1

Answers to Selected Problems

Chapter 1

1. (1.9)

a. The bank loan is a financial liability for Lanni. Lanni's IOU is the bank's financial

asset. The cash Lanni receives is a financial asset. The new financial asset created is

Lanni's promissory note held by the bank.

b. The cash paid by Lanni is the transfer of a financial asset to the software developer. In

return, Lanni gets a real asset, the completed software. No financial assets are created

or destroyed. Cash is simply transferred from one firm to another.

c. Lanni sells the software, which is a real asset, to Microsoft. In exchange Lanni

receives a financial asset, 5,000 shares of Microsoft stock. If Microsoft issues new

shares in order to pay Lanni, this would constitute the creation of new financial asset.

d. In selling 5,000 shares of stock for $125,000, Lanni is exchanging one financial asset

for another. In paying off the IOU with $50,000, Lanni is exchanging financial assets.

The loan is "destroyed" in the transaction, since it is retired when paid.

2. (1.10)

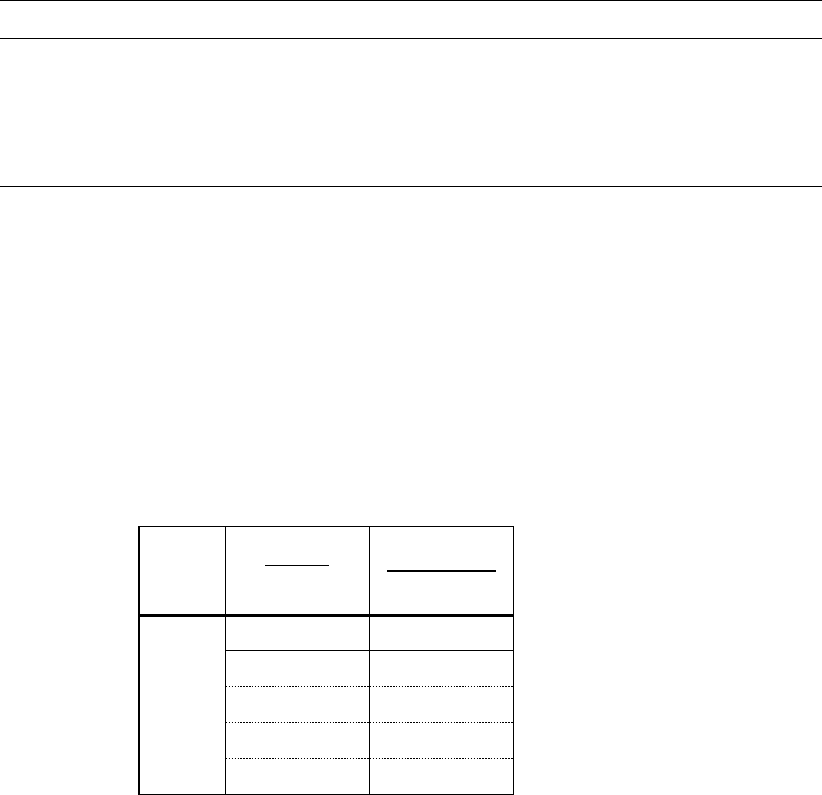

a.

Cash $70,000 Bank loan $50,000

Computers 30,000 50,000

Total $100,000 Total $100,000

Assets

Liabilities &

Ratio of real to total assets =

000,100$

000,30$

= 0.3

b.

Software product* $70,000 Bank loan $50,000

Computers 30,000 50,000

Total $100,000 Total $100,000

*Value at cost

Assets

Liabilities &

Ratio of real to total assets =

000,100$

000,100$

= 1.0

2

c.

Microsoft shares

$125,000 Bank loan $50,000

Computers 30,000 105,000

Total $155,000 Total $155,000

Assets

Liabilities &

Ratio of real to total assets =

000,155$

000,30$

= 0.2

Conclusion: When the firm starts up and raises working capital, it will be characterized

by a low ratio of real to total assets. When it is in full production, it will have a high ratio

of real assets. When the project "shuts down" and the firm sells it, the percentage of real

assets to total assets goes down again because the product is again exchanged into

financial assets.

(1.11)

3. Passed in 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act

proposes several mechanisms to mitigate systemic risk. The act attempts to limit the risky

activities in which the banks can engage and calls for stricter rules for bank capital,

liquidity, and risk management practices, especially as banks become larger and their

potential failure becomes more threatening to other institutions. The act seeks to unify and

clarify the lines of regulatory authority and responsibility in government agencies and to

address the incentive issue by forcing employee compensation to reflect longer-term

performance. It also mandates increased transparency, especially in derivatives markets.

(1.12)

4. For commercial banks, the ratio is:

3.157,12$

0.157$

= 0.0129

For non-financial firms, the ratio is:

196,28$

661,13$

= 0.4845

The difference should be expected since the business of financial institutions is to make

loans that are financial assets.

3

(1.13)

5. National wealth is a measurement of the real assets used to produce GDP in the economy.

Financial assets are claims on those assets held by individuals.

Financial assets owned by households represent their claims on the real assets of the

issuers, and thus show up as wealth to households. Their interests in the issuers, on the

other hand, are obligations to the issuers. At the national level, the financial interests and

the obligations cancel each other out, so only the real assets are measured as the wealth of

the economy. The financial assets are important since they drive the efficient use of real

assets and help us allocate resources, specifically in terms of risk return trade-offs.

6. (1.14)

a. A fixed salary means compensation is (at least in the short run) independent of the

compensation to the success of the firm, and thus allows the manager to envision and

seek the sustainable operation of the company. However, since the compensation is

secured and not tied to the performance of the firm, the manager might not be

motivated to take any risk to maximize the value of the company.

b. A salary paid in the form of stock in the firm means the manager earns the most when

shareholder wealth is maximized. When the stock must be held for five years, the

manager has less of an incentive to manipulate the stock price. This structure is most

likely to align the interests of managers with the interests of the shareholders. If stock

compensation is used too much, the manager might view it as overly risky since the

exacerbated with a large stock position in the firm.

c. When executive salaries are linked to firm profits, the firm creates incentives for

manipulation or accounting fraud, such as divestment of its subsidiaries or

unreasonable revenue recognition. That is what audits and external analysts will look

out for.

4

Chapter 2

(2.12)

1.

liquidity. The prices of money market securities are very stable, and they can be

converted to cash (i.e., sold) on very short notice and with very low transaction costs.

(2.13)

2. Equivalent taxable yield =

=

=

= .1038 or

10.38%

(2.14)

3. After-tax yield = Rate on the taxable bond x (1 Tax rate)

a. The taxable bond. With a zero tax bracket, the after-tax yield for the taxable bond

is the same as the before-tax yield (5%), which is greater than the 4% yield on the

municipal bond.

b. The taxable bond. The after-tax yield for the taxable bond is: 0.05 x (1 0.10) =

0.045 or 4.50%.

c. Neither. The after-tax yield for the taxable bond is: 0.05 x (1 0.20) = 0.4 or 4%.

The after-tax yield of taxable bond is the same as that of the municipal bond.

d. The municipal bond. The after-tax yield for the taxable bond is: 0.05 x (1 0.30)

= 0.035 or 3.5%. The municipal bond offers the higher after-tax yield for

investors in tax brackets above 20%.

(2.15)

4. The after-tax yield on the corporate bonds is: 0.09 x (1 0.30) = 0.063 or 6.3%.

Therefore, the municipals must offer at least 6.3% yields.

(2.16)

5. Using the formula of Equivalent taxable yield (r) =

, we get:

a. r =

= 0.04 or 4.00%

b. r =

= 0.0444 or 4.44%

c. r =

= 0.05 or 5.00%

5

d. r =

= 0.0571 or 5.71%

6. (2.17)

a. You would have to pay the asked price of:

98 = 98% of par = $980.00

b. The coupon rate is 4.25%, implying coupon payments of $42.5 annually or, more

precisely, $21.25 (= 42.5/2) semiannually.

c. Given the asked price and coupon rate, we can calculate current yield with the

formula:

Current yield =

= 4.25/98 = 0.0434 = 4.34%

7. (2.18)

a. The closing price today is $75.60, which is $0.97 above

$0.97 = $74.63.

b. You would buy 66 shares: $5,000/$75.60 = 66.14.

c. Your annual dividend income on 66 shares would be 66 x $1.88 = $124.08.

d. Earnings per share can be derived from the price-earnings (PE) ratio:

Given price/Earnings = 10.92 and Price = $75.60, we know that Earnings per

Share = $75.60/10.92 = $6.92.

8. (2.19)

a. At t = 0, the value of the index is: ($90 + $50 + $100)/3 = 80

At t = 1, the value of the index is: ($95 + $45 + $110)/3 = 83.33

The rate of return is:

1 = (83.33/80) 1 = 0.0417 or 4.17%

b. In the absence of a split, stock C would sell for $110, and the value of the index

would be the average price of the individual stocks included in the index: ($95 +

$45 + $110)/3 = $83.33.

After the split, stock C sells at $55; however, the value of the index should not be

affected by the split. We need to set the divisor (d) such that:

83.33 = ($95 + $45 + $55)/d

d = 2.34

c. The rate of return is zero. The value of the index remains unchanged since the

return on each stock separately equals zero.

6

9. (2.20)

a. Total market value at t = 0 is:

($90 x 100) + ($50 x 200) + ($200 x 100) = $39,000

Total market value at t = 1 is:

($95 x 100) + ($45 x 200) + ($110 x 100) = $40,500

Rate of return =

1 = ($40,500/$39,000) 1 = 0.0385 or 3.85%

b. The return on each stock is as follows:

R

A

=

1 = ($95/$90) 1 = 0.0556 or 5.56%

R

B

=

1 = ($45/$50) 1 = 0.10 or 10.00%

R

C

=

1 = ($110/$100) 1 = 0.10 or 10.00%

The equally-weighted average is: [5.56% + (10.00%) + 10.00%]/3 = 1.85%

(2.21)

10. The fund would require constant readjustment since every change in the price of a stock

would bring the fund asset allocation out of balance.

(2.22)

11. In this case, the value of the divisor will increase by an amount necessary to maintain the

index value on the day of the change. For example, if the index was comprised of only

one stock, it would increase by 2.06 points: ($95 $31) / $31 = 2.06.

CFA 1

Answer: c. Taxation

7

Chapter 3

1. (3.15)

a. The stock is purchased for $40 300 shares = $12,000.

Given that the amount borrowed from the broker is $4,000, Dees margin is the

initial purchase price net borrowing: $12,000 $4,000 = $8,000.

b. If the share price falls to $30, then the value of the stock falls to $9,000. By the

end of the year, the amount of the loan owed to the broker grows to:

Principal (1 + Interest rate) = $4,000 (1 + 0.08) = $4,320.

The value of the stock falls to: $30 300 shares = $9,000.

T

Margin on long position =

=

= 0.52 = 52%

Therefore, the investor will not receive a margin call.

c. Rate of return =

=

= 0.4150 = 41.50%

2. (3.16)

a. The initial margin was: $40 x 1,000 0.50 = $20,000.

As a result of the $10 increase in the stock price, Old Economy Traders loses: $10

1,000 shares = $10,000.

Moreover, Old Economy Traders must pay the dividend of $2 per share to the

lender of the shares: $2 1,000 shares = $2,000.

The remaining margin in the investors account therefore decreases to:

$20,000 $10,000 $2,000 = $8,000.

b. Margin on short position =

=

= 0.16 = 16%

Because the percentage margin falls below the maintenance level of 30%, there

will be a margin call.

8

c. The rate of return =

=

= 0.60 = 60%

3. (3.17)

a. The market-buy order will be filled at $50.25, the best price of limit-sell orders in

the book.

b. The next market-buy order will be filled at $51.50, the next-best limit-sell order

price.

c. As a security dealer, you would want to increase your inventory. There is

considerable buying demand at prices just below $50, indicating that downside

risk is limited. In contrast, limit-sell orders are sparse, indicating that a moderate

buy order could result in a substantial price increase.

4. (3.18)

a. Your initial investment is the sum of $5,000 in equity and $5,000 from borrowing,

which enables you to buy 200 shares of Telecom stock:

=

= 200 shares

The shares increase in value by 10%: $10,000 0.10 = $1,000.

You pay interest of = $5,000 0.08 = $400.

The rate of return will be:

= 0.12 = 12%

b. The value of the 200 shares is 200P. Equity is (200P $5,000), and the required

margin is 30%.

Solving

= 0.30, we get P = $35.71.

You will receive a margin call when the stock price falls below $35.71.

5. (3.19)

a. Initial margin is 50% of $5,000, which is $2,500.

b. Total assets are $7,500 ($5,000 from the sale of the stock and $2,500 put up for

margin). Liabilities are 100P. Therefore, net worth is ($7,500 100P).

9

Solving

= 0.30, we get P = $57.69.

A margin call will be issued when the stock price reaches $57.69 or higher.

(3.20)

6. The broker is instructed to attempt to sell your Marriott stock as soon as the Marriott

stock trades at a bid price of $20 or less. Here, the broker will attempt to execute but

may not be able to sell at $20, since the bid price is now $19.95. The price at which you

sell may be more or less than $20 because the stop-loss becomes a market order to sell at

current market prices.

7. (3.21)

a. The trade will be executed at $55.50.

b. The trade will be executed at $55.25.

c. The trade will not be executed because the bid price is lower than the price specified

in the limit-sell order.

d. The trade will not be executed because the asked price is higher than the price

specified in the limit-buy order.

CFA 1

c. Cannot tell from the information given.

The broker will start to sell when the stock price hits $55 and keep doing so if the

price further tumbles.

CFA 2

d. Act as odd-lot dealers.

10

Chapter 4

(4.11)

1. The offering price includes a 6% front-end load, or sales commission, meaning that every

dollar paid results in only $0.94 going toward the purchase of shares. Therefore:

Offering price =

06.01

70.10$

load1

NAV

= $11.38

(4.12)

2. NAV = Offering price (1 load) = $12.30 .95 = $11.69

(4.13)

3. Given that net asset value equals assets minus liabilities expressed on a per-share basis,

we first add up the value of the shares to get the market value of the portfolio:

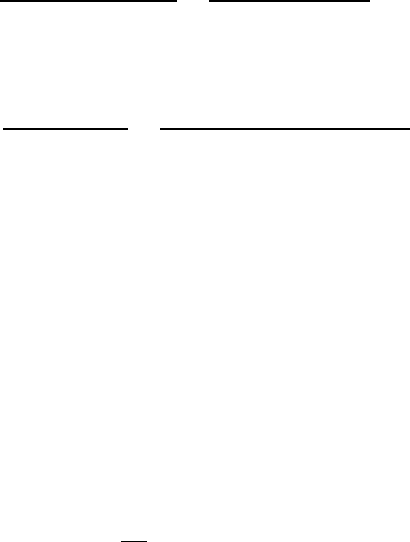

Stock

Value Held by

Fund

A

$ 7,000,000

B

12,000,000

C

8,000,000

D

15,000,000

Total

$42,000,000

Knowing that the accrued management fee, which adjusts the value of the portfolio, totals

$30,000, and the number of the shares outstanding is 4,000,000, we can use the NAV

equation:

Net asset value =

=

000,000,4

000,30$000,000,42$

= $10.49

(4.14)

4. The value of stocks sold and replaced = $15,000,000.

Turnover rate =

=

000,000,42$

000,000,15$

= 0.3571 = 35.71%

11

5. (4.15)

a. NAV =

=

= $39.40

b. Premium (or discount) =

NAV

NAVicePr

=

40.39$

40.39$36$

= 0.0863 = 8.63%

The fund sells at an 8.63% discount from NAV.

(4.16)

6. Given the NAV at the beginning and the end of the period, and the distributions during

the period, we can use the equation below to solve for the rate of return of the Corporate

Fund:

Rate of return =

=

50.12$

50.1$40.0$

= 0.0880 = 8.80%

(4.17)

7. As the price of a close-end fund may deviate from its NAV, we instead use the price of

the net asset value when we calculate the rate of return:

a. Start of year price = $12.00 1.02 = $12.24

End of year price = $12.10 0.93 = $11.253

Although NAV increased, the price of the fund fell by $0.987.

Rate of return =

=

24.12$

50.1$987.0$

= 0.0419 = 4.19%

b. An investor holding the same portfolio as the fund manager would have earned a

rate of return based on the increase in the NAV of the portfolio:

Rate of return =

=

00.12$

50.1$10.0$

= 0.1333 = 13.33%

12

(4.18)

8. Assume a hypothetical investment of $100. The end value of the investment will be equal

to I × (1 front-end load) × (1 + r true expense ratio)

T

Loaded-Up

We add the 12b-1 fee to the operating expenses to obtain the true expense ratio:

Expense ratio + (12b-1 fee) = 1% + 0.75% = 1.75%

a. Year 1 = $100 (1 + 0.06 0.0175) = $104.25

b. Year 3 = $100 (1 + 0.06 0.0175)

3

= $113.30

c. Year 10 = $100 (1 + 0.06 0.0175)

10

= $151.62

Economy fund

a. Year 1 = $100 0.98 (1 + 0.06 0.0025) = $103.64

b. Year 3 = $100 0.98 (1 + 0.06 0.0025)

3

= $115.90

c. Year 10 = $100 0.98 (1 + 0.06 0.0025)

10

= $171.41

9. (4.19)

a. NAV =

=

= $10

b. Because 1 million shares are redeemed at NAV = $10, the value of the portfolio

decreases to:

Portfolio value = $450million ($10 × 1million) = $440million

The number of shares outstanding will be the current shares outstanding minus the

number of shares redeemed: 44million 1million = 43million.

Thus, net asset value after the redemption will be:

NAV =

=

= $10

10. (4.20)

a. Empirical research indicates that past performance of mutual funds is not highly

predictive of future performance, especially for better-performing funds. While

there may be some tendency for the fund to be an above average performer next

year, it is unlikely to once again be a top 10% performer.

13

b. On the other hand, the evidence is more suggestive of a tendency for poor

performance to persist. This tendency is probably related to fund costs and

turnover rates. Thus if the fund is among the poorest performers, investors would

be concerned that the poor performance will persist.

(4.21)

11. Start of year NAV =

=

= $20

End of year NAV is based on the 8% price gain, less the 1% 12b-1 fee:

End of year NAV = $20 1.08 (1 0.01) = $21.384

Given the dividends per share is $0.20, we can calculate the rate of return using the

following equation:

Rate of return =

=

20$

20.0$20$384.21$

= 0.0792 = 7.92%

(4.22)

12. The excess of purchases over sales must be due to new inflows into the fund. Therefore,

$400 million of stock previously held by the fund was replaced by new holdings. So

turnover is:

Turnover rate =

=

= 0.1818 = 18.18%

(4.23)

13. Fees paid to investment managers were: 0.7% $2.2 billion = $15.4 million.

Since the total expense ratio was 1.1% and the management fee was 0.7%, we conclude

that 0.4% must be for other expenses. Therefore, other administrative expenses were:

0.004 $2.2 billion = $8.8 million.

14

(4.24)

14. Because the 4% load was paid up front and reduced the actual amount invested, only 96%

(1.00 - .04) of the contribution was invested. Given the value of the portfolio increased by

12% and the expense ratio was 1.2%, we can calculate the end value of the investment

against the initial contribution:

1 + r = 0.96 (1 + 0.12 0.012) = 1.0637

Thus, the rate of return was: 1.0637 1 = 0.0637 = 6.37%

Or otherwise, you can calculate the rate of return by the actual amount invested and value

changes:

To purchase the shares, you would have had to invest: $20,000/(1 0.04) = $20,833

The shares increase in value from $20,000 to $20,000 (1.12 0.012) = $22,160

The rate of return was: ($22,160 $20,833)/$20,833 = 0.0637 or 6.37%

15

Chapter 5

(5.5)

1. Using Equation 5.6, we can calculate the mean of the HPR as:

E(r) =

= (0.3 0.44) + (0.4 0.14) + [0.3 (0.16)] = 0.14 or

14%

Using Equation 5.7, we can calculate the variance as:

Var(r) =

2

=

E(r)]

2

= [0.3 (0.44 0.14)

2

] + [0.4 (0.14 0.14)

2

] + [0.3 (0.16 0.14)

2

]

= 0.054

Taking the square root of the variance, we get SD(r) = =

=

= 0.2324 or

23.24%

(5.6)

2. We use the below equation to calculate the holding period return of each scenario:

HPR =

a. The holding period returns for the three scenarios are:

Boom: (50 40 + 2)/40 = 0.30 = 30%

Normal: (43 40 + 1)/40 = 0.10 = 10%

Recession: (34 40 + 0.50)/40 = 0.1375 = 13.75%

E(HPR) =

= [(1/3) 0.30] + [(1/3) 0.10] + [(1/3) (0.1375)]

= 0.0875 or 8.75%

Var(HPR) =

E(r)]

2

= [(1/3) (0.30 0.0875)

2

] + [(1/3) (0.10 0.0875)

2

]

+ [(1/3) (0.1375 0.0875)

2

]

= 0.031979

SD(r) = =

=

79.319

= 0.1788 or 17.88%

b. E(r) = (0.5 8.75%) + (0.5 4%) = 6.375%

= 0.5 17.88% = 8.94%

16

3. (5.7)

a. Time-weighted average returns are based on year-by-year rates of return.

Year

Return = [(Capital gains + Dividend)/Price]

2010-2011

(110 100 + 4)/100 = 0.14 or 14.00%

2011-2012

(90 110 + 4)/110 = 0.1455 or 14.55%

2012-2013

(95 90 + 4)/90 = 0.10 or 10.00%

Arithmetic mean: [0.14 + (0.1455) + 0.10]/3 = 0.0315 or 3.15%

Geometric mean:

1

= 0.0233 or 2.33%

b.

Date

1/1/2010

1/1/2011

1/1/2012

1/1/2013

Net Cash Flow

300

208

110

396

Time

Net Cash flow

Explanation

0

300

Purchase of three shares at $100 per share

1

208

Purchase of two shares at $110,

plus dividend income on three shares held

2

110

Dividends on five shares,

plus sale of one share at $90

3

396

Dividends on four shares,

plus sale of four shares at $95 per share

The dollar-weighted return is the internal rate of return that sets the sum of the

present value of each net cash flow to zero:

0 = $300 + +

+

Dollar-weighted return = Internal rate of return = 0.1661%

4. (5.8)

a. Given that A = 4 and the projected standard deviation of the market return = 20%,

we can use the below equation to solve for the expected market risk premium:

A = 4 =

=

E(r

M

) r

f

= A

M

2

= 4 (0.20) = 0.16 or 16%

b. Solve E(r

M

) r

f

= 0.09 = A

M

2

= A (0.20) , we can get

A = 0.09/0.04 = 2.25

17

c. Increased risk tolerance means decreased risk aversion (A), which results in a

decline in risk premiums.

(5.9)

5. From Table 5.4, we find that for the period 1926 2010, the mean excess return for

S&P 500 over T-bills is 7.98%.

E(r) = Risk-free rate + Risk premium = 5% + 7.98% = 12.98%

(5.10)

6. To answer this question with the data provided in the textbook, we look up the real

returns of the large stocks, small stocks, and Treasury Bonds for 1926-2010 from Table

5.2, and the real rate of return of T-Bills in the same period from Table 5.3:

Total Real Return Geometric Average

Large Stocks: 6.43%

Small Stocks: 8.54%

Long-Term T-Bonds: 2.06%

Total Real Return Arithmetic Average

Large Stocks: 8.00%

Small Stocks: 13.91%

Long-Term T-Bonds: 1.76%

T-Bills: 0.68% (Table 5.3)

7. (5.11)

a. The expected cash flow is: (0.5$50,000) + (0.5$150,000) = $100,000

With a risk premium of 10%, the required rate of return is 15%. Therefore, if the

value of the portfolio is X, then, in order to earn a 15% expected return:

Solving X(1 + 0.15) = $100,000, we get X = $86,957

b. If the portfolio is purchased at $86,957, and the expected payoff is $100,000, then

the expected rate of return, E(r), is:

957,86$

957,86$000,100$

= 0.15 = 15%

The portfolio price is set to equate the expected return with the required rate of

return.

c. If the risk premium over T-bills is now 15%, then the required return is:

5% + 15% = 20%

The value of the portfolio (X) must satisfy: X*(1 + 0.20) = $100, 000*X = $83,333

d. For a given expected cash flow, portfolios that command greater risk premiums must

sell at lower prices. The extra discount in the purchase price from the expected value

is to compensate the investor for bearing additional risk.

18

8. (5.12)

a. Allocating 70% of the capital in the risky portfolio P, and 30% in risk-free asset,

the client has an expected return on the complete portfolio calculated by adding

up the expected return of the risky proportion (y) and the expected return of the

proportion (1 - y) of the risk-free investment:

E(r

C

) = y*E(r

P

) + (1 y)*r

f

= (0.7*0.17) + (0.3*0.07) = 0.14 or 14% per year

The standard deviation of the portfolio equals the standard deviation of the risky

fund times the fraction of the complete portfolio invested in the risky fund:

C

= y*

P

= 0.7*0.27 = 0.189 or 18.9% per year

b. The

the proportion of risky portfolio in the complete portfolio times the proportion

allocated in each stock.

Security

Investment

Proportions

T-Bills

30.0%

Stock A

0.7 27% =

18.9%

Stock B

0.7 33% =

23.1%

Stock C

0.7 40% =

28.0%

c. We calculate the reward-to-variability ratio (Sharpe ratio) using Equation 5.14.

For the risky portfolio:

S =

=

=

S =

=

= 0.3704

19

9. (5.13)

a. E(r

C

) = y*E(r

P

) + (1 y)*r

f

= y*0.17 + (1 y)*0.07 = 0.15 or 15% per year

Solving for y, we get y =

= 0.8

Therefore, in order to achieve an expected rate of return of 15%, the client must

invest 80% of total funds in the risky portfolio and 20% in T-bills.

b. The rall portfolio can be calculated by

the proportion of risky asset in the whole portfolio times the proportion allocated

in each stock.

c.

Security

Investment

Proportions

T-Bills

20.0%

Stock A

0.8 27% =

21.6%

Stock B

0.8 33% =

26.4%

Stock C

0.8 40% =

32.0%

d. The standard deviation of the complete portfolio is the standard deviation of the

risky portfolio times the fraction of the portfolio invested in the risky asset:

C

= y*

P

= 0.8*0.27 = 0.216 or 21.6% per year

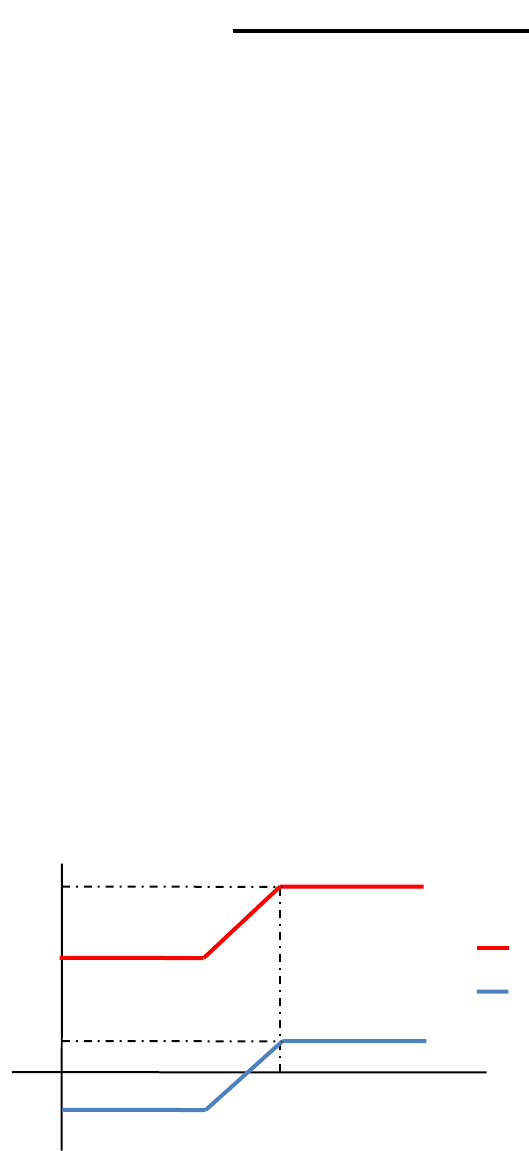

E(r)

7

27

14

17

P

CAL ( slope=.3704)

%

%

18.9

client

20

10. (5.14)

a. Standard deviation of the complete portfolio=

C

= y*0.27

If the client wants the standard deviation to be equal or less than 20%, then:

y = (0.20/0.27) = 0.7407 = 74.07%

He should invest, at most, 74.07% in the risky fund.

b. E(r

C

) = r

f

+ y*[E(r

P

) r

f

] = 0.07 + 0.7407*0.10 = 0.1441 or 14.41%

11. (5.15)

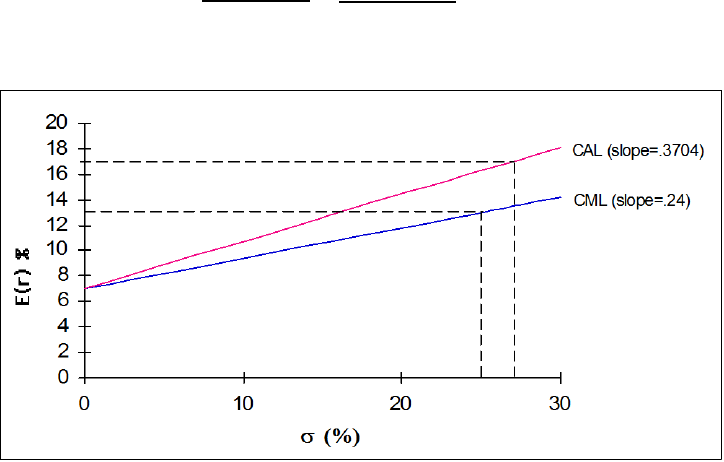

a. Slope of the CML =

=

= 0.24

See the diagram below:

b. Your fund allows an investor to achieve a higher expected rate of return for any

given standard deviation than would a passive strategy, i.e., a higher expected

return for any given level of risk.

12. (5.16)

a. With 70% of his money in your fund's portfolio, the client has an expected rate of

return of 14% per year and a standard deviation of 18.9% per year. If he shifts

that money to the passive portfolio (which has an expected rate of return of 13%

and standard deviation of 25%), his overall expected return and standard deviation

would become:

E(r

C

) = r

f

+ 0.7*E(r

M

) r

f

]

In this case, r

f

= 7% and E(r

M

) = 13%. Therefore:

E(r

C

) = 0.07 + (0.7*0.06) = 0.112 or 11.2%

21

The standard deviation of the complete portfolio using the passive portfolio would

be:

C

= 0.7*

M

= 0.7*0.25 = 0.175 or 17.5%

Therefore, the shift entails a decline in the mean from 14% to 11.2% and a decline

in the standard deviation from 18.9% to 17.5%. Since both mean return and

standard deviation fall, it is not yet clear whether the move is beneficial. The

disadvantage of the shift is apparent from the fact that, if your client is willing to

accept an expected return on his total portfolio of 11.2%, he can achieve that return

with a lower standard deviation using your fund portfolio rather than the passive

portfolio. To achieve a target mean of 11.2%, we first write the mean of the

complete portfolio as a function of the proportions invested in your fund portfolio,

y:

E(r

C

) = 7% + y*(17% 7%) = 7% + 10%*y

Because our target is E(r

C

) = 11.2%, the proportion that must be invested in your

fund is determined as follows:

11.2% = 7% + 10%*y, so y =

= 0.42

The standard deviation of the portfolio would be:

C

= y*27% = 0.42*27% = 11.34%

Thus, by using your portfolio, the same 11.2% expected rate of return can be

achieved with a standard deviation of only 11.34% as opposed to the standard

deviation of 17.5% using the passive portfolio.

b. The fee would reduce the reward-to-variability ratio, i.e., the slope of the CAL.

Clients will be indifferent between your fund and the passive portfolio if the slope

of the after-fee CAL and the CML are equal. Let f denote the fee:

Slope of CAL with fee =

=

Slope of CML (which requires no fee) =

= 0.24

Setting these slopes equal and solving for f:

= 0.24

10% f = 27%*0.24 = 6.48%

f = 10%*6.48% = 3.52% per year

22

CFA 1

Answer: V(12/31/2011) = V(1/1/2005)*(1 + g)

7

= $100,000*(1.05)

7

= $140,710.04

CFA 2

Answer: a. and b. are true. The standard deviation is non-negative.

CFA 3

volatility over time.

CFA 4

Answer: Investment 3.

For each portfolio: Utility = E(r) (0.5 4

2

)

Investment

E(r)

Utility

1

0.12

0.30

-0.0600

2

0.15

0.50

-0.3500

3

0.21

0.16

0.1588

4

0.24

0.21

0.1518

We choose the portfolio with the highest utility value.

CFA 5

Answer: Investment 4.

When an investor is risk neutral, A = 0 so that the portfolio with the highest utility is the

portfolio with the highest expected return.

CFA 6

23

Chapter 8

(8.11)

1. c. This is a predictable pattern of returns, which should not occur if the stock market is

weakly efficient.

(8.12)

2. c. This is a filter rule, a classic technical trading rule, which would appear to contradict the

weak form of the efficient market hypothesis.

(8.13)

3. c. The P/E ratio is public information so this observation would provide evidence against

the semi-strong form of the efficient market theory.

(8.14)

4. No, it is not more attractive as a possible purchase. Any value associated with dividend

predictability is already reflected in the stock price.

(8.15)

5. No, this is not a violation of the EMH. This empirical tendency does not provide investors

with a tool that will enable them to earn abnormal returns; in other words, it does not

suggest that investors are failing to use all available information. An investor could not

use this phenomenon to choose undervalued stocks today. The phenomenon instead

reflects the fact that dividends occur as a response to good performance. After the fact, the

stocks that happen to have performed the best will pay higher dividends, but this does not

imply that you can identify the best performers early enough to earn abnormal returns.

(8.16)

6. While positive beta stocks respond well to favorable new information about the

stocks returns should be predictable

and should not show abnormal returns around already anticipated events. If a recovery, for

example, is already anticipated, the actual recovery is not news. The stock price should

already reflect the coming recovery. The level of the stock price will be unpredictable

only when responding to new information.

7. (8.17)

a. Consistent. Half of all managers should outperform the market based on pure

luck in any year.

b. Violation. This would be the basis for an "easy money" rule: Simply invest with

last year's best managers.

c. Consistent. Predictable volatility does not convey a means to earn abnormal

returns.

d. Violation. The abnormal performance ought to occur in January, when the

increased earnings are announced.

24

e. Violation. Reversals offer a means to earn easy money: Simply buy last week's

losers.

(8.18)

8. An anomaly is considered an EMH exception because there are historical data to

substantiate a claim that says anomalies have produced excess risk-adjusted abnormal

returns in the past. Several anomalies regarding fundamental analysis have been

uncovered. These include the P/E effect, the momentum effect, the small-firm-in-January

effect, the neglected- firm effect, postearnings-announcement price drift, and the book-

to-market effect. Whether these anomalies represent market inefficiency or poorly

understood risk premiums is still a matter of debate. There are rational explanations for

each, but not everyone agrees on the explanation. One dominant explanation is that many

of these firms are also neglected firms, due to low trading volume, thus they are not part

of an efficient market or offer more risk as a result of their reduced liquidity.

CFA 1

Answer: b.

Public information constitutes semi-string efficiency, while the addition of private information

leads to strong form efficiency.

CFA 2

Answer: a.

The information should be absorbed instantly.

CFA 3

Answer: d.

All publically available information, including P/E ratio, should be absorbed in the price.

CFA 4

Answer: c.

Stocks producing abnormal excess returns will increase in price to eliminate the positive alpha.

CFA 5

Answer: c.

A random walk reflects no other information and is thus random.

CFA 6

Answer: d.

Unexpected results are by definition an anomaly.

25

Chapter 10

(10.12)

1. The current yield and the annual coupon rate of 6% imply that the bond price was at par a

year ago.

Using a financial calculator, FV = 1,000, n =7, PMT = 60, and i =7 gives us a selling

price of $946.11 this year.

Holding period return =

= 0.0061 = 0.61%

(10.13)

2. Zero coupon bonds provide no coupons to be reinvested. Therefore, the final value of the

investor's proceeds comes entirely from the principal of the bond and is independent of the rate

at which coupons could be reinvested (if they were paid). There is no reinvestment rate

uncertainty with zeros.

3. (10.14)

a. Effective annual rate on a three-month T-bill:

1 = (1.02412)

4

1 = 0.1000 = 10%

b. Effective annual interest rate on coupon bond paying 5% semiannually:

(1 + 0.05)

2

1 = 0.1025 = 10.25%

Therefore, the coupon bond has the higher effective annual interest rate.

(10.15)

4. The effective annual yield on the semiannual coupon bonds is (1.04)

2

= 8.16%. If the

annual coupon bonds are to sell at par they must offer the same yield, which requires an

annual coupon of 8.16%.

5. (10.16)

a. The bond pays $50 every six months.

Current price:

[$50 Annuity factor(4%, 6)] + [$1000 PV factor(4%, 6)] = $1,052.42

Assuming the market interest rate remains 4% per half year, price six months

from now:

[$50 Annuity factor(4%, 5)] + [$1000 PV factor(4%, 5)] = $1,044.52

b. Rate of Return =

=

= 0.0400 = 4.00% per six months.

26

6. (10.17)

a. Use the following inputs: n = 40, FV = 1,000, PV = 950, PMT = 40. We will

find that the yield to maturity on a semi-annual basis is 4.26%. This implies a

bond equivalent yield to maturity of: 4.26% 2 = 8.52%

Effective annual yield to maturity = (1.0426)

2

1 = 0.0870 = 8.70%

b. Since the bond is selling at par, the yield to maturity on a semi-annual basis is

the same as the semi-annual coupon, 4%. The bond equivalent yield to maturity

is 8%.

Effective annual yield to maturity = (1.04)

2

– 1 = 0.0816 = 8.16%

c. Keeping other inputs unchanged but setting PV = 1,050, we find a bond

equivalent yield to maturity of 7.52%, or 3.76% on a semi-annual basis.

Effective annual yield to maturity = (1.0376)

2

1 = 0.0766 = 7.66%

CFA 1

Answer:

a. (3) The yield on the callable bond must compensate the investor for the risk of

call.

Choice (1) is wrong because, although the owner of a callable bond receives

principal plus a premium in the event of a call, the interest rate at which he can

subsequently reinvest will be low. The low interest rate that makes it profitable

Choice (2) is wrong because a bond is more apt to be called when interest rates

are low. There will be an interest saving for the issuer only if rates are low.

b. (3)

c. (2)

d. (3)

CFA 2

Answer:

a. The maturity of each bond is 10 years, and we assume that coupons are paid

semiannually. Since both bonds are selling at par value, the current yield to maturity

for each bond is equal to its coupon rate.

If the yield declines by 1% to 5% (2.5% semiannual yield), the Sentinal bond will

increase in value to 107.79 [n=20; i = 2.5; FV = 100; PMT = 3].

The price of the Colina bond will increase, but only to the call price of 102. The

present value of scheduled payments is greater than 102, but the call price puts a

ceiling on the actual bond price.

27

b. If rates are expected to fall, the Sentinal bond is more attractive: Since it is not

subject to being called, its potential capital gains are higher. If rates are expected to

rise, Colina is a better investment. Its higher coupon (which presumably is

compensation to investors for the call feature of the bond) will provide a higher rate

of return than that of the Sentinal bond.

c.

back the Colina bond. If rates go down, the firm can call the bond, which puts a cap

on possible capital gains. So, higher volatility makes the option to call back the

bond more valuable to the issuer. This makes the Colina bond less attractive to the

investor.

CFA 3

Answer

Market conversion value = Value if converted into stock

= 20.83 $28 = $583.24

Conversion premium = Bond value Market conversion value

= $775 $583.24 = $191.76

CFA 4

Answer:

a. The call provision requires the firm to offer a higher coupon (or higher promised

yield to maturity) on the bond in order to compensate the investor for the firm's

option to call back the bond at a specified call price if interest rates fall

sufficiently. Investors are willing to grant this valuable option to the issuer, but

only for a price that reflects the possibility that the bond will be called. That price

is the higher promised yield at which they are willing to buy the bond.

b. The call option reduces the expected life of the bond. If interest rates fall

substantially so that the likelihood of a call increases, investors will treat the bond

as if it will "mature" and be paid off at the call date, not at the stated maturity

date. On the other hand if rates rise, the bond must be paid off at the maturity

date, not later. This asymmetry means that the expected life of the bond will be

less than the stated maturity.

c. The advantage of a callable bond is the higher coupon (and higher promised yield

to maturity) when the bond is issued. If the bond is never called, then an investor

will earn a higher realized compound yield on a callable bond issued at par than

on a non-callable bond issued at par on the same date. The disadvantage of the

callable bond is the risk of call. If rates fall and the bond is called, then the

investor receives the call price and will have to reinvest the proceeds at interest

rates that are lower than the yield to maturity at which the bond was originally

issued. In this event, the firm's savings in interest payments are the investor's loss.

28

CFA 5

Answer:

a.

(1) Current yield = Coupon/Price = $70/$960 = 0.0729 = 7.29%

(2) YTM = 3.993% semiannually or 7.986% annual bond equivalent yield

[n = 10; PV = 960; FV = 1000; PMT = 35]

Then compute the interest rate.

(3) Realized compound yield is 4.166% (semiannually), or 8.332% annual bond

equivalent yield. To obtain this value, first calculate the future value of

reinvested coupons. There will be six payments of $35 each, reinvested

semiannually at a per period rate of 3%:

[PV = 0; PMT = $35; n = 6; i = 3] Compute FV = $226.39

The bond will be selling at par value of $1,000 in three years, since coupon is

forecast to equal yield to maturity. Therefore, total proceeds in three years

will be $1,226.39. To find realized compound yield on a semiannual basis

(i.e., for six half-year periods), we solve:

$960 (1 + r

realized

)

6

= $1,226.39 r

realized

= 4.166% (semiannual)

b. Shortcomings of each measure:

(1) Current yield does not account for capital gains or losses on bonds bought at

prices other than par value. It also does not account for reinvestment income

on coupon payments.

(2) Yield to maturity assumes that the bond is held to maturity and that all

coupon income can be reinvested at a rate equal to the yield to maturity.

(3) Realized compound yield (horizon yield) is affected by the forecast of

reinvestment rates, holding period, and yield of the bond at the end of the

investor's holding period.

29

Chapter 11

(11.10)

1. The computation of duration is as follows:

Interest Rate (YTM) is 10%.

(1)

(2)

(3)

(4)

(5)

Time until

Payment

(Years)

Payment

(in millions

of dollars)

Payment

Discounted

At 10%

Weight

Column (1)

×

Column (4)

1

1

0.9091

0.2744

0.2744

2

2

1.6529

0.4989

0.9977

3

1

0.7513

0.2267

0.6803

Column Sum:

3.3133

1.0000

1.9524

Duration = 1.9524 years

(11.11)

2. The duration of the perpetuity is: (1 + y)/y = 1.10/0.10 = 11 years

Let w be the weight of the zero-coupon bond. Then we find w by solving:

(w 1) + [(1 w) 11] = 1.9523 w = 9.048/10 = 0.9048

Therefore, the portfolio should be 90.48% invested in the zero and 9.52% in the

perpetuity.

(11.12)

3. Using Equation 11.2, the percentage change in the bond price will be:

P

P

= Duration

00463.0

08.1

0010.0

0.5

y1

y

or a 0.463% increase.

4. (11.13)

a. Bond B has a higher yield to maturity than bond A since its coupon payments and

maturity are equal to those of A, while its price is lower. (Perhaps the yield is higher

because of differences in credit risk.) Therefore, the duration of Bond B must be

shorter. Homer and Liebowitz (1972) had demonstrated that the sensitivity of a

bonds price to a change in its yield is inversely related to the yield to maturity at

which the bond currently is selling. Thus, with a lower YTM, Bond A has higher

duration and is more sensitive to the interest rate change.

b. Bond A has a lower yield and a lower coupon, both of which cause it to have a longer

duration than that of Bond B. Moreover, Bond A cannot be called. Therefore, the

maturity of Bond A is at least as long as that of Bond B, which implies that the

duration of Bond A is at least as long as that of Bond B.

30

CFA 1

Answer:

C: Highest maturity, zero coupon

D: Highest maturity, next-lowest coupon

A: Highest maturity, same coupon as remaining bonds (Bond B and E)

B: Lower yield to maturity than bond E

E: Highest coupon, shortest maturity, highest yield of all bonds

CFA 2

Answer:

a. Modified duration =

YTM1

durationMacaulay

If the Macaulay duration is 10 years and the yield to maturity is 8%, then the

modified duration is: 10/1.08 = 9.26 years

b. For option-free coupon bonds, modified duration is better than maturity as a

measure of the bond’s sensitivity to changes in interest rates. Maturity considers

only the final cash flow, while modified duration includes other factors such as the

size and timing of coupon payments and the level of interest rates (yield to

maturity). Modified duration, unlike maturity, tells us the approximate proportional

change in the bond price for a given change in yield to maturity.

c. i. Modified duration increases as the coupon decreases.

ii. Modified duration decreases as maturity decreases.

CFA 10

Answer:

a. (4) A low coupon and a long maturity

b. (4) Zero, long

c. (4) All the above

d. (2) Great price volatility

31

Chapter 12

(12.13)

1. This exercise is left to the student.

(12.14)

2. Expansionary (i.e., looser) monetary policy to lower interest rates would help to stimulate

investment and expenditures on consumer durables. Expansionary fiscal policy (i.e.,

lower taxes, higher government spending, increased welfare transfers) would directly

stimulate aggregate demand.

(12.15)

3. A depreciating dollar makes imported cars more expensive and American cars cheaper to

foreign consumers. This should benefit the U.S. auto industry.

CFA 2

Answer:

a. The concept of an industrial life cycle refers to the tendency of most industries to

go through various stages of growth. The rate of growth, the competitive

environment, profit margins and pricing strategies tend to shift as an industry

moves from one stage to the next, although it is difficult to pinpoint exactly when

one stage has ended and the next begun.

The start-up stage is characterized by perceptions of a large potential market and

by high optimism for potential profits. In this stage, however, there is usually a

high failure rate. In the second stage, often called rapid growth or consolidation,

growth is high and accelerating, markets broaden, unit costs decline, and quality

improves. In this stage, industry leaders begin to emerge. The third stage, usually

called the maturity stage, is characterized by decelerating growth caused by such

things as maturing markets and/or competitive inroads by other products. Finally,

an industry reaches a stage of relative decline, in which sales slow or even

decline.

Product pricing, profitability, and industry competitive structure often vary by

phase. Thus, for example, the first phase usually encompasses high product

prices, high costs (R&D, marketing, etc.) and a (temporary) monopolistic industry

structure. In phase two (consolidation stage), new entrants begin to appear and

costs fall rapidly due to the learning curve. Prices generally do not fall as rapidly,

however, allowing profit margins to increase. In phase three (maturity stage),

growth begins to slow as the product or service begins to saturate the market, and

margins are eroded by significant price reductions. In the final stage, cumulative

industry production is so high that production costs have stopped declining, profit

margins are thin (assuming competition exists), and the fate of the industry

depends on the extent of replacement demand and the existence of substitute

products/services.

32

b. The passenger car business in the United States has probably entered the final

stage in the industrial life cycle because normalized growth is quite low. The

information processing business, on the other hand, is undoubtedly earlier in the

cycle. Depending on whether or not growth is still accelerating, it is either in the

second or third stage.

c. Cars: In the final phases of the life cycle, demand tends to be price sensitive.

Thus, Universal can not raise prices without losing volume. Moreover, given the

any

boxed in: Product pricing is determined by the market, and the company is a

-

Idata: Idata should have much more pricing flexibility given that it is in an earlier

phase of the industrial life cycle. Demand is growing faster than supply, and,

depending on the presence and/or actions of an industry leader, Idata may price

high in order to maximize current profits and generate cash for product

development, or price low in an effort to gain market share.

CFA 3

Answer:

a. A basic premise of the business cycle approach to investing is that stock prices

anticipate fluctuations in the business cycle. For example, there is evidence that

stock prices tend to move about six months ahead of the economy. In fact, stock

prices are a leading indicator for the economy.

Over the course of a business cycle, this approach to investing would work

roughly as follows. As the top of a business cycle is perceived to be approaching,

stocks purchased should not be vulnerable to a recession. When a downturn is

perceived to be at hand, stock holdings should be reduced, with proceeds invested

in fixed-income securities. Once the recession has matured to some extent, and

interest rates fall, bond prices will rise. As it is perceived that the recession is

about to end, profits should be taken in the bonds and proceeds reinvested in

stocks, particularly stocks with high beta that are in cyclical industries.

Abnormal returns will generally be earned only if these asset allocation switches

are timed better than those of other investors. Switches made after the turning

points may not lead to excess returns.

b. Based on the business cycle approach to investment timing, the ideal time to

invest in a cyclical stock like a passenger car company would be just before the

would be too late. The equities market generally anticipates changes in the

Universal Auto should already reflect the anticipated improvements in the

economy.

33

Chapter 13

(13.13)

1. FCFE

1

= FCFF Interest expenses(1 t

c

) + Increases in net debt

= $205 $22 (1 0.35) + $3 = $193.70 (million)

Market value of equity =

=

= $2,152.22 (million)

(13.14)

2. Cost of equity = r

f

+ E(Risk premium) = 7% + 4% = 11%

Because the dividends are expected to be constant every year, the price can be calculated

as the no-growth-value per share:

P

0

=

=

= $19.09

(13.15)

3. k = r

f

+ [E(r

M

) r

f

] = 0.05 + 1.5 (0.10 0.05) = 0.125 or 12.5%

Therefore:

P

0

=

=

= $29.41

(13.25)

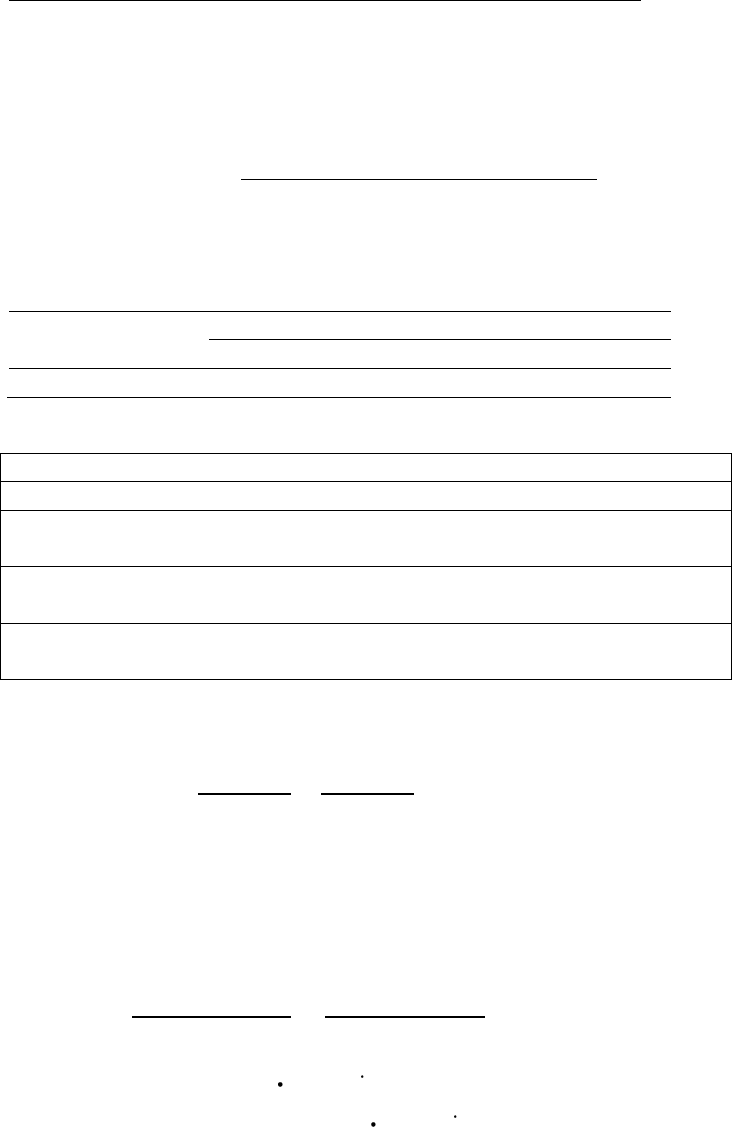

4. Use this spreadsheet for all answers

Inputs

Year Dividend Div growth

Term

value

Investor

CF

beta 1.05

2009 0.90 0.90

mkt_prem

0.085

2010 0.98 0.98

rf 0.035

2011 1.07 1.07

k_equity 0.12425

2012 1.15 1.15

plowback

0.7

2013 1.25 0.0851 1.25

ROE 0.11

2014 1.35 0.0843 1.35

term_gwth

0.077

2015 1.47 0.0835 1.47

2016 1.59 0.0827 1.59

2017 1.72 0.0819 1.72

2018 1.86 0.0811 1.86

2019 2.01 0.0803 2.01

2020 2.16 0.0794 2.16

2021 2.34 0.0786 2.34

2022 2.52 0.0778 2.52

2023 2.71 0.0770 2.71

2024 2.92 0.0770 66.54 69.46

Price = $20.07

34

a. Price = $20.62

b. Price = $18.95

c. Price = $20.07

CFA 1

Answer:

a. This director is confused. In the context of the constant growth model, it is true that

price is higher when dividends are higher holding everything else (including

dividend growth) constant. But everything else will not be constant. If the firm

raises the dividend payout rate, then the growth rate (g) will fall, and stock price

will not necessarily rise. In fact, if ROE > k, price will fall.

b. i. An increase in dividend payout reduces the sustainable growth rate as fewer

funds are reinvested in the firm.

ii. The sustainable growth rate is (ROE plowback), which falls as the plowback

ratio falls. The increased dividend payout rate reduces the growth rate of book

value for the same reasonfewer funds are reinvested in the firm.

CFA 2

Answer:

a. It is true that NewSoft sells at higher multiples of earnings and book value than

Capital. But this difference may be justified by NewSoft's higher expected growth

rate of earnings and dividends. NewSoft is in a growing market with abundant

profit and growth opportunities. Capital is in a mature industry with fewer growth

prospects. Both the price-earnings and price-book ratios reflect the prospect of

growth opportunities, indicating that the ratios for these firms do not necessarily

imply mispricing.

b. The most important weakness of the constant-growth dividend discount model in

this application is that it assumes a perpetual constant growth rate of dividends.

While dividends may be on a steady growth path for Capital, which is a more mature

firm, that is far less likely to be a realistic assumption for NewSoft.

c. NewSoft should be valued using a multi-stage DDM, which allows for rapid growth

in the early years, but also recognizes that growth must ultimately slow to a more

sustainable rate.

CFA 3

Answer:

a.

P

0

/E

1

= payout ratio/(r g)

However, since r and g are not explicitly given, they must be computed using the

following formulas:

35

g

ind

= ROE retention rate = 0.25 0.40 = 0.10

r

ind

= government bond yield + ( industry beta equity risk premium)

= 0.06 + (1.2 0.05) = 0.12

Therefore:

P

0

/E

1

= 0.60/(0.12 0.10) = 30.0

b.

i. Forecast growth in real GDP would cause P/E ratios to be generally higher for

Country A. Higher expected growth in GDP implies higher earnings growth

and a higher P/E.

ii. Government bond yield would cause P/E ratios to be generally higher for

Country B. A lower government bond yield implies a lower risk-free rate and

therefore a higher P/E.

iii. Equity risk premium would cause P/E ratios to be generally higher for

Country B. A lower equity risk premium implies a lower required return and

a higher P/E.

CFA 4

Answer:

a. k = r

f

+ [E(r

M

) r

f

] = 0.045 + 1.15 (0.145 0.045) = 0.16 or 16%

b.

Year Dividends

2010 $1.72

2011 $1.72 1.12 = $1.93

2012 $1.72 1.12

2

= $2.16

2013 $1.72 1.12

3

= $2.42

2014 $1.72 1.12

3

1.09 = $2.63

Present value of dividends paid in years 2011 to 2013:

Year PV of Dividends

2011 $1.93/1.16 = $1.66

2012 $2.16/1.16

2

= $1.61

2013 $2.42/1.16

3

= $1.55

Total: $4.82

P

2013

=

=

= $37.57

PV (in 2010) of P

2013

= $37.57/(1.16

3

) = $24.07

36

Intrinsic value of stock = $4.82 + $24.07 = $28.89

c. The table presented in the problem indicates that QuickBrush is selling below

intrinsic value, while we have just shown that SmileWhite is selling somewhat

above the estimated intrinsic value. Based on this analysis, QuickBrush offers

the potential for considerable abnormal returns, while SmileWhite offers slightly

below-market risk-adjusted returns.

d. Strengths of two-stage DDM compared to constant growth DDM:

The two-stage model allows for separate valuation of two distinct periods in a

company’s future. This approach can accommodate life cycle effects. It also

can avoid the difficulties posed when the initial growth rate is higher than the

discount rate.

The two-stage model allows for an initial period of above-sustainable growth.

It allows the analyst to make use of her expectations as to when growth may

shift to a more sustainable level.

A weakness of all DDMs is that they are all very sensitive to input values.

Small changes in k or g can imply large changes in estimated intrinsic value.

These inputs are difficult to measure.

37

Chapter 15

1. (15.4)

Cost Payoff Profit

Call option, X =

160

15.00 5.00 -10.00

Put option, X =

160

9.40 0.00 -9.40

Call option, X =

165

11.70 0.00 -11.70

Put option, X =

165

10.85 0.00 -10.85

Call option, X =

170

8.93 0.00 -8.93

Put option, X =

170

13.00 5.00 -8.00

(15.5)

2. If the stock price drops to zero, you will make $160 $2.62 per stock, or $157.38. Given

100 units per contract, the total potential profit is $15,738.

3. (15.9)

a. i. A long straddle produces gains if prices move up or down and limited losses if

prices do not move. A short straddle produces significant losses if prices move

significantly up or down. A bullish spread produces limited gains if prices move

up.

b. i. Long put positions gain when stock prices fall and produce very limited losses

if prices instead rise. Short calls also gain when stock prices fall but create losses

if prices instead rise. The other two positions will not protect the portfolio should

prices fall.

(15.10)

4. The initial outlay of this position is $38, the purchase price of the stock, and the payoff of

such position will be between two boundaries, $35 and $40. The maximum profit will

thus be: $40 $38 = $2, and the maximum loss will be: $35 $38 = $3.

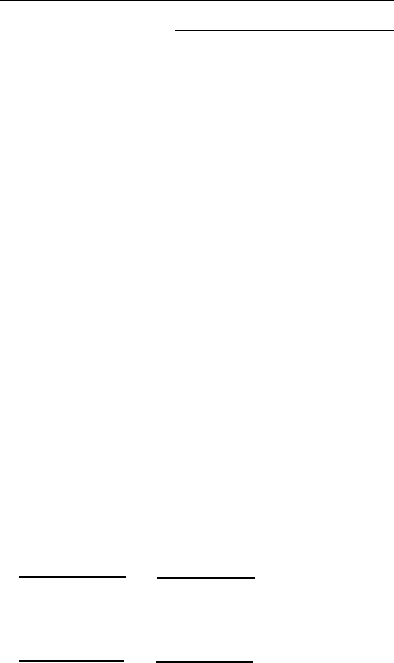

S

T

35

40

Payoff

Profit

3

2

Value

0

40

35

38

(15.11)

5. The collar involves purchasing a put for $3 and selling a call for $2. The initial outlay is

$1.

a. S

T

= $30

Value at expiration = Value of call + Value of put + Value of stock

= $0 + ($35 $30) + $30 = $35

Given 5,000 shares, the total net proceeds will be:

(Final Value Original Investment) # of shares

= ($35 $1) 5,000 = $170,000

Net proceeds without using collar = S

T

# of shares

= $30 5,000 = $150,000

b. S

T

= $40

Value at expiration = Value of call + Value of put + Value of stock

= 0 + 0 + $40 = $40

Given 5,000 shares, the total net proceeds will be:

(Final value Original investment) # of shares

= ($40 $1) 5,000 = $195,000

Net proceeds without using collar = S

T

# of shares

= $40 5,000 = $200,000

c. S

T

= $50

Value at expiration = Value of call + Value of put + Value of stock

= ($45 $50) + 0 + $50 =$45

Given 5,000 shares, the total net proceeds will be:

(Final value Original investment) # of shares

= ($45 $1) 5,000 = $220,000

Net proceeds without using collar = S

T

# of shares

= $50 5,000 = $250,000

With the initial outlay of $1, the collar locks the net proceeds per share in between the

lower bound of $34 and the upper bound of $44. Given 5,000 shares, the total net

proceeds will be between $170,000 and $220,000 when the position is closed. If we

simply continued to hold the shares without using the collar, the upside potential is not

limited but the downside is not protected.

39

(15.12)

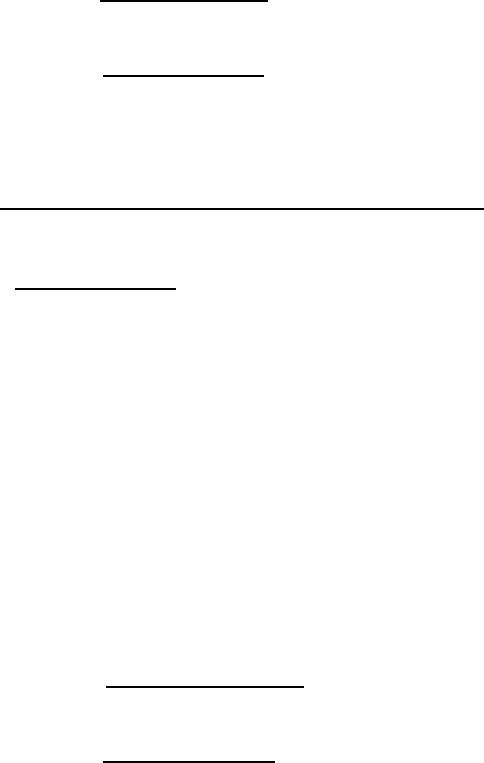

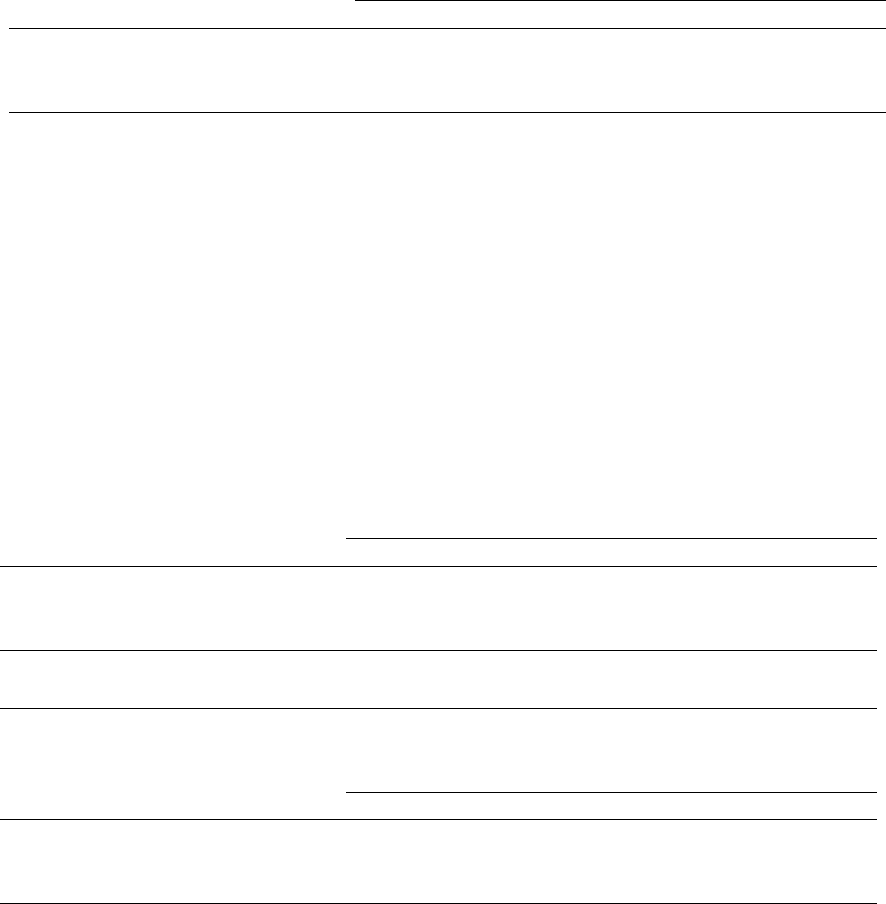

6. In terms of dollar returns:

Price of Stock Six Months from Now

Stock price:

$80

$100

$110

$120

a. All stocks (100 shares)

8,000

10,000

11,000

12,000

b. All options (1,000 shares)

0

0

10,000

20,000

c. Bills + 100 options

9,360

9,360

10,360

11,360

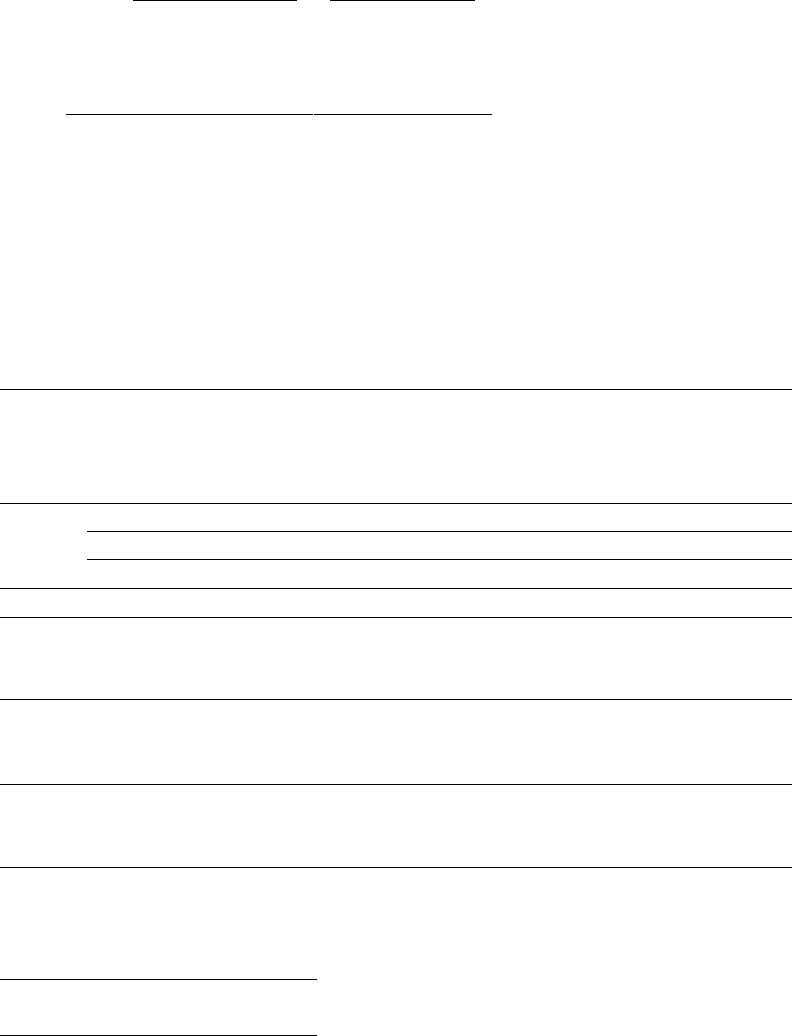

In terms of rate of return, based on a $10,000 investment:

Price of Stock Six Months from Now

Stock price:

$80

$100

$110

$120

a. All stocks (100 shares)

20%

0%

10%

20%

b. All options (1,000 shares)

100%

100%

0%

100%

c. Bills + 100 options

6.4%

-6.4%

3.6%

13.6%

-150%

-100%

-50%

0%

50%

100%

150%

0 50 100 150

a. All stocks (100 shares)

b. All options (1,000 shares)

c. Bills + 100 options

Rate of Return

Stock Price ($)

-6.4%

40

Chapter 17

(17.2)

1. Futures price = S

0

(1+ r

f

d)

T

= $1,200 (1 + .01 .02) = $1,188

(17.3)

2. The theoretical futures price = S

0

(1+ r

f

)

T

= $1,700 (1 + .02) = $1,734. At $1,641, the

gold futures contract is underpriced. To benefit from the mispricing, we sell gold short

$1,700 today, lend the money at risk-free rate, and long gold future of $1,641. One year

from today well have cash inflows from the loan of $1,734 and the proceeds from future

position of (S

T

$1,641), and outflow to close the short position of gold at spot price (

S

T

). The arbitrage profit is thus $1,734 + (S

T

$1,641) + (S

T

) = $93.

This answer presumes that that the commodity is available for short sale without fees and

with full access to the proceeds of the short sale. In real-world practice, failure to satisfy

these conditions may limit the apparent arbitrage opportunity.

(17.4)

3. Margin = $115,098 .15 = $17,264.70

Total $ Loss = $115,098 $108,000 = $7,098

Total % Loss = $7,098/$17,264.70 = 41.11 % loss

(17.9)

4. According to the parity relationship, the proper price for December futures is:

F

Dec

= F

June

(l + r

f

)

l/2

= $1,646.30 (1.04)

1/2

= $1,678.90

The listed futures price for December is too low relative to the June price. We could long

the December contract and short the June contract to exploit the opportunity.

5. (17.10)

a.

Action

Initial Cash Flow

Cash Flow at Time T

Buy stock

S

0

S

T

+ D

Short futures

0

F

0

S

T

Borrow

S

0

S

0

(1 + r)

Total

0

F

0

+ D S

0

(1 + r)

b. The net initial investment is zero, whereas the final cash flow is not zero.

Therefore, in order to avoid arbitrage opportunities, the equilibrium futures price

will be the final cash flow equated to zero. Accordingly:

F

0

= S

0

(1 + r) D

c. Noting that D = (d S

0

), we substitute and rearrange to find that:

F

0

= S

0

(1 + r d)

41

6. (17.11)

a. F

0

= S

0

(1 + r

f

)

T

= $150 1.03 = $154.50

b. F

0

= S

0

(1 + r

f

)

T

= $150 (1.03)

3

= $163.91

c. F

0

= S

0

(1 + r

f

)

T

= $150 (1.05)

3

= $173.64

CFA 1

Answer:

a. Contrasts

CFA 2

Answer:

d. Maintenance margin

CFA 3

Answer:

Total losses may amount to $3,500 before a margin call is received. Each contract calls

for delivery of 5,000 ounces. Before a margin call is received, the price per ounce can

increase by: $3,500/5,000 = $ .70

The futures price at this point would be: $28 + $ .70 = $28.70

42

Chapter 18

7. (18.5)

a.

E(r)

Portfolio A

11%

10%

.8

Portfolio B

14%

31%

1.5

Market index

12%

20%

1.0

Risk-free asset

6%

0%

0.0

The alphas for the two portfolios are:

A

= E(r

A

) required return predicted by CAPM

= .11 [.06 + .8 (.12 .06)] = 0.2%

B

= E(r

B

) required return predicted by CAPM

= .14 [.06 + 1.5 (.12 .06)] = 1.0%

Ideally, you would want to take a long position in Portfolio A and a short position

in Portfolio B.

b. If you hold only one of the two portfolios, then the Sharpe measure is the

appropriate criterion:

S

A

=

=

= .5

S

B

=

=

= .26

Therefore, using the Sharpe criterion, Portfolio A is preferred.

(18.6)

8. We first distinguish between timing ability and selection ability. The intercept of the

scatter diagram is a measure of stock selection ability. If the manager tends to have a

market has zero excess return) then we conclude that the manager has, on average, made

good stock picks. In other words, stock selection must be the source of the positive

excess returns.

Timing ability is indicated by the curvature of the plotted line. Lines which become

steeper as you move to the right of the graph show good timing ability. The steeper slope

shows that the manager maintained higher portfolio sensitivity to market swings (i.e., a

higher beta) in periods when the market performed well. This ability to choose more

market-sensitive securities in anticipation of market upturns is the essence of good

timing. In contrast, a declining slope as you move to the right indicates that the portfolio

was more sensitive to the market when the market performed poorly and less sensitive to

the market when the market performed well. This indicates poor timing.

43

We can therefore classify performance ability for the four managers as follows:

Selection Ability

Timing Ability

A

Bad

Good

B

Good

Good

C

Good

Bad

D

Bad

Bad

9. (18.7)

a. Actual: (.70 .02) + (.20 .01) + (.10 .005) = .0165 = 1.65%

Bogey: (.60 .025) + (.30 .012) + (.10 .005) = .0191 = 1.91%

Underperformance = .0191 .0165 = .0026 = .26%

b. Security Selection:

(1)

(2)

(3)

(4)

(5) = (3) (4)

Market

Portfolio

Performance

Index

Performance

Excess

Performance

Manager’s

Portfolio

Weight

Contribution

Equity

2.0%

2.5%

.5%

.70

.35%

Bonds

1.0%

1.2%

.2%

.20

.04%

Cash

.5%

.5%

0%

.10

.00%

Contribution of Security Selection:

.39%

c. Asset Allocation:

(1)

(2)

(3)

(4)

(5) = (3) (4)

Market

Actual

Weight

Benchmark

Weight

Excess

Weight

Index Return

Contribution

Equity

.70

.60

.10

2.5%

.25%

Bonds

.20

.30

.10

1.2%

.12%

Cash

.10

.10

0

.5%

0%

Contribution of Asset Allocation:

.13%

Summary

Security selection

.39%

Asset allocation

.13%

Excess performance

.26%

CFA 1

Answer:

d. Russell 2000 Index

44

CFA 2

Answer:

a.

A

= .24 [ .12 + 1.0 ( .21 .12)] = 3.0%

B

= .30 [ .12 + 1.5 ( .21 .12)] = 4.5%

b. (i) The managers may have been trying to time the market. In that case, the SCL

of the portfolios may be non-linear.

(ii) One year of data is too small a sample.

(iii) The portfolios may have significantly different levels of diversification. If

both have the same risk-adjusted return, the less diversified portfolio has a higher

exposure to risk because of its higher diversifiable risk. Since the above measure

adjusts for systematic risk only, it does not tell the entire story.

CFA 3

Answer:

a. Indeed, the one year results were terrible, but one year is a poor statistical base

from which to draw inferences. Moreover, the fund manager was directed to adopt

a long-term horizon. The Board specifically instructed the investment manager to

give priority to long term results.

b. The sample of pension funds held a much larger share in equities compared to the

Alpine pension fund. The stock and bond indexes indicate that equity returns

significantly exceeded bond returns. The Alpine fund manager was explicitly

directed to hold down risk, investing at most 25% of fund assets in common

responsible for an asset allocation policy dictated by the client.

c. Over the five-year period, -adjusted

performance compared to the market, was positive:

= .133 [ .075 + 0.9 ( .138 .075)] = .13%

d. Note that, over the last five years, and particularly the last one year, bond

performance has been poor; this is significant because this is the asset class that

Alpine had been encouraged to hold. Within this asset class, however, the Alpine

fund fared much better than the index, as shown in the last two lines of the table.

Moreover, despite the fact that the bond index underperformed both the actuarial

return and T-bills, the Alpine fund outperformed both for the five-year period. On

a risk-within each asset class has been

superior. The overall disappointing returns were the result of the heavy asset

e. A trustee may not care about the time-weighted return, but that return is more

ger has no control

over the cash inflow to the fund.

45

CFA 4

Answer:

a.

Alpha ():

i

= E(r

i

) {r

f

+

i

[E(r

M

) r

f

]}

Expected excess return: E(r

i

) r

f

A

= .20 [ .08 + 1.3 ( .16 .08)] = 1.6%

.20 .08 = 12%

B

= .18 [ .08 + 1.8 ( .16 .08)] = 4.4%

.18 .08 = 10%

C

= .17 [ .08 + 0.7 ( .16 .08)] = 3.4%

.17 .08 = 9%

D

= .12 [ .08 + 1.0 ( .16 .08)] = 4.0%

.12 .08 = 4%

Stocks A and C have positive alphas, whereas stocks B and D have negative

alphas.

The residual variances are:

2

(e

A

) = .58

2

= .3364;

2

(e

B

) = .71

2

= .5041

2

(e

C

) = .60

2

= .3600;

2

(e

D

) = .55

2

= .3025

b. To construct the optimal risky portfolio, we first determine the optimal active

portfolio. Using the Treynor-Black technique, we construct the active portfolio:

A

.0476

0.6136

B

.0873

1.1261

C

.0944

1.2185

D

.1322

1.7060

Total

.0775

1.0000

Do not be disturbed by the fact that the positive alpha stocks get negative

weights and vice versa. The entire position in the active portfolio will turn out to

be negative, returning everything to good order.

With these weights, the forecast for the active portfolio is:

= [ .6136 .016] + [1.1261 ( .044)] [1.2185 .034]

+ [1.7060 ( .04)] = 16.90%

= [ .6136 1.3] + [1.1261 1.8] [1.2185 0.70] + [1.7060 1.0] = 2.08

The high beta (higher than any individual beta) results from the short positions in

the relatively low beta stocks and the long positions in the relatively high beta

stocks.

46

2

(e) = [( .6136)

2

.3364] + [1.1261

2

.5041]

+ [(1.2185)

2

.36] + [1.7060

2

.3025]

= 2.18082 so e = 147.68%

Here, again, the levered position in stock B [with the high

2

(e)] overcomes the

diversification effect, and results in a high residual standard deviation. The

optimal risky portfolio has a proportion w

*

in the active portfolio, computed as

follows:

w

0

=

=

= .05124

The negative position is justified for the reason given earlier.

The adjustment for beta is:

w

*

=

=

= .0486

Because w* is negative, we end up with a positive position in stocks with positive

alphas and vice versa. The position in the index portfolio is:

1 (0.0486) = 1.0486

c. To calculate Sharpe's measure for the optimal risky portfolio we compute the

appraisal ratio for the active portfolio and Sharpe's measure for the market

portfolio. The appraisal ratio of the active portfolio is:

A = /e)= .1690/1.4768 = .1144

A

2

= .0131

Hence, the square of Sharpe's measure (S) of the optimized risky portfolio is:

1341.00131.0

23

8

ASS

2

22

M

2

S = .3662

Compare this to the market's Sharpe measure: S

M

= 8/23 = .3478

The difference is: .0184

Note that the only-moderate improvement in performance results from the fact

that only a small position is taken in the active portfolio A because of its large

residual variance.

We calculate the "Modigliani-squared" (M

2

) measure, as follows:

E(r

P

*

) = r

f

+ S

P

M

= .08 + ( .3662 .23) = 16.423%

M

2

= E(r

P

*

) E(r

M

) = .16423 .16 = .423%

47

Chapter 19

1. (19.5)

a. $10,000/$2 = £5,000

£5,000/£40 = 125 shares

The investor can buy 125 shares.

b. To fill in the table, we use the relation:

1 + r(US) = [(1 + r

f

(UK)] E

1

/E

0

Price per

Pound-Denominated

Dollar-Denominated Return (%)

for Year-End Exchange Rate

Share (£)

Return (%)

$1.80/£

$2.00/£

$2.20/£

£35

12.5%

21.25%

12.5%

3.75%

£40

0.0%

10.00%

0.0%

10.00%

£45

12.5%

1.25%

12.5%

23.75%

c. The dollar-denominated return equals the pound-denominated return when the

exchange rate at year-end equals the exchange rate at initial investment.

(19.6)

2. The standard deviation of the pound-denominated return (using 3 degrees of freedom) is

10.21%. The dollar-denominated return has a standard deviation of 13.10% (using 9

degrees of freedom), greater than the pound-denominated standard deviation. This is due

to the addition of exchange rate risk.

3. (19.7)

a. First we calculate the dollar value of the 125 shares of stock in each scenario.

Then we add the profits from the forward contract in each scenario.

Price per

Dollar Value of Stock

at Given Exchange Rate

Share (£)

Exchange Rate:

$1.80/£

$2.00/£

$2.20/£

£35

7,875

8,750

9,625

£40

9,000

10,000

11,000

£45

10,125

11,250

12,375

Profits on Forward Exchange:

[ = 5000 (2.10 E

1

)]

1,500

500

500

Price per

Total Dollar Proceeds

at Given Exchange Rate

Share (£)

Exchange Rate:

$1.80/£

$2.00/£

$2.20/£

£35

9,375

9,250

9,125

£40

10,500

10,500

10,500

£45

11,625

11,750

11,875

48

Finally, calculate the dollar-denominated rate of return, recalling that the initial

investment was $10,000:

Price per

Rate of return (%)

at Given Exchange Rate

Share (£)

Exchange Rate:

$1.80/£

$2.00/£

$2.20/£

£35

6.25%

7.50%

8.75%

£40

5.00%

5.00%

5.00%

£45

16.25%

17.50%

18.75%

The standard deviation is now 10.24%. This is lower than the unhedged dollar-

denominated standard deviation, and is only slightly higher than the standard deviation of

the pound-denominated return.

CFA 1

Answer:

a. We exchange $1 million for foreign currency at the current exchange rate and sell

forward the amount of foreign currency we will accumulate 90 days from now.

For the yen investment, we initially receive:

$1 million 133.05 = ¥133.05 million

Invest for 90 days to accumulate:

¥133.05 [1 + ( .076/4)] = ¥135.57795 million

(We divide the quoted 90-day rate by 4, since quoted money market interest