1

Pandemic’s Impact on

Health Insurance Coverage

in Minnesota Was Modest

by Summer 2020

Key Findings:

1. Preceding the 2020

pandemic in Minnesota, an

estimated 95.3 percent of

the state’s population had

health insurance coverage

and 4.7 percent were

uninsured.

2. Midway through 2020,

uninsurance remained

largely unchanged, at 4.6

percent.

3. Minnesotans saw increased

enrollment in public health

insurance programs and in

the individual market,

offsetting losses in employer

coverage.

4. State and federal reforms

that improved eligibility,

affordability and ease of

enrollment in coverage, as

well as COVID-19 related

federal financial supports

and coverage decisions

pertaining to state public

programs, helped soften the

adverse economic impact of

the pandemic on health

insurance coverage.

The COVID-19 pandemic, which arrived in the United States in

January 2020, continues to cause major economic and social

disruptions across the globe, and experts believe the impact

will be felt for years to come. Because of the connection for

many in Minnesota and the U.S. between health insurance

coverage and employment, there is a particular concern that

pandemic-related job losses and declines in income could

have affected access to, and affordability of, health insurance

coverage and health care services.

Past economic downturns have shown such a link and

demonstrated the downstream effects on access to health

care services. Access to health insurance coverage and health

care services is always a critical component of economic and

personal wellbeing – in a pandemic it holds additional

importance: to manage viral spread and recovery, individuals

must have access to testing, diagnostic services and

treatment, much of which is facilitated through services

financed by health insurance coverage.

1

In this brief we describe changes in health insurance coverage

in Minnesota between the fall of 2019 and July 2020 using

data from the Minnesota Health Access Survey (MNHA), a

biennial survey of health insurance coverage and access, and

data on enrollment collected from health insurance carriers

providing coverage to Minnesotans.

2

Because of the

importance of health care costs in accessing care, we also

present updated estimates about the impact of increasing

health care costs on Minnesotans. We expect to update this

issue brief in late spring to present early 2021 coverage

results.This analysis was conducted in partnership between

the Minnesota Departments of Health and Commerce and the

State Health Access Data Assistance Center (SHADAC).

P A N D E M I C ’ S I M P A C T O N H E AL T H I N S U R A N C E C O V E R A G E

2

Health Insurance Coverage in 2019

Results from the MNHA show that Minnesota maintained high rates of coverage in 2019 that were

consistent with levels experienced after the full implementation of the Affordable Care Act in Minnesota

in 2014 – 95.3 percent of Minnesotans had health insurance coverage that year.

3

Compared to 2017,

coverage in the state was significantly higher,

4

likely because of Minnesota’s the strong economy and job

market, as well as by provisions enacted by the Minnesota Legislature to help stabilize the individual

health insurance market.

5

Coverage through employers, often called group coverage, actually increased relative to 2017 from 51.9

to 53.6 percent. At the same time enrollment in individual health insurance, where people purchase

coverage directly without the support of an employer, stopped the downward trend observed between

2016 and 2018. Public coverage in 2019 remained unchanged in total. While Minnesota’s aging

population resulted in increased Medicare coverage for the elderly, income growth appears to have

limited increases in enrollment among the non-elderly for state public programs.

In 2019, around 264,000 Minnesotans (4.7 percent) lacked health insurance coverage.

Changes in Health Insurance in 2020

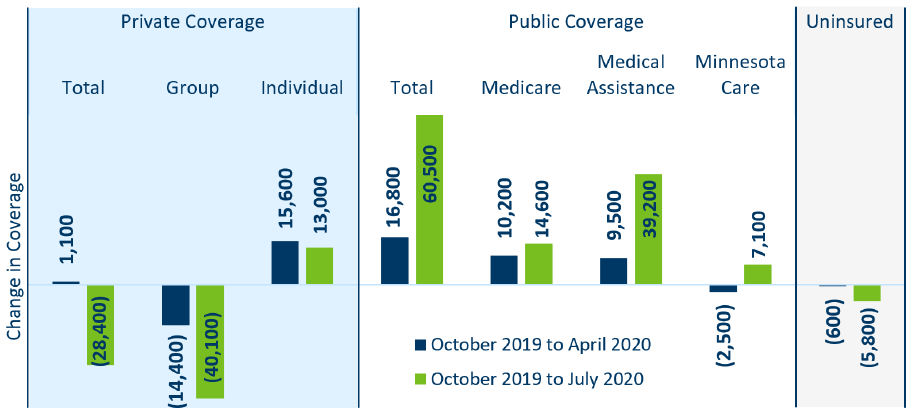

By April 2020, three months after COVID-19 had arrived in Minnesota, the state saw small declines in

group coverage (14,500) which was more than offset by enrollment gains in public coverage (16,800) and

the individual market (15,600)

6

. After accounting for population growth, this shift in coverage resulted in

no significant change in the number of Minnesotans without health insurance (Figure 1).

Figure 1: Change in Enrollment between 2019 and 2020, by Coverage Type

Source: Minnesota Department of Health, Health Economics Program 2019 Minnesota Health Access Survey and 2020 Health Insurance

Enrollment Survey. Fully-insured group coverage and self-insured group coverage are combined. Not shown: short-term health

insurance plans (which represents 0.1% of people covered) and other public programs (which represents 1.1% of people covered). They

are included in Table 1 in the Supplement: Data and Methods.

P A N D E M I C ’ S I M P A C T O N H E A L T H I N S U R A N C E C O V E R A G E

3

Three months later, by July 2020, the number of uninsured Minnesotans had fallen by an estimated 5,800

Minnesotans, relative to October 2019. While losses in group coverage had increased to 40,100 and

individual market gains remained largely unchanged, enrollment in Minnesota Health Care Programs

(Medical Assistance and MinnesotaCare) had risen substantially (46,300) to more than offset private

market coverage losses.

There are three likely factors contributing to why the pandemic, at least through the summer of 2020, had

a limited impact on overall levels of coverage in Minnesota:

1) Federal and state support for state public health programs, unemployment and businesses;

2) Provisions in state and federal health reforms that improved affordability and access to the

individual market and state public programs; and

3) The historical lack of employer-based coverage in industries and for types of jobs experiencing the

highest levels of layoffs.

Through state Executive Orders and Center for Medicare & Medicaid Services waiver programs, the

Minnesota Department of Human Services permitted Minnesotans enrolled in state public health care

programs in March 2020 to maintain coverage until the end of the Public Health Emergency. This means

that people who otherwise would have had to renew eligibility for Medical Assistance and MinnesotaCare

after March 31, 2020 remained enrolled.

7

In addition, federal support for businesses, such as the

Paycheck Protection Program (PPP), which provided grants to cover wages during COVID-19 related

closures, allowed businesses to continue offering benefits and wages. State and federal expanded

unemployment benefits were increased and extended to contract or gig workers, allowing them to

maintain income, and, potentially, health insurance coverage. Data show that through September 2020,

42 percent of employers who told employees not to work continued to cover at least part of their health

insurance premiums, though this varied by industry.

8

The ACA’s role in supporting stability of coverage during the pandemic played out with the help of

MNsure, Minnesota’s health insurance exchange, through which Minnesotans can enroll in private and

public coverage. As part of its efforts, MNsure offers eligibility assessment for state public programs and

access to premium support for individual market coverage, thereby creating greater affordability of

coverage for some Minnesotans. In addition, MNsure offered a COVID-19 Emergency Special Enrollment

Period in the spring of 2020, during which they reported that more than 23,000 people signed-up for

coverage; 59.2 percent applied for state public programs, the remaining 40.8 percent for individual

market coverage.

9

Medicaid, which covers people with lower incomes, children, the elderly and people

with disabilities, had increased enrollment of 39,200 individuals between October 2019 and July 2020,

with all enrollment gains in programs for families, children and adults without children. MinnesotaCare,

which covers people with moderate incomes who do not have access to employer coverage, had

increased enrollment of 7,100 individuals over the same period (Figure 1).

10

Finally, employment losses may not have translated to coverage losses, in part, because industries and job

types most impacted by the pandemic-related downturn are less likely to offer health insurance coverage

to their employees. In other words, among people who experienced job losses, some never had access to

employer-based coverage in the first place. For example, in 2019, only about 55.8 percent of non-elderly

adult employees in leisure and hospitality reported having group coverage (as compared to 71.1 percent

P A N D E M I C ’ S I M P A C T O N H E A L T H I N S U R A N C E C O V E R A G E

4

of all employed Minnesotans age 18 to 64). These individuals were also more likely to be uninsured (13.4

percent as compared to 6.0 percent of all employed Minnesotans ages 18 to 64).

11

Similarly, for food

preparation and serving, the occupational category with the highest number of unemployment claims

between March and December 2020, only 37 percent of vacancies indicated an offer of health insurance

coverage.

Impact of Health Insurance on Health Care Costs

Despite the positive indications that most Minnesotans were able to retain or gain coverage in 2020, the

cost of health care remains a continuing and significant challenge for many of the state’s residents,

regardless of access to coverage. The 2019 data – collected in a strong economy – raise significant

concerns about access to health care services and the financial protection Minnesotans gain from holding

health insurance coverage.

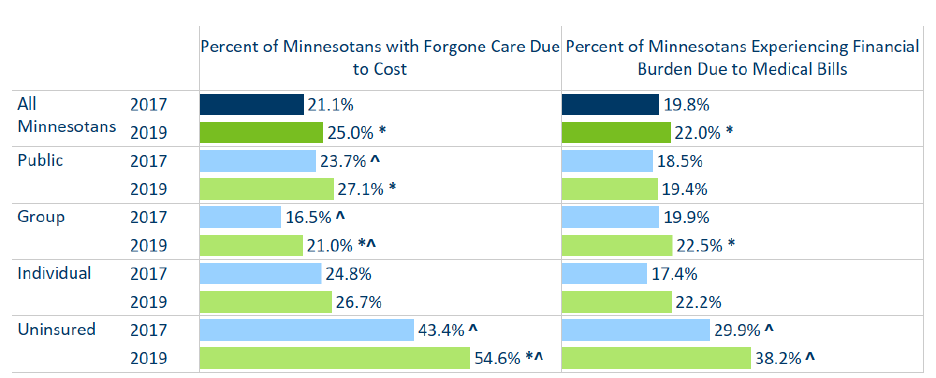

Overall, 25 percent of Minnesotans reported having to forgo needed health care due to cost, up from

about 21 percent two years earlier (Figure 2). The increases were concentrated in those with employer

coverage and the uninsured. While only 16.5 percent of people with group coverage reported having to

forgo care due to cost in 2017, 21 percent reported the same in 2019. This coincides with increases in cost

sharing for people with employer coverage. Further, 22 percent of Minnesotans reported having had

problems paying medical bills, or having had trouble paying for basic bills, like rent, heat and groceries,

due to medical bills (Figure 2).

Forgone care and problems with medical bills remain a bigger problem for uninsured Minnesotans. Health

insurance companies usually negotiate discounts from health care providers, and the federal government

sets prices for Medicare services (Medicaid services are based on federal prices). Those discounts are not

available to the uninsured, who therefore face higher prices. In addition, the uninsured are exposed to the

full cost of health care services at the point of care, not just a fraction of the total in the form of premiums

plus cost-sharing obligations.

People with individual market coverage also report higher levels of forgone care and problems with

medical bills, which is important context for growing enrollment in that market space. Similar to the

uninsured, people with individual market coverage pay the full cost of their health coverage, because they

lack the benefit of an employer subsidy, though some receive tax credits to reduce premiums based on

income.

12

Unlike the uninsured, they do have the advantage that payments are spread out across a

benefit year, and their costs are based on discounted rates negotiated between carriers and providers.

P A N D E M I C ’ S I M P A C T O N H E A L T H I N S U R A N C E C O V E R A G E

5

Figure 2: Forgone Care and Financial Burden by Coverage Type, 2017 to 2019

Source: Minnesota Health Access Surveys, 2017 to 2019

* Indicates statistically significant difference (95%) level from prior year shown.

^ Indicates statistically significant difference (95%) level from all Minnesotans within the year.

Conclusions

Because of the close connection between jobs and health insurance coverage, economic downturns in the

United States often affect access to health insurance. As such, it comes as a positive and somewhat

unexpected surprise that overall levels of health insurance coverage in Minnesota, by the summer of

2020, was only modestly impacted by the pandemic and its associated economic consequences. While

Minnesotans with employer-based insurance experienced substantial losses in coverage, gains in public

program and individual market coverage offset these losses, and, as a result the number of uninsured

people in the state actually fell slightly between October of 2019 and July 2020. This likely indicates that

flexibility for many to maintain coverage in state public programs, and policies to shore up the availability

and affordability of private and state public programs coverage, in addition to state and federal stimulus

and financial supports, worked as intended.

At the same time, there are several ongoing concerns about access to insurance coverage and health care

services: First, one reason for the relative stability in coverage is unequal access to health insurance

through the job market. Industries and occupations with the largest job losses were less likely to offer and

subsidize job-based coverage. Among the uninsured Minnesotans are individuals who did not have access

to employment-based coverage and have since lost job-based income. It will be important to understand

why many are not taking advantage of public program coverage and to what extent lack of insurance

coverage affects access to needed health care services. The 2021 Minnesota Health Access Survey will

provide important information for policymakers by early 2022.

Second, we worry that the rising rates of COVID-19 infections since July 2020 and the ongoing economic

hardship experienced by many Minnesotans and businesses led to higher levels of uninsurance later in

2020. While the recent congressional action on stimulus funding and ongoing debate on further supports,

along with continued maintenance of coverage through state public programs, will be helpful to many, it

remains to be seen how sufficient these actions are under persistent economic pressure.

P A N D E M I C ’ S I M P A C T O N H E A L T H I N S U R A N C E C O V E R A G E

6

Lastly, the high and rising cost of health care, which affected many Minnesotans – even in strong

economic times – may further increase financial barriers Minnesotans face when trying to access needed

health care services. This is particularly concerning as many Minnesotans have delayed care during the

pandemic to avoid COVID-19 infection – national estimates suggest health care utilization between March

and May 2020 had fallen by as much as 50 percent compared with the previous year – and many may be

urgently looking to address those health care needs.

13

It is also concerning because affordability related

barriers are rooted in inequities: these barriers affect lower income individuals and the uninsured most

significantly, and they also disproportionately affect Minnesotans of color and American Indians. These

Minnesotans are also disproportionately affected by the pandemic, and many may be struggling with

long-term consequences of exposure to the virus. The inability to address those consequences may

represent additional harm beyond the existing economic hardships and exacerbate the challenges to

recover from the impact of the pandemic.

To help policymakers and the public understand how the coverage environment in Minnesota continues

to involve under the pandemic, MDH will conduct a number of follow-ups to our enrollment surveys. In

the second half of 2021, we will also conduct the next wave of the Minnesota Health Access Survey, in

partnership with the University of Minnesota School of Public Health, through which we will get a deeper

understanding of how Minnesotans experience access to health insurance and health care.

For more information on the data and methods, as well as a full table, see Supplement: Data and Methods

(https://www.health.state.mn.us/data/economics/docs/inscoverage2020methods.pdf )

Endnotes

1

Substantial resources, both federal and state, have been made available for COVID-19 testing and treatment, to limit

costs for individuals who contract or are exposed to the disease. Minnesota has a robust system of community testing,

including the ability to have a test mailed to your home, all available no cost.

2

This brief focuses on health insurance coverage, but there are other direct and indirect impacts of the pandemic on

economic and personal wellbeing, which may vary by demographic or economic characteristics, that need to be better

understood.

3

Minnesota access to health insurance coverage in 2015 and 2017, the two previous points-in-time when the MNHA was

conducted, were 95.7 percent and 93.9 percent, respectively.

4

The difference between the number of uninsured Minnesotans in 2017 and 2019 was statistically significant at the 95%

level. Significance testing is not conducted for comparison of estimates between the MNHA, a statistical probability

survey, and the enrollment data, because the latter represent estimates drawn from the full population, rather than a

sample.

5

The goal of the Premium Security Plan, created by the Minnesota Legislature in 2017, was to lower premiums

Minnesotans who purchase coverage in the individual insurance market. To do this, Minnesota reduces the financial

obligation of insurers by covering part of their expenses for high-cost health care claims (reinsurance).

6

The majority of the gains in individual market coverage, around 12,000 individuals, happened during the 2020 open

enrollment period between November 1 and December 23, 2019. However, while enrollment in MNsure usually declines

about 1 percent per month between February and July; in 2020, enrollment actually increased an average of 0.5 percent.

P A N D E M I C ’ S I M P A C T O N H E A L T H I N S U R A N C E C O V E R A G E

7

7

There are three exceptions to this policy under which individuals will lose Medical Assistance or MinnesotaCare

coverage: if they voluntarily end coverage, move out of Minnesota, or become deceased. The change was passed through

State Emergency Executive Orders 20-11 and 20-12. For more information, see: DHS Announces Temporary Policy

Changes to Minnesota Health Care Programs During the COVID-19 Peacetime Emergency

https://www.dhs.state.mn.us/main/idcplg?IdcService=GET_FILE&RevisionSelectionMethod=LatestReleased&Rendition=P

rimary&allowInterrupt=1&noSaveAs=1&dDocName=dhs-321263.

8

Bureau of Labor Statistics, 2020 Results of the Business Response Survey, Table 10; https://www.bls.gov/brs/2020-

results.htm accessed January 11, 2020.

9

Note that enrollment in the individual market can help consumers avoid a gap in insurance coverage while they are

between jobs. Individuals can also enroll year-round due to loss of job, a family change or other qualifying life events; this

is why the number of applicants is larger than the change in enrollment. Minnesotans may enroll in MinnesotaCare or

Medical Assistance at any time. More than 9,400 Minnesotans Enrolled in Private Health Insurance Coverage During

MNsure's COVID-19 Emergency Special Enrollment Period https://www.mnsure.org/news-

room/news/index.jsp#/detail/appId/1/id/429411.

10

The enrollment change compares total enrollment at two different time points. We cannot differentiate between

people who were new to Medical Assistance or MinnesotaCare and Minnesotans who would have lost coverage, but did

not due to maintenance of coverage provisions.

11

Minnesota Department of Health and SHADAC, 2019 Minnesota Health Access Survey.

12

Around 65,000 Minnesotans see their individual market premiums reduced through Advanced Premium Tax Credits

(APTC).

13

Cox, C. and Amin, K. “How have health spending and utilization changed during the coronavirus pandemic?” December

1, 2020; Peterson-Kaiser Family Foundation Health System Tracker. Accessed January 12, 2021 at How have health

spending and utilization changed during the coronavirus pandemic? https://www.healthsystemtracker.org/chart-

collection/how-have-healthcare-utilization-and-spending-changed-so-far-during-the-coronavirus-pandemic/.

Minnesota Department of Health

Health Economics Program

PO Box 64882

Saint Paul, MN 55164-0882

651-201-4520

www.health.state.mn.us/healtheconomics

2/2/2021

To obtain this information in a different format, call: 651-201-3550