with viability often diffi cult

to secure. Even though headline infl ation is falling, the increases in

the pricing of raw materials over the last 2 years has outstripped

property returns and CVs.

Robert Bath, London, QUadrin Valuations Ltd, rbath@ipva.com.

au - Overall a reduction in asset values in the lower end of the price

spectrum due to increasing interest rates erroding real income

values and a continuation of the decline in confi dence for UK assets

due to the removal of the UK from the EU.

Rod Bowers, London, Wimbledon Exclusive, realapps2016@gmail.

com - Stubborn supply side constraints obstructing fair price

discovery.

Rodney Eborn, Romford, Retired, rodneyeborn654@gmail.com - The

market is making downward adjustments to refl ect current cost of

interest rates/borrowing and infl ation.

Russell Francis, London, Colliers International, russell.francis@

btinternet.com - The probable peak in interest rates and the

medium hope for economic recovery and hence rental increases is

starting to have a positive impact but it is tentative at the moment.

S P Dempsey, London, Boultbee LDN Capital Ltd, sean@boultbeeldn.

co.uk - Expectations of the beginning of a recovery in both the

occupational and investment markets, across most sectors and

at some point in late 2024 or early 2025, are now more openly

discussed. A continued return to offi ce occupation, reducing energy

costs, stabilised interest rates, an end to the confl ict in the Middle

East, and an improvement in funding availability could do it.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

James Carter, Preston, Eric Wright Group, jimc@ericwright.co.uk - A

very nervous backdrop with many holding back for the time being.

James Munnery, Manchester, Footprint, jamesmunnery@

footprintpropertyservices.co.uk - Tentative signs of recovery

particularly in city centre offi ces.

Martin Acton, London, Howard Harrison Ltd, martin.acton@hhretail.

uk - Demand for the better centres is improving - the real issue is

still an oversupply in the smaller and weaker towns.

Michael Nuttall, Clitheroe, Brookhouse Group, mike.nuttall@

brookhousegroup.co.uk - Continuing economic uncertainty, driven

in the main by external factors to the UK. These have increased

cost and continue to threaten demand, growth and values. Adding

in political uncertainty, this is also having a negative eff ect on

sentiment.

Michael Walton, Carlisle, Walton Goodland Ltd, michael@

waltongoodland.com - The market outside major cities in the North

of England and Southern Scotland is at best static and hardly keeps

pace with infl ation. A lack of banking and credit facilities for SMEs,

an uncertain political future and fi scal uncertainty are underlying

reasons for lack of demand, coupled with changing work patterns

and poor economic growth.

Mike Fisher, Lancaster, Fisher Wrathall Commercial, mike@

fwcommercial.co.uk - Lack of readily available land for industrial

development is holding back the local economy.

Neil Lovell-Kennedy, Manchester, Proxmity, neil@weareproximity.

co.uk - Generally fl at market especially for secondary properties.

Peter Green, Stockport, Railway Paths Ltd, pgreen1098@gmail.com

- The mainstream market remains unsettled by the impacts of Covid

and creeping digitalisation of work and retail environments. Post

covid patterns of working seem to be driving moves to higher quality

but smaller units refl ecting lower levels of staff attendance. This is

impacting on associated retail activity at both prime and secondary

levels.

Richard Fee, Manchester, Nikal, rjf@nikal.uk.com - A general election

will see 2 years of inertia. Risk in USA election. War in Ukraine and

Palestine set to continue. Care costs crisis in UK. Taxes too high

but need to go higher. North of England continues to decline versus

South. Local authority fi nance in distress. Pay crisis in NHS. Banks

in denial about bad loan books. Three year depression is likely - akin

to 1929.

Rick Gordon, Manchester, Stewart Montrose, rgordon@

stewartmontrose.com - Market conditions remain uncertain. Many

businesses lack confi dence in the economic conditions and most

at best remain neutral in terms of investing capital back into the

business. Construction and supply chain costs (including labour)

remain high meaning development appraisals often throw up

negative values. A general feeling that values have not yet reached

the bottom and that “deals” may start to come through during 2nd

half of 2024. A general election to get through etc.

Robert Keith Dalrymple, Isle Of Man, Keith Dalrymple Chartered

Surveyor, keith.dalrymple@outlook.com - Political and economic

uncertainty exacerbated by negative media coverage is undermining

confi dence.

William Madada, Manchester, Jacobs, william.madada@jacobs.com -

There seems to be perceived upturn and return for the offi ce sector

in the north west by 2025.

Northern Ireland

Arthur Connell Hugh Nugent, Newry, Young -Nugent, achn488@

outlook.com - Industrial property or agricultural land have been

steady in both rental and capital value in recent times. Retail and

offi ce has been shaky.

David Downing, Newcastle Upon Tyne, Sanderson Weatherall LLP,

david.downing@sw.co.uk - The shortage of supply of Grade A offi ces

is beginning to persuade landlords to refurbish their Grade B/C

stock to better standards to obtain improved rental values. Despite

the prevailing economic conditions and the uncertainty around who

will be governing the UK that comes with a forthcoming general

election, the NE real estate market still feels relatively optimistic.

Duncan Grant, Barnsley, Grant Fieldhouse, duncan@

grantfi eldhouse.co.uk - While demand has reduced, overall stock

levels remain very low so values have not been signifi cantly aff ected.

Graham Hall, Durham, Graham S Hall Chartered Surveyors, ghall@

grahamshall.com - Many changes in Durham City centre with

redevelopment proposed for Prince Bishops shopping centre as

such retailers looking to relocate. Prime Silver street changing from

fashion and tech retailing to food and beverage with many food

tech and fashion retailers moving out of town. City is dominated by

students with the University having expanded in last few years.

Helen Wall, Sunderland, Bradley Hall Sunderland, linsleyhelen@

yahoo.co.uk - Opportunistic, out of town cash investors are

seeking bargains on high yielding properties and development

opportunities. Commercial properties are still transacting but must

be priced appropriately. Residential buyer demand remains strong

in the North East but sensitive to pricing.

Kevan Carrick, Newcastle Upon Tyne, JK Property Consultants LLP,

kevan@jkpropertyconsultants.com - A quiet market. Too early to

see impact of benefi ts off ered to businesses through the Autumn

Statement. Good news of inward investors from automotive, energy

and digital sectors for the NE region.

Simon Haggie, Newcastle Upon Tyne, Knight Frank LLP, simon.

haggie@knightfrank.com - Feels like nothing is happening of any

signifi cance and people are sitting on their hands waiting for an

upturn which may or may not happen in the next 6 - 12 months.

Stephen Bennett, Durham, N S Bennett and Associates, stephen@

nsbennett.co.uk - Flat with realistic prices essential to achieve sales

or lets.

North West

Andrew Taylorson, Preston, Eckersley Property Limited, at@

eckersleyproperty.co.uk - The shortage of available stock and land

for development has meant that there has been limited market

reaction to higher levels of interest rate but it is apparent that

many businesses and investors are cautious in their approach

to purchasing new assets unless needs must. There is limited

speculative development at the present time but owner occupiers

are still actively looking. Residential development and the delivery of

stock has, however, slowed but the appetite for land remains.

Charles Maunsell, Liverpool, Blackpool Council, charliemaunsell@

aim.com - General upturn in areas like Liverpool...less so in

Blackpool.

Graham Cooke, Manchester, GEECEE property consultancy,

gj.cooke@outlook.com - Generally the market across most sectors

except retail is holding steady. Residential will depend on an

optimistic spring activity level and a hold on interest rates. Industrial

has pegged back a little and offi ce working is still uncertain although

workers prefer to interact with co workers. City centres suff er due to

uncertain public transport effi ciency and high car park charges.

Henry Prescott, Liverpool, Prescott & Partners, henry@

pandpartners.co.uk - The ability to borrow money and the cost

of money is fundamental. The elders are few and the cost is

extortionate.

Henry Simon Miller, Bolton, Millers Commercial, simon@

millerspropertyservices.co.uk - Market remains very diffi cult.

Ian Birtwistle, Manchester, The Childrens Society, ian.birtwistle@

childrenssociety.org.uk - Slow upturn.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

South East

Adrian Howse, Tunbridge Wells, Howse Associates Ltd, adrian@

howseassociates.co.uk - The commercial property market looks

to be on a downward trajectory although I think that it will bottom

out by the Spring of 2024. The industrial warehousing market has

been remarkably resilient until recently when ocupier demand has

noticably declined. I expect market rents in this sector to come

down. The retail and offi ce markets have possibly already hit the

bottom and may begin to pick up ahead of the industrial warehouse

market.

Alex Hirst, Winchester, Gentian Development, hirstalex@hotmail.

com - Market conditions surrounding development will largely be

determined by infl ation and interest rates over the next 12 months.

Almost all appraisals are skinnier due to high cost of borrowing, high

build costs and pressures on values from interest rate hikes.

Alex Medhurst, Chichester, Medhursts Commercial Surveyors,

alex@medhursts.com - I am sensing a fairly fl at market across

most sectors with increased borrowing costs and the prospect of

a general election in the next 12 months likely to hold up decision

making and confi dence.

Aroon Rana, London/ South East, , aroonrana@gmail.com - The

secondary market overall, although down from this time last year,

appears to be holding up better than the prime market across most

key sectors.

Ben O’Connor, London & Se, Benocpc, benoc72@gmail.com -

Developer nervousness, investor caution, commercial occupier

down, BTR up.

Charles Palmer, London/ South East, Charles Palmer Property Ltd,

cp@charlespalmerproperty.com - Green shoots of recovery. Retail

still hampered by punitive business rates. Offi ce occupiers returning

and the service industries in town and city centres are recovering

slowly too.

Christopher Sims, Tunbridge Wells, CHRISTOPHER SIMS LTD, cjsims@

cjsimsllp.com - The market is in the doldrums waiting for political

change, tax cuts & lower debt costs.

Colin Brades, Brighton & Hove, Avison Young, colin.brades@

avisonyoung.com - Brighton prime retail: Generally a slight upturn

in the number of requirements received and open market lettings

successfully completing. Secondary retail market demand remains

static.

Conrad Bacon, Carshalton, Town Centre Regeneration Ltd, cb@

conradbacon.co.uk - Signs of rents having stabilised in retail, but at

a level that remains suppressed by rates. Increases possible, but

rating system is the primary blocker of, and cap on, growth and

investment - far higher barrier than in France, for example. This

leaves physical centres of communities too expensive to run, they

lack the stock and online retail becomes dominant.

Courage Ikonagbon, London/ South East, Royal Borough of

Greenwich, courage.ikonagbon@royalgreenwich.gov.uk - The

industrial market in the South East has been resilient in the face

of high interest rates albeit now showing signs of stabilisation with

the Bank of England possibly cutting rates in the coming years.

Occupancy rate and rent levels generally have been encouraging .

However, the retail sector has not improved post the pandemic with

landlords having to off er substantial incentives to secure lettings.

David Hooper, Redhill, HCP Ltd, david@hoopercommercialproperty.

com - Have seen an uptick in enquiries and activity since October.

Retail led by independent, franchised and market town operators.

Leisure we are seeing some F&B, but much more competitive

socialising and sport/lifestyle related concepts. Bowling, Axe

Throwing, Darts, Ping Pong and Yoga/Pilates.

Scotland

Chris Paterson, Edinburgh, Burns & Partners, cp@bap.co.uk - We

have seen a signifi cant drop in enquiries to purchase premises

from investors and occupiers alike. Increasing interest rates and

tightening lending criteria have been major factors.

Craig Thomson, Glasgow, City Property Glasgow (Investments) LLP,

craig.thomson@citypropertyglasgow.co.uk - Slow and unchanged in

recent times.

David Rooney, Glasgow, Whitelaw Baikie Figes, david@wbf.co.uk - For

buyers with access to funds, there are plenty of opportunities to

cherry pick from.

Douglas Wilson, Glasgow, Kintyre LLP, douglas@kintyre.uk.com

- Expecting a relatively slow start to the year but an outlook/

expectation of improving market conditions towards the back half of

the year, although this will be determined in large part by infl ation/

interest rates and the outcome of the General Election, both of

which could have a material impact on the performance of the

commercial property market in 2024.

Gavin Anderson, Glasgow, whitelaw baikie fi ges, gavin@wbf.co.uk

- General lack of investment stock , complicated and understaff ed

planning systems makes new development pipeline slow and

unreliable. If you need to take debt then realistically you need to be

an existing borrower, very hard for new entrants.

Graham Mitchell, Glasgow, George Davie, grahamm@georgedavie.

co.uk - There are signs of recovery in the market place and there

are increases in enquiries and demand. There are sectors that are

defi nitely seeing improvements in enquiries and business activity

over a number of sectors.

Guy Strachan, Edinburgh, Smolka Strachan LLP, guy@

smolkastrachan.com - A diffi cult market with build costs & debt

pricing still high.

John Brown, Edinburgh, EDINBURGH AND LONDON LTD, john.

brown@jb-uk.com - Despite the concern of many as to the fi nancial

management of Scotland by the SNP/Green Coalition and impact

of tax rises announced and clear fi nancial burden faced through

imprudence, there is still confi dence in doing business in the

major cities and professional service provision is focusing on less

space but better buildings and more effi ciency. Older offi ce stock

continues to revert to residential use. Industrial units still at a

premium. Retail is selective, locations change to Hubs.

John White, Glasgow, Hunting Real Estate, john@huntingrealestate.

co.uk - Offi ces are probably nearing the bottom of the cycle, as

is retail. However the lack of supply of development land for

Industrials will continue to drive rents forward.

Len Kidd, Edinburgh, Retired, len.kidd57@btinternet.com - I notice

a general shrinking of traditional “High Street” prime areas in part

to contrived communication/ transport diffi culties - Low emission

zones/ reductions in public transport. Some increase in minor,

small industrial unit development on secondary location or close to

residential. No noticeable increase in any offi ce sector other than

via public authority need - though even there a desire to move away

from the large offi ce building to free up site for new development.

Malcolm Donald, Dundee, Valuation, malcolm.donald@g-s.co.uk -

Limited due to being a residential surveyor and limited commercial

work.

Paul Kettrick, Falkirk, Falkirk Council, pkettrick@gmail.com -

Industrial demand buoyant locally due to infrastructure investment

programmes.

Robert Harkness, South Lanarkshire, South Lanarkshire Council,

robert.harkness@southlanarkshire.gov.uk - Industrial market is

strongest.

Shaun Crosby, Fife, Fife Council, shaun.crosby@fi fe.gov.uk -

Challenging times, with borrowing rates high and uncertainty in

offi ce occupation levels.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

Nathan Wareing, London, Wareing & Partners, nathan@

wareingpartners.com - Capital values may be building in more risk

in the commercial leisure market than actually exists. Occupational

demand remains selective but fundamentally strong.

Nick Ekins, London/ South East, Gentian, nick@gentian.co.uk - Prime

retail still looks very cheap - too cheap. But more competition from

investors has entered the market.

Paolo Antonio Iacobucci, Ipswich, countywide properties, paul@

countywideproperties.co.uk - Market for industrial still showing

resilience, retail and offi ce sector weak.

Paul Russell, Winchester, Carter Jonas, paul.russell@carterjonas.

co.uk - Still signifi cant caution in the markets.

Philip Marsh, Beaconsfi eld, Philip Marsh Collins Deung, philip@

pmcd.co.uk - It has been a tough 9 months and 2024 has the

potential to continue to be diffi cult.

Phillip Fry, Bournemouth, Phillip Fry FRICS, phillipfry28@btinternet.

com - Fundamental demand likely to rise from bottom of cycle.

Richard Harding, London/ South East, Bray Fox Smith,

richardharding@brayfoxsmith.com - Prime headline rents for best

in class offi ces will continue to increase whilst secondary rents will

come under downward pressure. Capital values will fall as a result of

yield shift brought on by rising interest rates.

Sharon Roskilly, St Albans, Hertfordshire County Council, sharon.

roskilly@hertfordshire.gov.uk - St Albans remains static, low

availability continues due to lack of new development. Broxbourne

seeing higher level of upcoming development proposals in

Hertfordshire.

Simon Browne, Brighton, Crickmay Chartered Surveyors, scb@

crickmay.co.uk - Noticeably less bank lending on new purchases.

Simon Lawson, Brighton, Jason & Lawson, lawson6102@gmail.

com - Confi dence is not strong generally with so many economic

uncertainties, with most predicting a mid to late 2024 slow recovery.

Stephen Ray, Redhill And Reigate, SHW, sray@shw.co.uk - If

interest rates do fall we are likely to see a general property market

strengthening in the South East.

Steve Masters, London/ South East, Chase Realty, steve.masters@

chaserealty.co.uk - Whilst the economic backdrop and markets

remain challenging, retail pricing, particularly top retail parks,

looks attractive compared to other sectors. Occupier demand in

hospitality/leisure appears to be picking up slightly too in better

markets.

Stewart Gray, Brighton, Austin Gray, stewartgray@austingray.

co.uk - Market diffi cult - funding very diffi cult -many buyers turning

to private funding and ignoring major Banks with their restrictive

policies. Yields have rocketed.

Terence Firrell, London/ South East, Terence Firrell Ltd, terence@

terencefi rrell.co.uk - All market sectors in my view are aff ected by

uncertainty, which will impact upon future growth in respect of

rental and capital values.

Tim Davis, Sussex, Hargreaves, timjadavis@gmail.com - Treading

water and waiting to see a clearer picture on interest rate rise

impacts, political change and geopolitical stability and direction in

the Middle East. Also waiting for the rain to stop.

Victor Forson, Tunbridge Wells, Tunbridge Wells Borough Council,

victor.forson@tunbridgewells.gov.uk - Early recovery of the markets.

David Martin, Brighton, SHW, dmartin@shw.co.uk - Activity in all

commercial sectors remains positive but transactions are taking

too long to complete and the outlook for the economy remains

uncertain. The direction of travel of interest rates is very important

now, in terms of providing confi dence back to the economy and for

companies decision making process.

Dermot P Main, Woking, Main Allen, dermot@mainallen.com - Very

diffi cult to engage clients in acquisitions and they are taking far too

long to be documented and completed.

Desmond Ely, Southampton, Ely Langley Grieg, dr.ely@btinternet.

com - The retail market has been rather slow as have offi ces whilst

industrial has been more positive.

Edward Iliff e, Southampton, Yattendon Group, edward.iliff e@

yattendon.co.uk - I believe there will be some interesting buying

opportunities as yields increase.

Henry Richard Howard-Vyse, London/ South East, , henry.

howardvyse@gmail.com - Regional and location variations on top of

those of sector and building characteristics make valuation more of

an art than a science at the moment.

Iain Steele, Farnham, Park Steele, iain@parksteele.com - Freeholds in

all sectors continue to be of interest with multiple potential buyers

bidding, although no real price increases. Leasehold shops at the

lower end of market remain of interest to independents but up

to certain rental level, only varying from area to area. Leasehold

offi ces remain subdued although some takers and alternative users

taking up some of the space. The market in general was quiet in

the summer then picked up during October to November then has

settled down again in December.

Jeremy Clayden, Crawley, Sanguine Surveyors, jeremy@

sanguinesureyorsl.com - I believe the market is awaiting an

indication of the change in political climate and the announcement

of a general election.

John Mitchell, London/ South East, Avison Young, john.mitchell@

avisonyoung.com - General evidence in the market that with

stabilised interest rates and borrowing costs reducing, there is a

bit more certainty which is helping to increase leisure spend in the

market.

Jon Chapman, Central Milton Keynes, Pinders Professional &

Consultancy Services Ltd, jon.chapman@pinders.co.uk - The rapid

rise in interest rates has had a greater impact on market activity and

values than the Covid pandemic but some stability may return as

interest rates fi nd their new level.

Mark Howard, London/ South East, Doherty Baines Limited,

mhoward@dohertybaines.com - Older secondary offi ces and lower

grade industrial to have capital values and rental growth curtailed

by MEES and EPC requirements. For offi ces, a prerequisite for a

successful leasing campaign is strong ESG credentials and for larger

companies it is also for a building to assist them in the reduction of

operational carbon.

Mark Minchell, Chichester, Flude Property Consultants, m.minchell@

fl ude.com - We are looking at optimism for 2024 with shoots of

recovery, all things being equal, showing by spring and a stronger

end to 2024 than 2023.

Matthew Diamond, Basingstoke, Diamond Land, matthew.

diamond@diamond-land.co.uk - I expect the yield on 10 yr gilts to

rise over the next few years under a new Labour administration.

This will increase the cost of fi nance and decrease capital values.

Mellawood Properties Ltd, Beaconsfi eld, Mellawood Properties Ltd,

bryan.galan@outlook.com - Market fragile and little demand with

rents continuing to drop. Investment demand but only for good

quality assets/covenants.

Michael Rowlands, Haslemere, Lambert Smith Hampton,

mrowlands828@gmail.com - Diffi cult conditions across most of the

markets. No upturn yet.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

Luke Sparkes, Cirencester, Marriotts Property, luke.sparkes@

marriotts.co.uk - There has been the expected downturn in demand

for commercial property to let due to the impending Christmas

holidays. The New Year still appears to bring uncertainty but one

hopes we will begin to turn the corner by Spring.

Michael Oldrieve, Exeter, , m.oldrieve@btinternet.com - Steady as

she goes.

Mike Nightingale, Truro, Miller Commercial LLP, msn@miller-

commercial.co.uk - Transaction volumes have reduced in H2 2023

and transaction times have become protracted due to a lack of

urgency and competition amongst buyers. There are early signs that

this status quo is shifting as interest rates appear to have stabilised.

Oliver Workman, Cheltenham, THP Chartered Surveyors, oliver@

thponline.co.uk - General market conditions remain fl at. Survive until

25 is being said a lot and there is some truth in that phrase. There

are some sectors remaining more resilient including secondary retail

and industrial.

Patrick Dempsey, Circencester, Royal Agricultural University,

fosseproperty@gmail.com - Market remains nervous.

Peter Woodley, Cheltenham, Cheltenham Borough Council,

peter.j.woodley@btinternet.com - Interesting times, especially for

ground rents and residential development.

Roger Ewart Smith, Swindon, Wilts. Sn4 8Dt, Smith and Foyle,

Chartered Surveyors., smithandfoyle@btconnect.com - Swindon

Wilts, is suff ering very badly with regard to town centre retail trading

and retail outlets doing well are those out of town centres with easy

access, no parking charges, with no drunken louts and beggars to

annoy and upset shoppers. Some demand for smaller industrial

units and the larger occupiers of multiples seem to be holding their

own. Very few new occupiers of small industrial units but some

specialist outlets are thriving.

Rupert Stephens, London, Hobden Group, rupert.stephens@

hobden-group.co.uk - Negative outlook for all sectors across

investment, occupational and development. Expect a period of low

activity ahead of a larger downturn.

Simon Walsham, Bournemouth Poole And Christchurch, James

and Sons, simonwalsham@jamesandsons.co.uk - Industrial market

growth has slowed but demand still exceeding supply. Retail market

remains poor with the exception of pockets of growth in select

locations. Offi ce market fl at.

Stephen Matcham, Plymouth, stratton breber commercial, stevem@

sccplymouth.co.uk - Market shows signs of returning confi dence.

Tim Smith, Cullompton, Hitchcocks Business Park Limited, tim@

hitchcocksbusinesspark.co.uk - Lack of new build stock holding up

capital and rental values.

Tim Wright, Dorchester, Greenslade Taylor Hunt, tim.wright@gth.net

- The commercial property market remains fairly quiet with generally

low enquiry levels. The industrial sector continues to outperform

the retail and offi ce sectors. We will get a better idea of where the

market is heading in the New Year.

Wales

Chris Sutton, Cardiff , Sutton Consulting Ltd, chris.sutton@

suttonconsulting.co.uk - The commercial property market in

Wales experienced an increase in supply, however, Grade A

accommodation remains in demand with rising rents in both

industrial and offi ce sectors for the very best fl oorspace. Industrial

rents at St Modwen Park, Newport now exceed £9.00 per sq ft for

new-build accommodation with healthy take-up in 2023. The central

Cardiff offi ce market continues to see churn as occupiers use lease

events to readjust to new ways of working with Veezu relocating to

Hodge House.

Will Staniland, London/ South East, Rumsey and Partners, will@

rumseyandpartners.co.uk - Sense we have spent the last 3 months

reaching the bottom of the market zone, but still signifi cant vendor

reluctance to accept realities. As such, this bottom period will

continue for another 3-9 months as refi nancing, in particular,

becomes an uncomfortable reality forcing vendors to reconsider

where the values are and opportunity buyers start cautiously

moving into the market at pricing which is discounted to current

levels.

South West

Alastair Andrews, Swindon, Loveday, alastair@loveday.uk.com -

Although occupier demand has generally reduced in the Swindon

industrial market, supply of good quality space across all size ranges

remains constrained which is continuing to put upwards pressure on

rents and capital values. A lack of land supply is holding back new

development and unless we see a signifi cant increase in business

failures, these trends may well continue.

Andrew Hardwick, Bristol, Carter Jonas, andrew.hardwick@

carterjonas.co.uk - Market conditions are challenging with economic

and political conditions subduing sentiment. High quality new

offi ces with strong sustainability credentials are still able to

command high rentals and capital values for owner occupier offi ces

in Bristol have held up well, in the latter case due to acute scarcity

and the availability of cash.

Andrew Kilpatrick, Swindon, Kilpatrick & Co Commercial Property

Consultants Limited, a.kilpatrick@kilpatrick-cpc.co.uk - Market

relatively subdued in Swindon & surrounds, refl ecting fl at economy

and lack of confi dence in the face of global uncertainties from the

wars in Ukraine & Gaza, infl ation worries from prospect of rising

energy costs and UK political uncertainties for 2024.

Chris Wilson, Poole, Goadsby, chris.wilson@goadsby.com - Business

confi dence has improved since interest rates stopped rising and

following headlines reporting that infl ation has continued to fall.

Damian Cook, Exeter, Stratton Creber Commercial, damian@

sccexter.co.uk - Reasonably healthy demand for correctly priced

property with caution shown by prospective buyers.

Daniel Smethurst, Swindon, Smethurt Property Consultants Ltd,

daniel@smethprop.co.uk - General enquiry levels are down but we

are seeing the return of larger offi ce requirements with a primary

focus on ESG and a quality built environment.

David Monk, Plymouth, Monk & Partners, david@monkandpartners.

co.uk - Unsettled with delays at legal stage leaving a number of deals

not proceeding to completion. Worry with interest rate levels and

debt the main factor holding back sales.

Huw Thomas, Chippenham, Huw Thomas Commercial., huw@

huwthomascommercial.com - Slight resurgence in the offi ce market

as companies strive to entice staff back to an offi ce environment.

Reduced demand in the industrial and warehouse sector,

particularly for mid size units; good demand for secondary retail

with a particular increase in demand by independent convenience

store operators.

Ifan Rhys-Jones, Plymouth, Listers, irj@listers.uk.com - Supply still

fairly thin. Development remains marginal. Occupier demand has

eased but is still out of balance with supply.

John Corben, Swanage, Corbens, john@corbens.co.uk - The

commercial market for the retail sector has remained encouragingly

constant with many new business start ups. Landlords have had to

to negotiate with opening incentives and fair rents.

Jon Stone, Exeter, Jon Stone Surveyors, jon@jonstone.co.uk - Small

space occupier and investment market holding up. Others faltering.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

John Andrews, Kidderminster, Doolittle & Dalleuy Holdings Ltd,

johnandrews@doolittle-dalley.co.uk - Industrial rental and capital

values increasing due to demand outstripping supply. Retail and

offi ces poor.

John Emms, Dudley, John Emms Commercial, john@

johnemmscommercial.co.uk - High St retailers seem to be

experiencing a diffi cult trading time evidenced by the number of

discounted off ers available pre-Christmas. The impact of Wilkinsons

stores closures around the country is having a marked eff ect

in many town centres across the region. Demand for freehold

industrials is still good but lack of stock is helping to keep prices at

current levels.

Michael D Jones Frics, Malvern Worcestershire, Michael d jones

ltd, mjones5400@yahoo.com - I believe an increasing downturn in

demand to rent both retail and offi ce premises and in particular

secondary premises will accelerate over the year ahead . However, I

anticipate capital vales for warehouse/industrial premises will hold

fi rm as in my previous long experience of such market conditions eg

the early 1990s and between 2008/12.

Mr Simon Horan, Hereford, Fairfi eld Land & Development Ltd,

simon.horan@fairfi eldland.co.uk - Speculative is on the decline

as the market tries to reduce its risk profi le to short term market

fl uctuations. Until there is a noticeable trend that infl ation is under

control and the economy is on the up, low risk assets will be the

order of the day where demand remains strong and the supply

chain is weak.

Neil G Harris, Birmingham, Lane Cove, neil@lanecoveproperties.com

- The market is in ‘slack water’ meaning the tide is neither outgoing

nor incoming, it is really waiting for the market to choose a direction

of travel, most likely dictated by politics and (planning) policies.

Nick Yates, Birmingham, Colliers, nick.yates@colliers.com - Seeing

a lot of interest in the independent retail sector, and equally some

consolidation from the larger retailers. Demand for prime industrial

space still appears at a premium. Lots of new construction is making

prime space the new norm so secondary and tertiary space is

being devalued and landords having to consider refurbishment or

development options to ensure compliance with modern legislation

and to avoid obsolescence. Lifecyle of properties is shorter now to

meet modern tenant needs.

Paul Beardmore, Stoke-On-Trent, Butters John Bee,

paulbeardmore@bjbmail.com - Slow but steady.

Paul James, Stoke-On-Trent, , pjames.huntersview@gmail.com - Flat.

Peter Holt, Coventry, Holt Commercial Ltd, peter@holtcommercial.

co.uk - Industrial still sees a good demand across the whole sector.

Demand for offi ces having been very poor is just beginning to

improve particularly for mid size units from 3,000 to 8,000sq ft. A

shift towards sustainable space. Retail will be interesting with the

redevelopment of Coventry City Centre South. This is creating a

demand from some retailers needing to relocate to accommodate

the development.

Philip Moran, Redditch, Philip Moran Chartered Surveyors,

philipjmoran@yahoo.com - The market refl ects the present fi nancial

position.

Richard Topps, Stratford Upon Avon, NFU Mutual, richard_topps@

nfumutual.co.uk - Markets remain fragile. Expectations are for

growth into 2024 and beyond but few consistent signs of that

materialising yet.

Simon Smith, Atherstone, Smith Brothers (Tamworth) Developments

Limited, chris@bat-survey.co.uk - The market appears to be mid

downturn in some sectors with values higher than bids in some

sectors.

Tony Broad, Alvechurch, Birmingham, Tony Broad Associates,

timbroad1103@gmail.com - Challenging.

Dylan Williams, Swansea, Rees Richards and Partners, dylan@

reesrichards.co.uk - The tide is certainly turning in Swansea, with

the local authority and local developers taking the initiative in

redeveloping city centre property, in turn, leading to an upturn in

prime offi ce rents and capital values. It is hoped that with a vastly

improved city centre off ering and footfall, the decimated retail

sector will recover. In addition, well serviced industrial property

along the M4 corridor is also seeing an upturn in demand; long may

it continue.

Haydn Thomas, Newport, Hutchings & Thomas, ht@hutchings-

thomas.co.uk - Industrial market remains buoyant with good tenant

and purchaser demand. Supply still low with reduced development.

Offi ce market showing some improvement at the lower size market

ie. 1500 - 3000 sq ft both leasehold and freehold. Increase in

demand for owner occupier market in the same size bracket.

Lack of supply of freeholds in this area. Larger offi ces with 5000sq ft

+ fl oor plates may struggle and alternative uses may be considered.

Retail high street demand low, secondary demand increasing.

James Perry, Cardiff , Property Consultants, jperry@middletonperry.

co.uk - Predominantly deal with industrial property and whilst

demand has reduced slightly over last 6 months, it is still strong and

outstripping supply for all but the largest properties.

Michael Bruce, Cardiff , DLP SURVEYORS, michael@dlpsurveyors.

co.uk - Still plenty of market activity although a noticeable slowing

down over the last 3 months or so. Development start ups in South

Wales continue to be few and far between - particularly noticeable

when comparing with other bordering areas such as the South West,

West Midlands, and North West. A particularly worrying tone is the

apparent reluctance of developers to consider South Wales, many

apparently being put off by the perceived ‘anti-business’ sentiment

being expressed by Welsh Govt.

Richard Baddeley, Glan Conwy. Colwyn Bay, Richard Baddeley &

Company, richardbaddeleyco@gmail.com - There is considerable

uncertainty and caution in the commercial market generally and

particularly in North Wales. The market is awaiting a decision on the

Wylfa Nuclear Proposal and development within Holyhead to cater

for the growing Irish freight traffi c.

Robert James Harrison, Welshpool, Triang Developments Ltd,

j.harrison@triang.co.uk - Remains shortage of industrial buildings

for business growth in parts of Wales due to lack of availability of

development land and high construction costs.

Stuart R J Phillips, Oswestry, Celt Rowlands & Co, oswestry@

celtrowlands.com - Industrial remains strong and appears to have

seen a surge upwards in rents in last 6 months.

West Midlands

Chris Keye, Birmingham, Darby Keye Property, chris.keye@

darbykeye.co.uk - Occupational demand in Q4 2023 appears to

have improved slightly but capital market transactions remain

challenging.

Christian Smith, Birmingham, Savills, christian.smith@savills.com

- The industrial market remains ok, close to pre-covid average,

incentives are pushing out but rents are still slowly rising. In my

view available units on the market have about peaked as little new

development is currently coming through. Expect market to be

slightly stronger as next year unfolds.

David Macmullen, Sambourne Redditch, MacMullen Associates Ltd,

dmacmullen@macmullenassociates.com - More optimism apparent

in the market than possibly is justifi ed. There is no great overhang

of new stock but secondary and second hand offi ce and retail

properties are burdensome to landlords when vacant because of

void rates and service charge. The level of potential insolvency in the

construction sector is concerning.

David Willmer, Birmingham, Avison Young, david.willmer@

avisonyoung.com - The Industrial/logistics market has softened over

the past 12 months but is still active and in line with the 5yr average.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

Tony Rowland, Evesham, Sheldon Bosley Knight, trowland@

sheldonbosleyknight.co.uk - Its a tough trading market suff ering

from occupier uncertainty. When interest rates stabilise, I am sure

we will see increased business activity.

Yorkshire & the Humber

Andrew Mcbeath, York, McBeath Property Consultancy Limited,

andrew@mcbeathproperty.co.uk - Flat market but due partly to

seasonal lethargy.

Brian Reynolds, Wakefi eld, NorthCountry Homes, brian@

northcountryhomes.co.uk - As a low cost house builder the buying

market is looking good, providing opportunities if not hamstrung

for cash. Sales are low cost, so will stand up, demand is high and will

remain so now the interest rate change has been ‘accepted’.

David Broschomb, Leeds, Dabro & Associates, dabroandco@gmail.

com - The Leisure Market in which I specilise is going through

changes and struggling due to the after aff ects of the Pandemic,

Business Rates, Cost of Food, Utilities and Staffi ng. This will aff ect

investment, property availability and values.

David Melvyn Woodhead, Wakefi eld, Woodhead Investment &

Development Services Ltd, dwoodhead@woodheadinvestments.

co.uk - High cost of borrowing is revealing a two tier market. Debt

laden buyers are inactive / generally selling whilst cash purchasers

are still active. Not seeing any signifi cant “forced sale” events (yet).

Jason Barnsdale, South Yorkshire, Barnsdales, jason@barnsdales.

co.uk - Lack of supply of stock is probably artifi cially holding values

steady.

Jonathan Duck, York, Bramall Properties Limited, jonathan.duck@

bramallproperties.co.uk - Quiet.

Michael Hughes, York, MJD HUGHES Ltd, info@mjdhughes.com -

The commercial property market cannot be said to be improving

but there is a sense that is not going backwards. There is a general

positive attitude amongst landlords and freehold buyers who want

to make their business move forward. The extended period of

stagnation or poor returns is helping investors to focus on how this

can be improved. There is no specifi c trend at the moment but there

is certainly a will for improvement.

Mr Richard J Heslop, Leeds, DE Commercial, richard@de-

commercial.co.uk - We are clearly at the bottom of the cycle or very

close to it. Developers, investors and occupiers are clearly waiting

to see what will happen in the wider economy vis-a-vis interest rates

and the ability to access fi nance from the banks.

Richard Corby, Leeds, Lambert Smith Hampton, rcorby@lsh.

co.uk - Deals across all sectors continue to be slow to complete

or frequently fail to transact, but occupier enquiries are still being

received and those parties that can proceed have a better choice

and stronger negotiating position than has been the case over the

last couple of years. The offi ce market is becoming fragmented

between prime space and the remainder, with few takers for the

latter.

Robin Beagley, Leeds, WSB Property Consultants LLP, rbeagley@

wsbproperty.co.uk - Demand from occupiers across all sectors is

subdued, caution remains but limited supply should help maintain

rental and capital values.

UK COMMERCIAL PROPERTY MONITORECONOMICS

rics.org/economics

UK Commercial Property Monitor

RICS UK Commercial Property Monitor is a quarterly guide

to the trends in the commercial property investment

and occupier markets. The report is available from the

RICS website www.rics.org/economics along with other

surveys covering the housing market, residential lettings,

commercial property, construction activity and the

facilities management market.

Methodology

Survey questionnaires were sent out on 6 December

2023 with responses received until 12 January 2024.

Respondents were asked to compare conditions over the

latest three months with the previous three months as well

as their views as to the outlook. A total of 850 company

responses were received.

Responses have been amalgamated across the three

real estate sub-sectors (offi ces, retail and industrial) at a

country level, to form a net balance reading for the market

as a whole.

Net balance = proportion of respondents reporting a rise