CONSUMER FINANCIAL PROTECTION BUREAU | JUNE 2022

A Beginner’s Guide to

Accessing and Using

Home

Mortgage

Disclosure

Act

Data

1 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

Table of Contents

Table of Contents ........................................................................................................ 1

1. Purpose ................................................................................................................. 2

2. What are HMDA data? .......................................................................................... 3

2.1 Where to find HMDA data ....................................................................... 3

2.2 Who reports HMDA data ......................................................................... 4

2.3 HMDA data points .................................................................................... 5

2.4 Public access to HMDA data .................................................................... 5

3. Step-by-Step Guide .............................................................................................. 6

3.1 Using the Data Browser to filter and download a dataset ....................... 6

3.2 Using Excel to understand your data: Introduction to pivot tables ...... 10

3.3 Grouping in Excel ................................................................................... 16

3.4 Using the VLOOKUP function in Excel to match different datasets ..... 18

4. Conclusion .......................................................................................................... 28

2 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

1. Purpose

Mortgage lending data reported in accordance with the Home Mortgage Disclosure Act

(HMDA), commonly called “HMDA data,” is the largest source of publicly available data on

mortgage lending in the United States.

The purpose of this guide is to introduce this data to potential users who have little to no

experience with handling and analyzing raw data. This guide covers the basics of what HMDA

data are and how to access the data, as well as a step-by-step guide for using HMDA data. The

guide will instruct the beginner user how to find and download HMDA data, select subsets and

filters for the data, and begin to analyze the HMDA data using pivot tables, grouping data

together, and matching data across datasets. For these exercises, you will need a computer with

internet access and Microsoft Excel.

The methods described are examples only of how to understand the HMDA data and do not

describe all the ways the data can be used and understood. In addition, we caution against

drawing legal conclusions from a particular analysis suggested in this guide. Legal compliance

may depend on a variety of factors that may not be accounted for in an analysis provided using

the methods described here.

3 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

2. What are HMDA data?

The Home Mortgage Disclosure Act requires financial institutions to maintain, report, and

publicly disclose loan-level information about mortgages. These data help show whether lenders

are serving the housing needs of their communities; give a range of stakeholders information

that helps them make recommendations, decisions and policies; and shed light on lending

patterns that could be discriminatory. The CFPB modifies publicly released data to protect

applicant and borrower privacy.

HMDA was originally enacted by Congress in 1975 and is implemented by Regulation C.

1

HMDA

has been amended by Congress several times since it was enacted, and federal agencies have

issued multiple regulatory changes to Regulation C as well. Collectively, the Board of Governors

of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), the

National Credit Union Administration (NCUA), the Office of the Comptroller of the Currency

(OCC), and the CFPB comprise the Federal Financial Institutions Examination Council (FFIEC),

a governmental interagency body that facilitates public access to the data.

Over the years, amendments to HMDA and agency rulemakings have changed which financial

institutions are required to report, and the data they are required to report under HMDA.

2.1 Where to find HMDA data

HMDA data is available at https://ffiec.cfpb.gov/. They can be accessed by using:

• The HMDA Data Browser ; the entire static HMDA dataset or custom datasets and

summary tables are available at this site.

• The Dynamic National Loan Level Dataset.

These resources help provide additional background on the HMDA data:

• HMDA Public Data Fields with Values and Definitions

provides an overview of the fields

and the content.

• Public LAR Schema indicates the maximum length of each field.

1

12 C.F.R. Part 1003.

4 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

• HMDA “Getting It Right!” Guide is a comprehensive resource explaining what is

included in HMDA data, including the meanings of all fields and variables.

If you experience technical problems in accessing the p

ublic HMDA data, you can email

hmdahelp@cfpb.gov.

2.2 Who reports HMDA data

HMDA requires financial institutions

2

, including depository (e.g. banks) and non-depository

(e.g. non-bank mortgage companies) institutions, to report HMDA data. However, not every

institution that issues or originates a home mortgage is required by HMDA to report its

mortgage data.

For example, an institution must have had a home or branch office location in a metropolitan

statistical area (MSA) on the preceding December 31st in order to be covered by HMDA’s

requirements.

3

In this example, a non-depository financial institution is deemed to have a

branch office in an MSA if, in the preceding calendar year, it received applications for,

originated, or purchased five or more HMDA-reportable loans related to property located in that

MSA, even if it does not have an office in that MSA.

4

Similarly, the depository or non-depository institution must have originated at least 100 closed-

end mortgage loans in each of the two preceding calendar years or have originated at least 200

open-end lines of credit in each of the two preceding calendar years in order to be covered by

HMDA’s reporting requirements.

Other institutional coverage rules apply. A chart summarizing HMDA institutional coverage is

available here

. In addition, for those institutions that are covered, only loans that meet

Regulation C’s transactional coverage requirements must be reported.

5

A chart summarizing

HMDA transactional coverage is found here

.

2

Regulation C defines “financial institutions” at 12 CFR § 1003.2(g).

3

12 CFR 1003.2(g)(1)(ii).

4

12 CFR 1003.2(c)(2).

5

Regulation C’s transactional coverage criteria is generally found within the definition of “Covered Loan,” located at

12 CFR 1003.2(e) and the associated commentary.

5 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

2.3 HMDA data points

Financial institutions subject to HMDA’s requirements report up to 110 different data points for

each mortgage application they receive. Collectively, the data points for each application are

referred to as a “loan/application register” or “LAR.” Among the data points are loan type, loan

purpose, demographic information of the borrower or co-borrowers including race, ethnicity,

sex and age, the location of the dwelling, the action the financial institution took on the

application, the loan amount, the interest rate, any points and fees charged in connection with

the loan, and the property value.

For some transactions, a certain data point may not be applicable. For example, if a borrower

withdrew a mortgage application before the institution made a credit decision, the institution

would report the code for “not applicable” for the interest rate data point. HMDA also provides

that certain financial institutions may be eligible for partial exemptions for certain transactions.

If a financial institution is eligible for a partial exemption for a specific transaction, then the

financial institution is not required to collect, record, or report certain data points for the

transaction.

2.4 Public access to HMDA data

Financial institutions are required to submit annual HMDA LAR in electronic format by March 1

of the year following the calendar year for which the data are collected.

6

The CFPB releases the

data to the public on or before March 31 following data collection.

In order to protect borrower and applicant privacy, the publicly-released data exclude or modify

several data points reported by financial institutions, such as the universal loan identifier, the

date the application was received or the date shown on the application form, the address of the

property, the credit score or scores relied on in making the credit decision, and applicant

borrower or ethnicity free-form text field.

7

6

12 CFR 1003.5(a)(1)(i).

7

CFPB, Disclosure of Loan-Level HMDA Data, 84 FR 649 (Jan. 31, 2019). Note that the above is not a

comprehensive list of excluded data points.

6 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

3. Step-by-Step Guide

Below is a sample exercise to explain how to find, download, and begin to analyze available

HMDA data. You’ll need access to the internet and Microsoft Excel to follow this example.

In this exercise, we will use HMDA data to find out how many applications HMDA reporters in

Birmingham, Alabama received from minority neighborhoods. For the purpose of this exercise,

a minority neighborhood is a census tract where at least 50% of the residents are identified by

the U.S. Census Bureau as a racial or ethnic minority (i.e., Black or African American, Hispanic,

American Indian or Alaska Native, Asian, Native Hawaiian or Other Pacific Islander, or some

other race)

3.1 Using the Data Browser to filter and

download a dataset

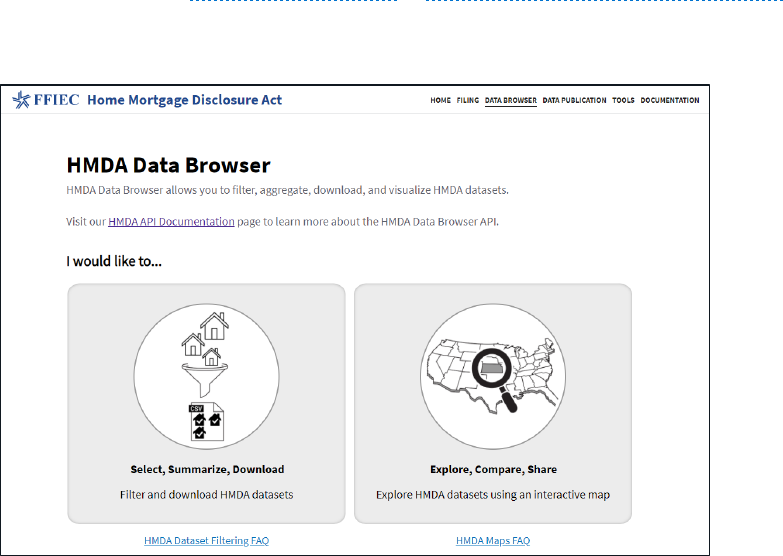

STEP 1: Go online and find the HMDA Data Browser at https://ffiec.cfpb.gov/data-browser/.

STEP 2: Click “Select, Summarize, Download”

7 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

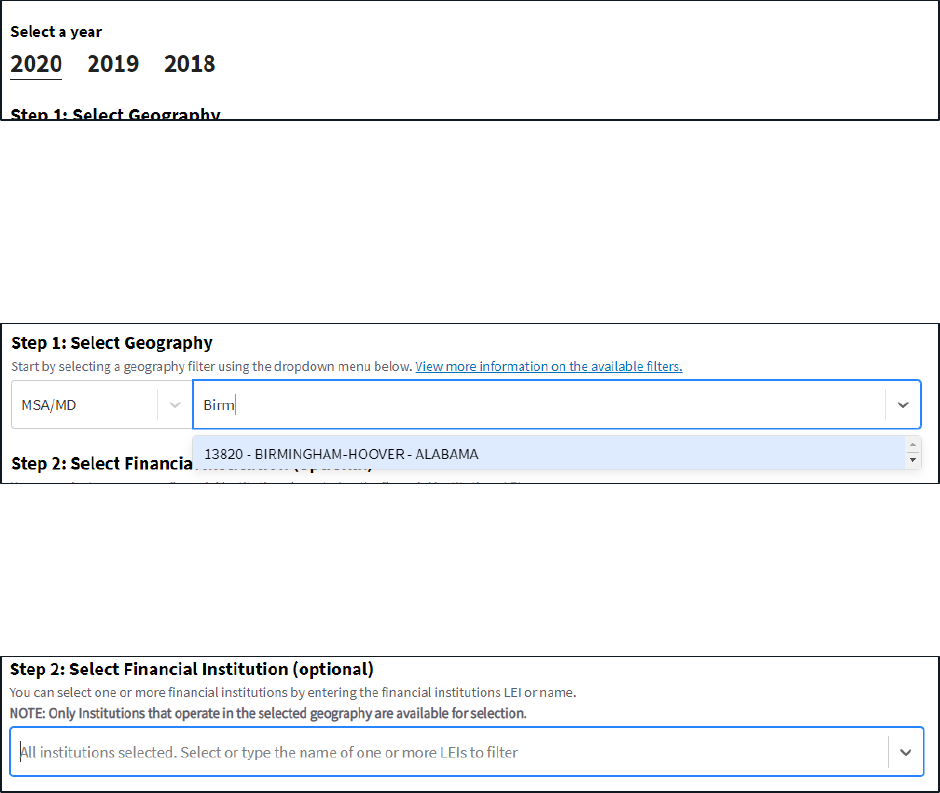

STEP 3: Select the year for which you want HMDA data. For our example, click 2020.

STEP 4: Select a Geography, by State, County, Metropolitan Statistical Area/Metropolitan

Division (MSA/MD), or Nationwide. For our example, select “MSA/MD” and start typing

“Birmingham,” and you will see the Birmingham-Hoover-Alabama MSA appear for selection.

STEP 5: Select one or more financial institutions, or leave it blank to see all financial institutions

that reported HMDA Data in that geography. For our example, leave this blank.

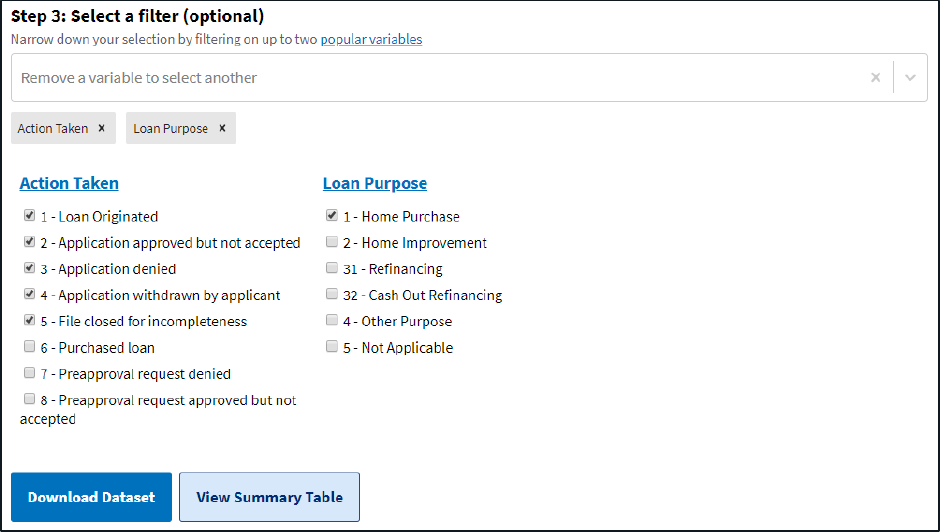

STEP 6: Select any filters. The filters you apply will directly affect the results you receive. When

selecting which filters to apply, you may consider:

• Am I interested only in originated loans? Or all applications? Or all HMDA records

including preapprovals and post-origination secondary market loan purchases? The

Action Taken filter will be helpful if these are concerns.

• Am I focused only on conventional loans? Or Federal Housing Administration (FHA),

Department of Veterans Affairs (VA), or Rural Housing Service (RHS) loans? Find the

Loan Type filter if these questions are important to your analysis.

8 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

• Am I interested in HMDA records only for purchasing a home? Or refinancing, home

improvement loans, or loans for other purposes? The Loan Purpose filter is helpful

here.

• Do I want to analyze only manufactured housing in my analysis? Find the Construction

Method filter for this.

For our example, both “Action Taken” and “Loan Purpose” filters are selected.

Selections for each filter will appear. For our example, under the Action Taken column, select

Loan Originated, Application approved by not accepted, Application denied, Application

withdrawn by applicant, and File closed for incompleteness. Under the Loan Purpose column,

select Home Purchase.

9 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

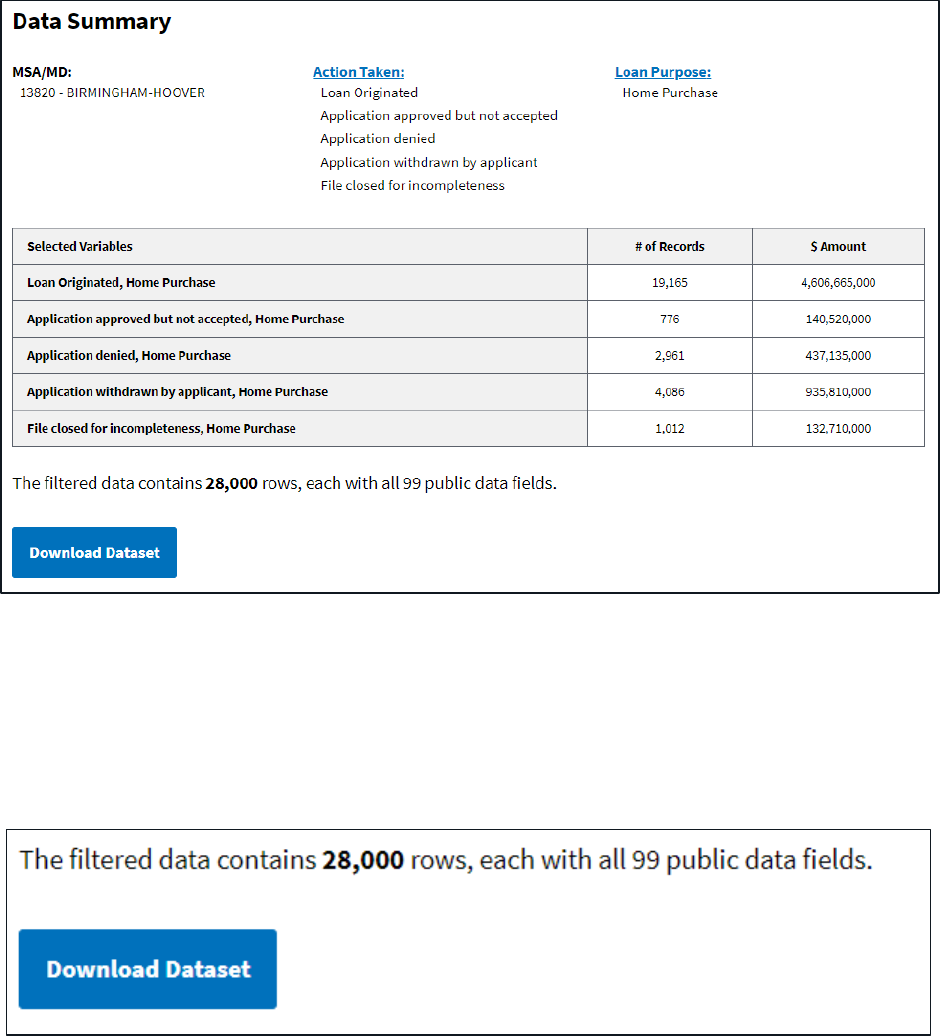

STEP 7: Click “View Summary Table” to see a summary of the data you are about to download.

Make sure that the total record count does not exceed Excel’s capacity (which is normally a few

hundred thousand records). Beyond this number, you will need other software to download and

analyze the data. Here is the summary that will appear, based on the choices you made thus far:

STEP 8: Next, you can click the “Download Dataset” button to download the dataset to conduct

further analysis. The default download is into a comma separated values (CSV) file that can be

opened and used in Excel and similar types of software. Note that it may take a few minutes to

download the file.

10 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

3.2 Using Excel to understand your data:

Introduction to pivot tables

One way to work with large amounts of HMDA data in a manageable way is with “pivot tables”

in Microsoft Excel. There are many online resources to learn how to use Excel, including

free

tutorial videos.

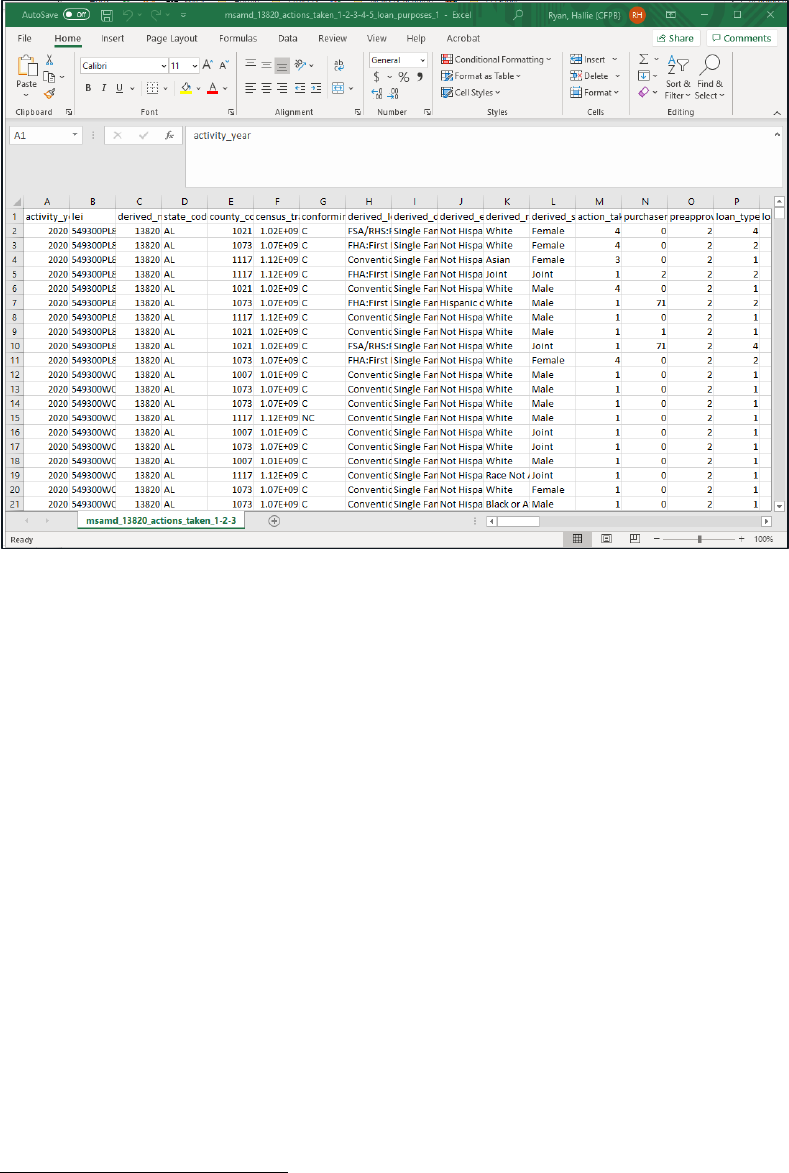

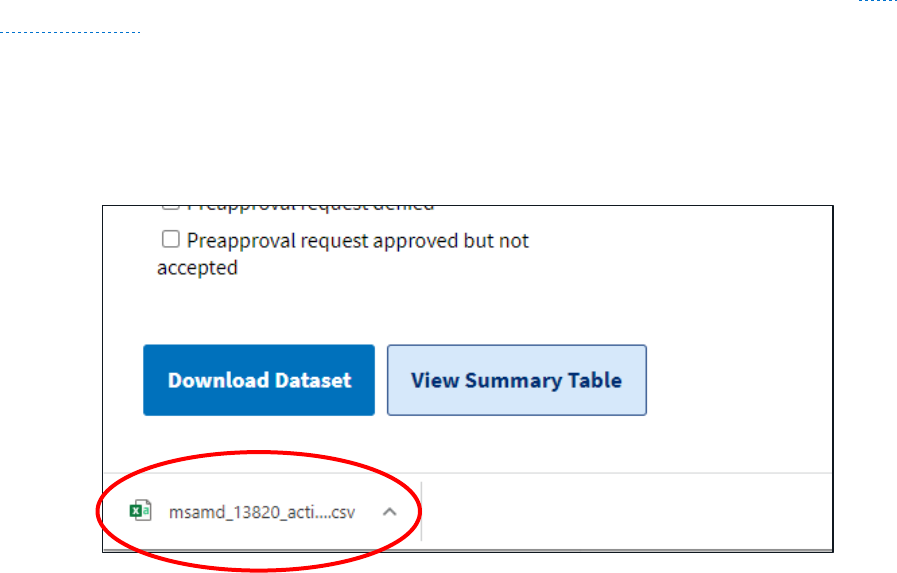

STEP 1: Open the CSV file you just downloaded by clicking on Excel file that appears in the

lower left hand of your screen after you click the “Download Dataset” button.

12 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

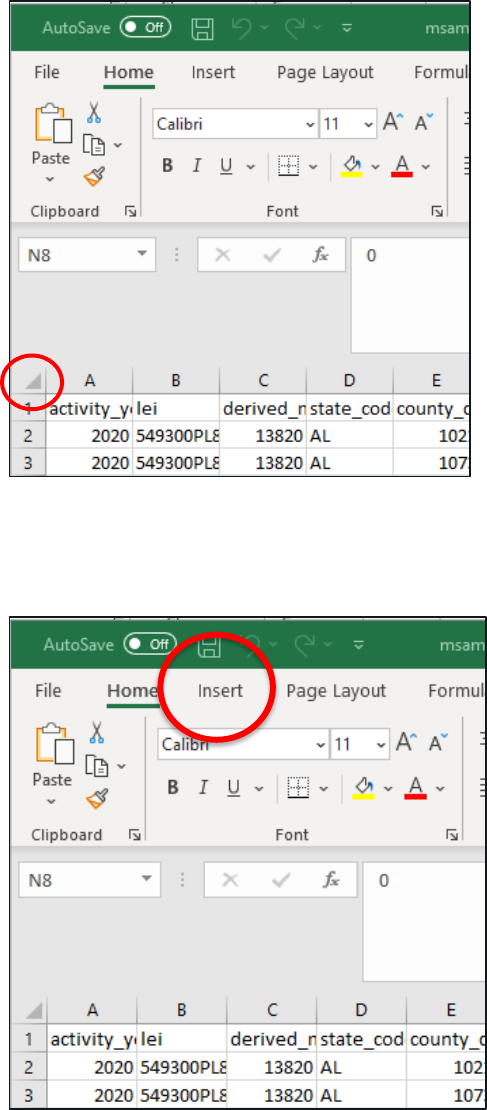

STEP 2: Click on the triangle in the upper left-hand corner of the table. This will select all of the

data in the file.

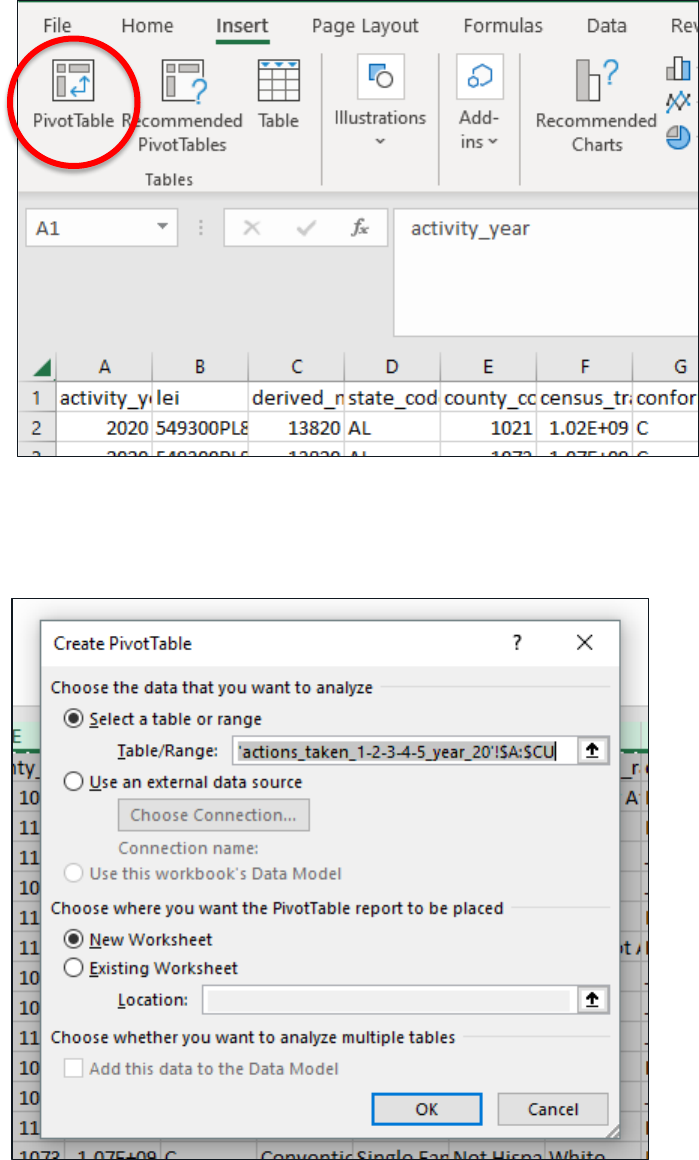

STEP 3: Click “Insert”

13 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

STEP 4: Click “Pivot Table.”

You will see a dialog box pop up:

14 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

If you are new to using pivot tables, use all of the pre-selected default settings and click “OK.”

With experience, you may want to consider changing some of these settings.

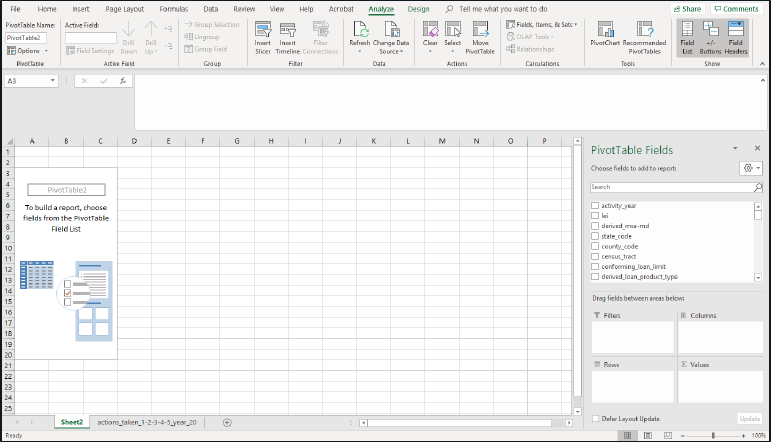

The pivot table will open in a new tab and will look like this:

15 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

STEP 5: Using the PivotTable Fields section

appearing along the right side of your screen, select

and drag the fields you want into the rows,

columns, and values section to see summary tables

of your dataset.

For this example, we want to determine the number

of applications that each lender in the Birmingham

MSA received from minority neighborhoods. To do

so, you will need the unique identifier for each

financial institution—called the Legal Entity

Identifier (LEI). To add it, click on the “lei” field

and drag into the “Rows” box below.

To find whether an application came from a

minority census tract, select the

“tract_minority_pop_percent” field and drag that

in the “Columns” box.

Finally, you will need to select the “Values” you

want displayed in the pivot table. Here, we are

going to select LEI because each application will

have that value. Click and drag “lei” to the Values

box.

The Custom Name should pre-populate with

“Count of lei” (as in the photo immediately

above) but if it displays something different,

click on the small down arrow to the right

and select “Value Field Settings.” A box will

appear. Select “Count” from the list of

options and click “OK.”

16 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

3.3 Grouping in Excel

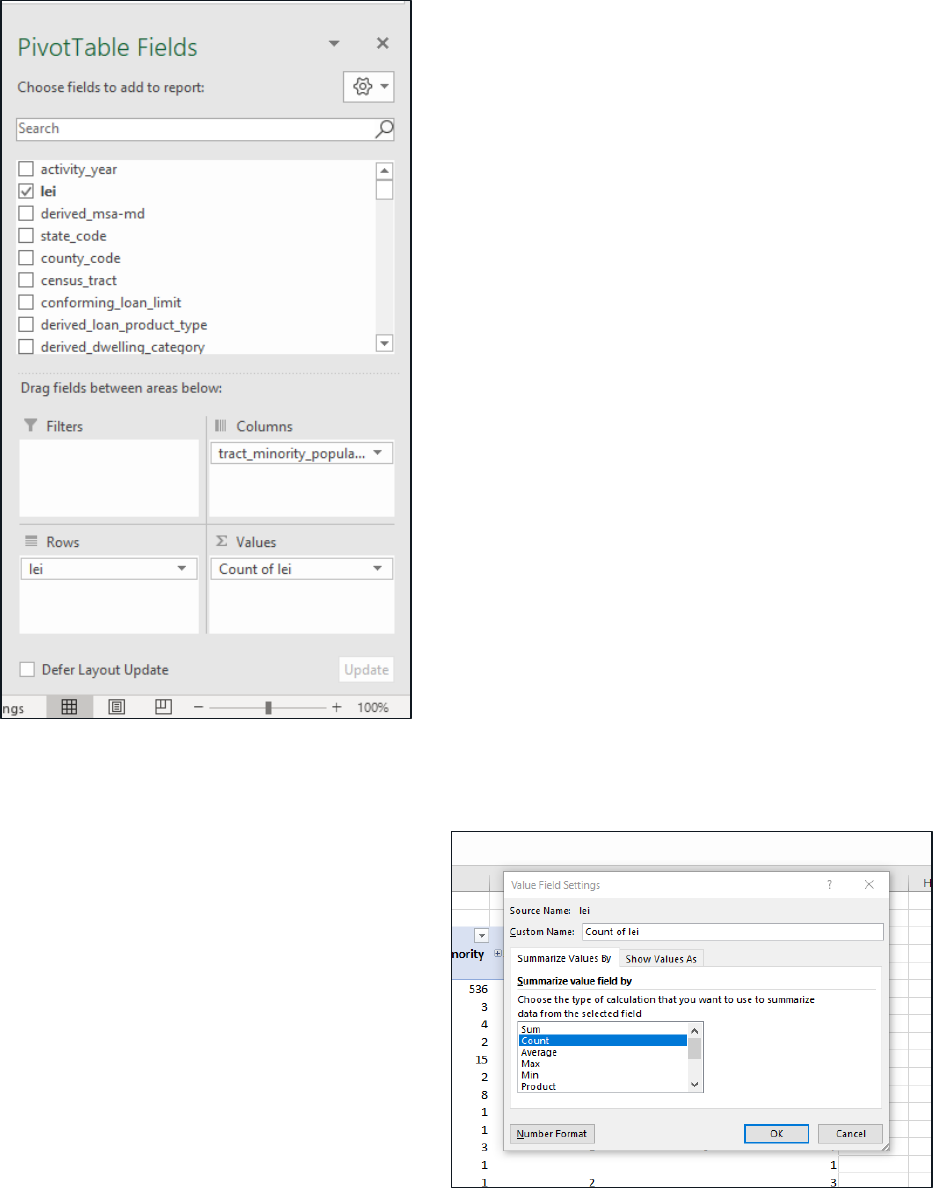

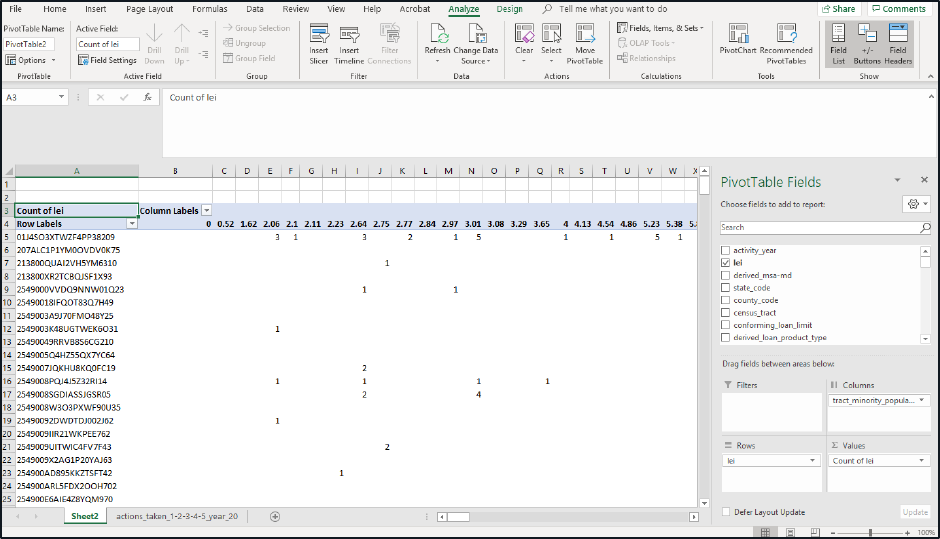

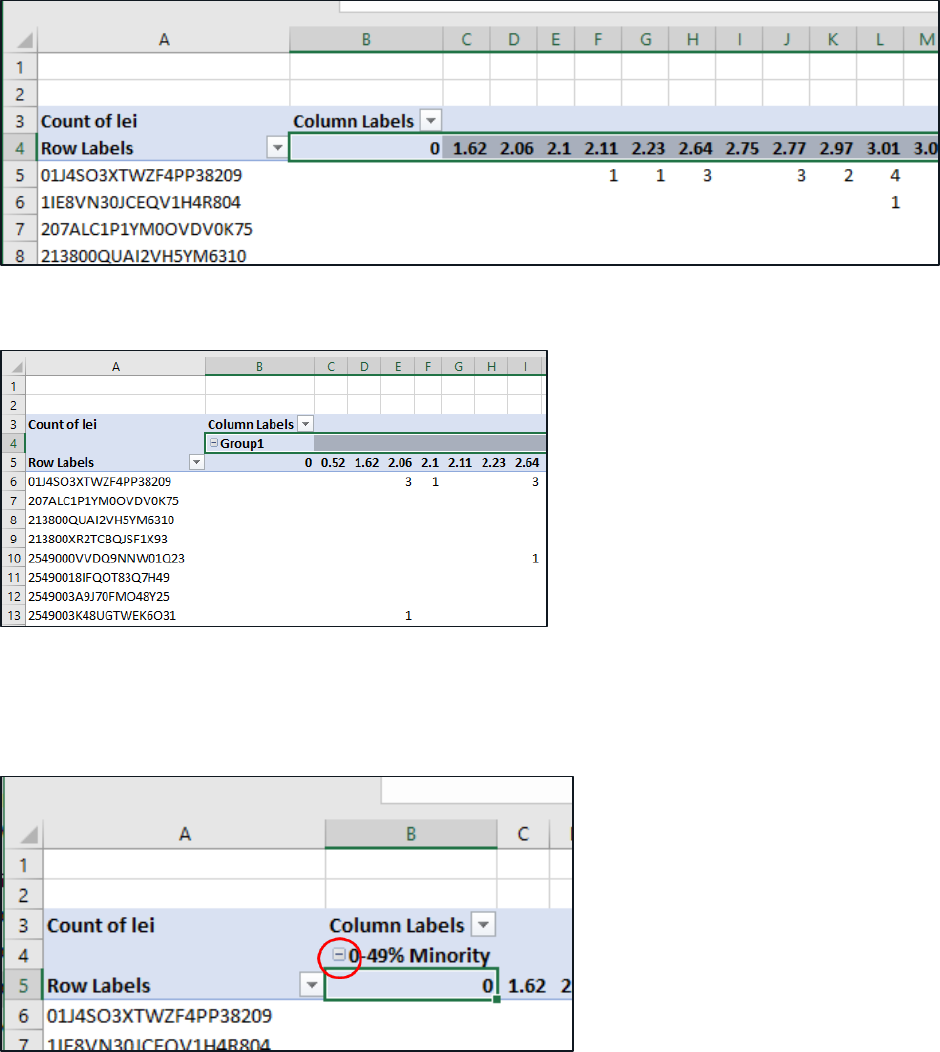

At this point, you should see a table something like the one below. Each column represents a

census tract identified with its percentage of minority residents. Each row represents a mortgage

lender who reported loans for the Birmingham MSA. The values in the table represent how

many applications were received and loans were originated in each census tract by each lender.

To better visualize the data, you can group data together in Excel. In this example, we will group

the “tract minority population” columns to analyze whether loan applications are coming from

low minority neighborhoods (0-49% minority), majority minority neighborhoods (50-79%

minority), or high minority neighborhoods (80-100% minority).

17 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

STEP 1: Select all of the values that you want to group together. In this case, for the first group

that includes census tracts for what we are calling low minority neighborhoods (meaning 0-49%

minority), click and drag your cursor on the values in the “Row Labels” rows from 0 all the way

up to (but not including) 50. Right click on the selected group, and select “Group.”

A new row will appear with a place to name that group.

Click on the cell that says “Group1” and insert your new group name. You may want to refer to it

as “0-49% Minority.” Click on the minus sign to collapse the table and consolidate all of the

values that you just grouped together into the new “0-49% Minority” column.

18 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

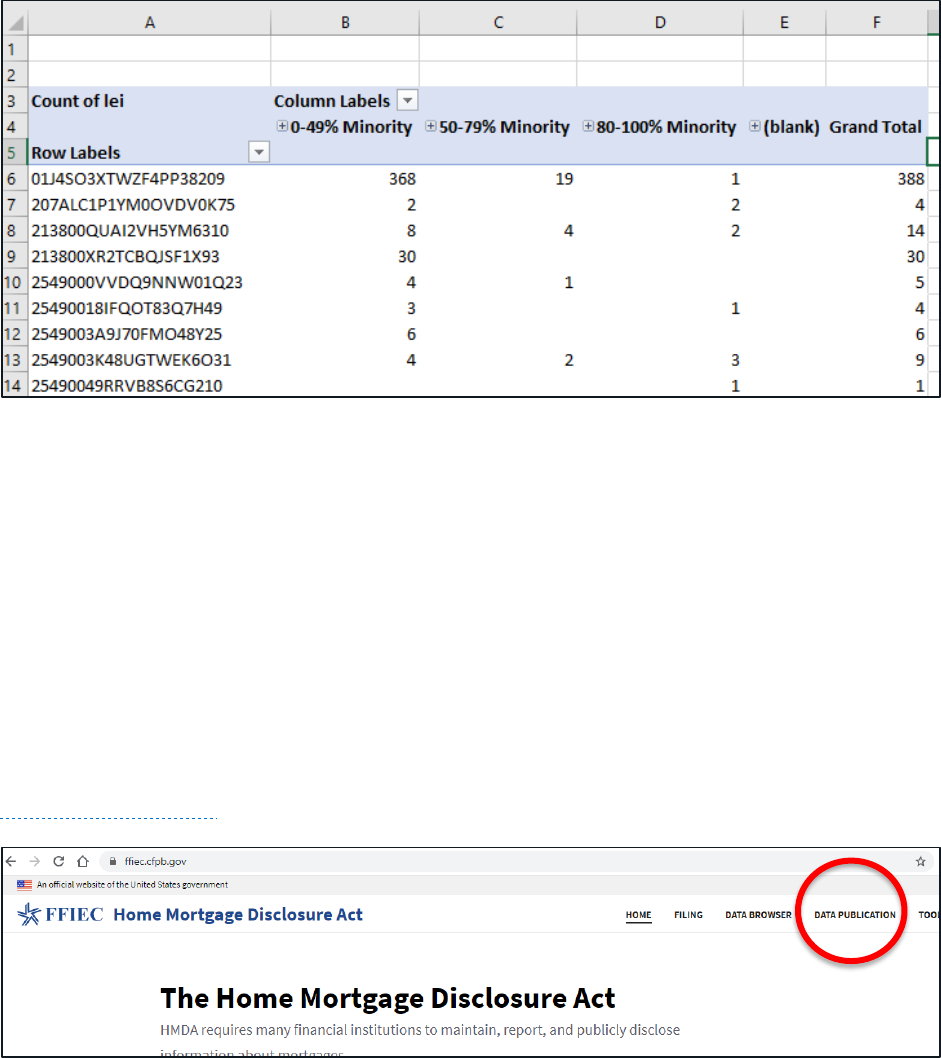

STEP 2: Repeat this step with the other minority groupings for 50-79% and 80-100%. This will

result in a list of each financial institution (by LEI) and the number of applications they received

from minority neighborhoods.

However, the HMDA data only have the legal entity identifier (LEI), not the institution name.

3.4 Using the VLOOKUP function in Excel

to match different datasets

In order to see the names of all the institutions, you may use the VLOOKUP function, which

matches data in your dataset with another.

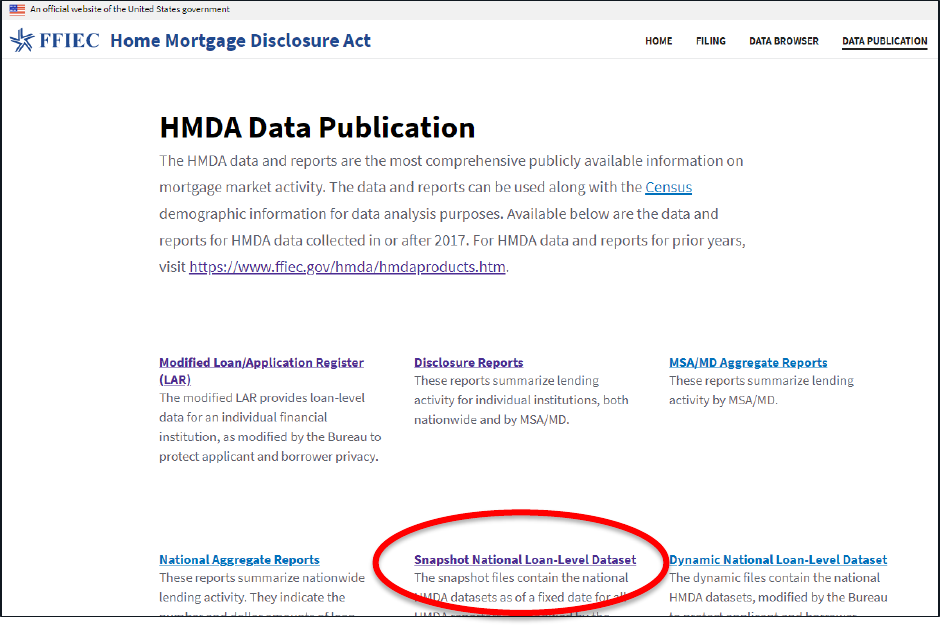

STEP 1: First, you need to find the dataset with institution names that you want to use to match

to the LEI in your spreadsheet. This can be found in the HMDA transmittal sheet. Go back to

https://ffiec.cfpb.gov/

and select “Data Publication.”

19 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

Then select “Snapshot National Loan-Level Dataset.”

20 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

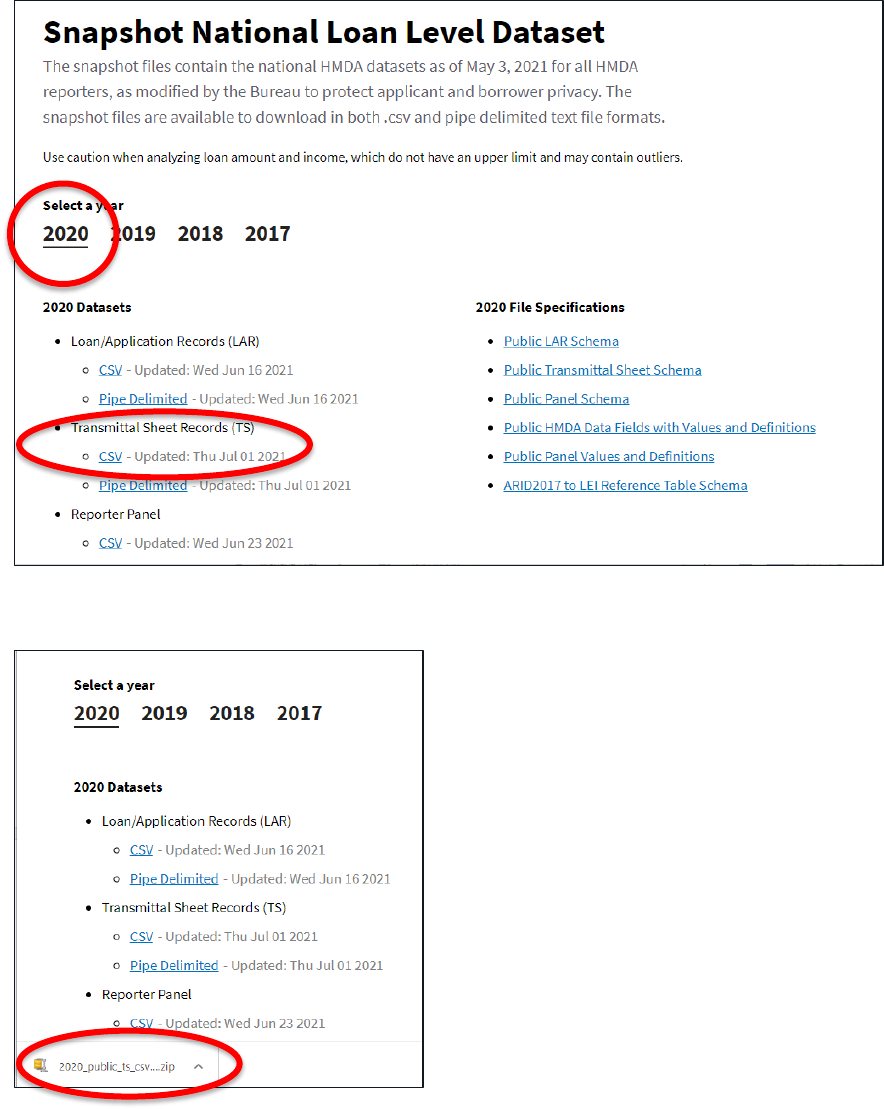

Select the year (and make sure that you are using HMDA data from the same year). For our

example, click “2020.”

Select the Transmittal Sheet (TS) CSV file to download.

This file will download into a zip file. Open and unzip the file.

21 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

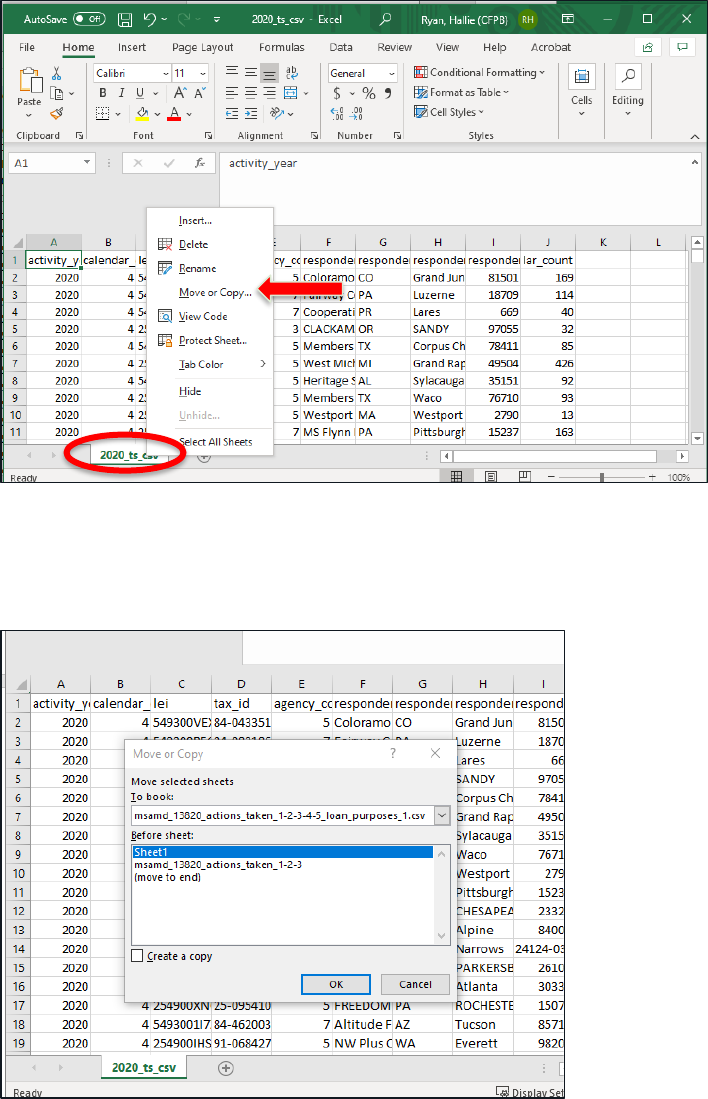

STEP 2: Move the new file into the original file you used to build your pivot table as a new tab.

Do that by right clicking on the tab at the bottom of the spreadsheet labeled “2020_ts_cvs.”

Then click “Move or Copy.”

For the top box, you want to move the selected sheet to book “msa_13820 …” For the “Before

sheet” box, it does not matter where you move it to as long as you can keep track of the sheets,

but for ease, choose “move to end.” Click “OK.”

22 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

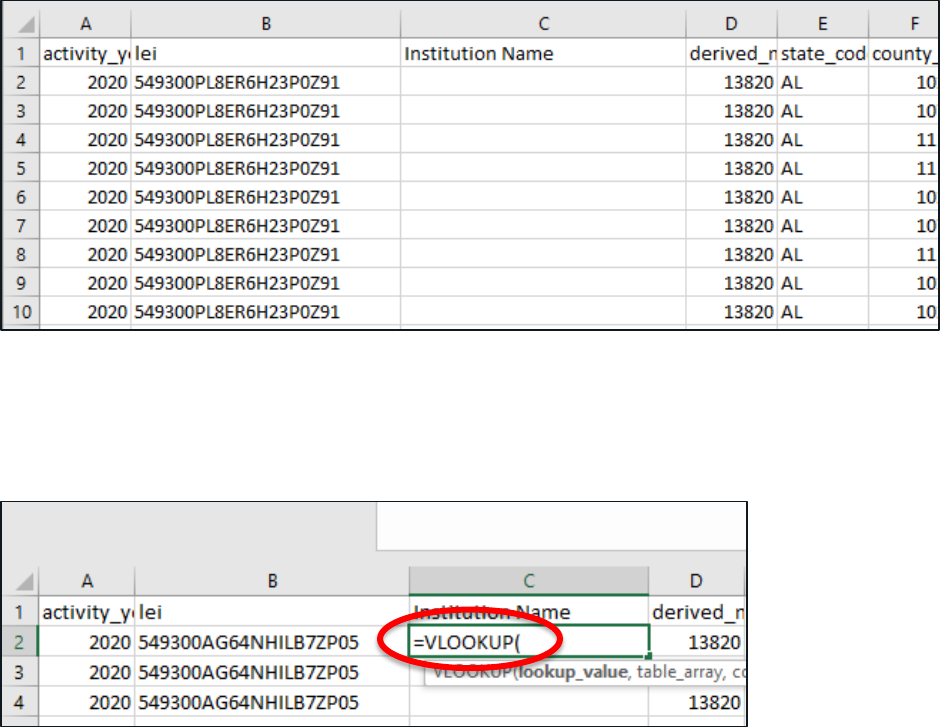

STEP 3: In the original data sheet, called “msamd_13820 …”, insert a blank column where you

want to add the name of the financial institution. Right click on the column, select “Insert

Column.”

STEP 4: Name the column (e.g., “Institution Name”).

STEP 5: Begin typing the VLOOKUP statement (=VLOOKUP) in the first empty cell below the

column header.

When you enter the formula into Excel, you will need to include four parts:

1. Lookup value (what field are you using to match between the datasets)

2. Table array (where should Excel look in order to find the new data)

3. Column index number (which column should the new data come from)

4. Range lookup (you can just write “false” here until you get more advanced with Excel)

STEP 6: Select as the lookup value the “lei” (Legal Entity Identifier) by simply clicking on the B2

cell (or by typing “B2”). Type a comma and a space.

23 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

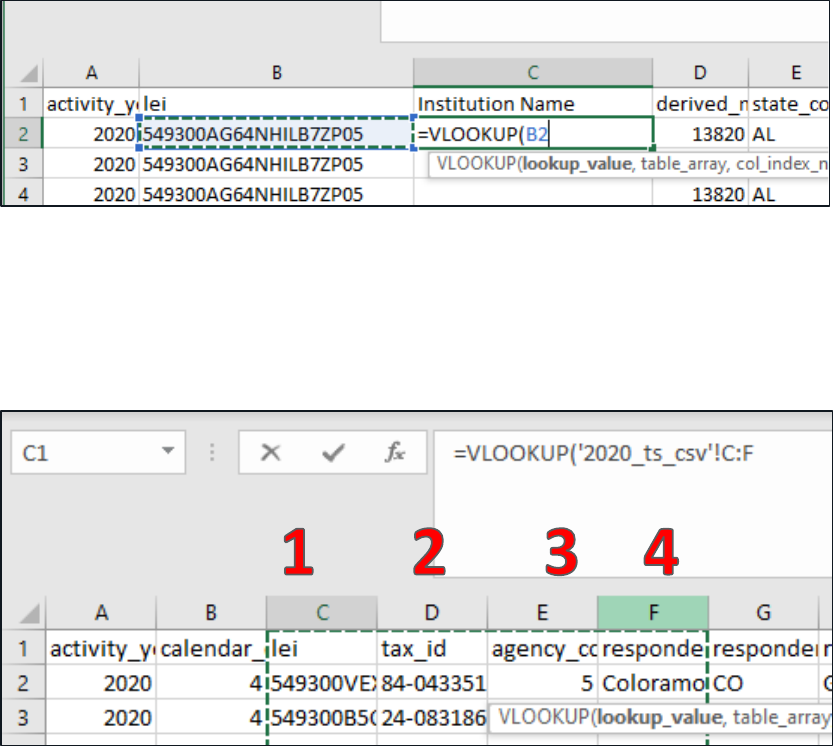

STEP 7: Select the Table Array – Navigate to the “2020_ts_csv” sheet and select the columns

where Excel should be matching the LEI and the institution’s name. For our example, select four

columns, from “lei” to “respondent_name,” by clicking on the “C” and drag your cursor to “F.”

Type a comma and a space.

24 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

STEP 8: Now add the column of those selected where the name can be found, in this case

column 4 by typing “4”. Type a comma and a space.

For the last part of the VLOOKUP, just type “FALSE.” Your complete command should read:

=VLOOKUP(B2, ‘2020_ts_csv’!C:F, 4, FALSE).

Hit enter to submit the formula and you will be able to see the matched entity name.

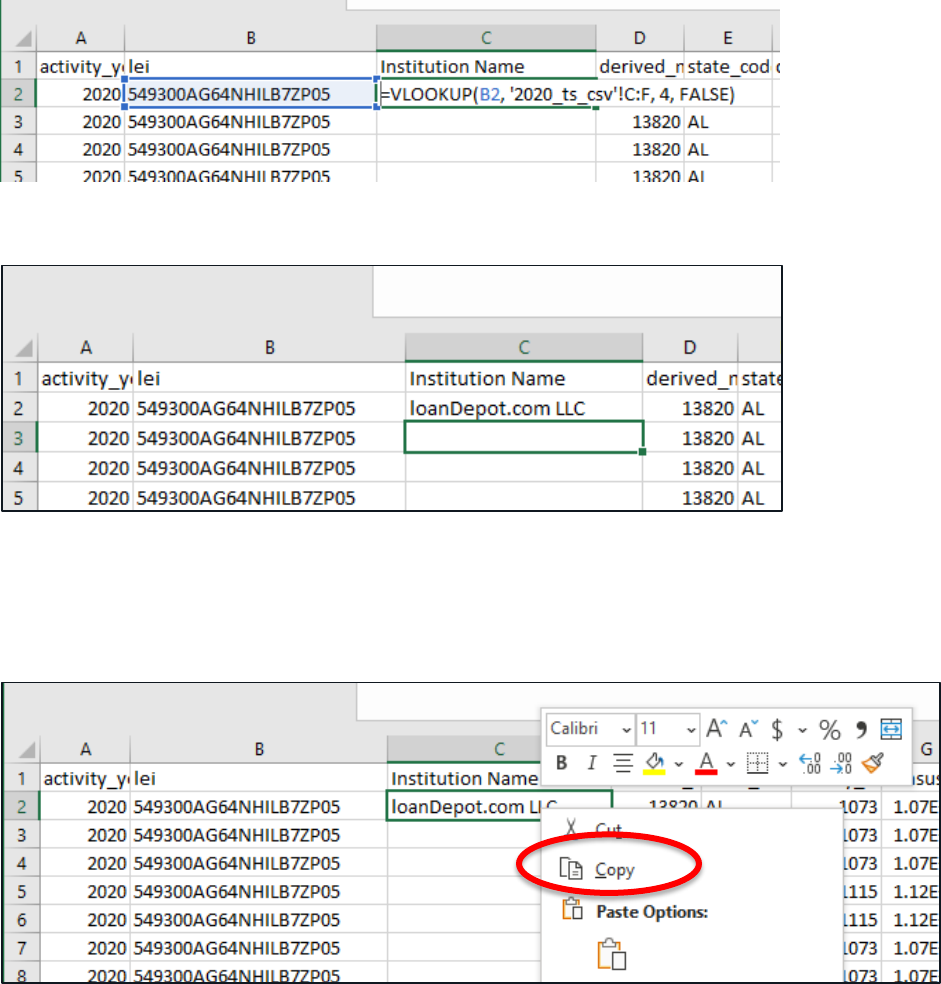

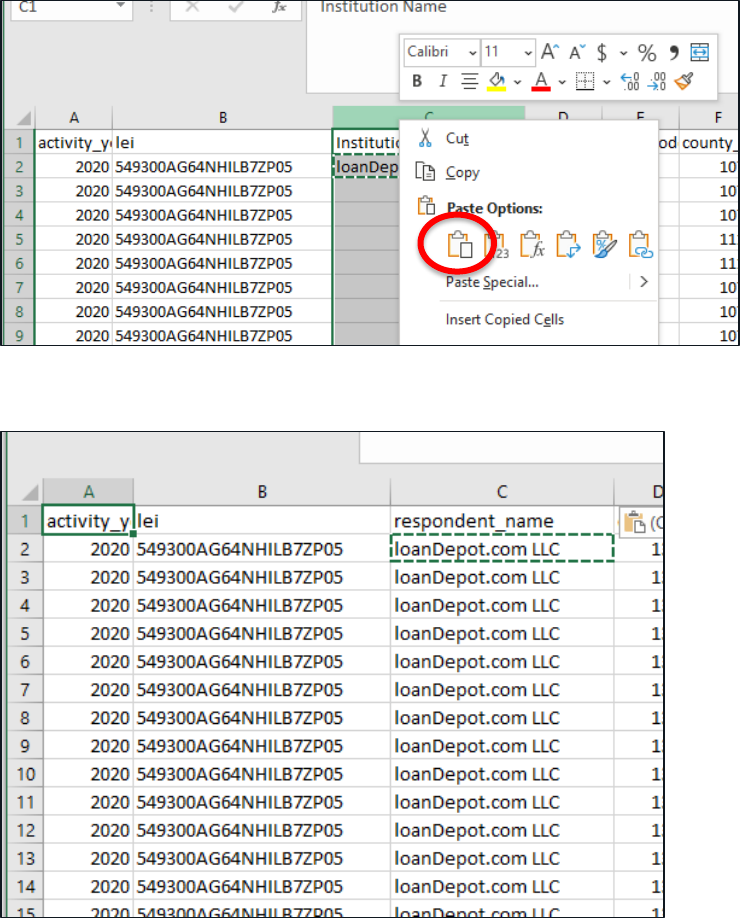

STEP 9: Paste the formula into the entire column to match all names. Right click on the cell with

the formula (cell C2) and select “Copy” (note: you can also copy by typing Ctrl + C)

25 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

Then right click on the column header “C” and select the Paste icon.

You should now have the name of the institution in column C.

26 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

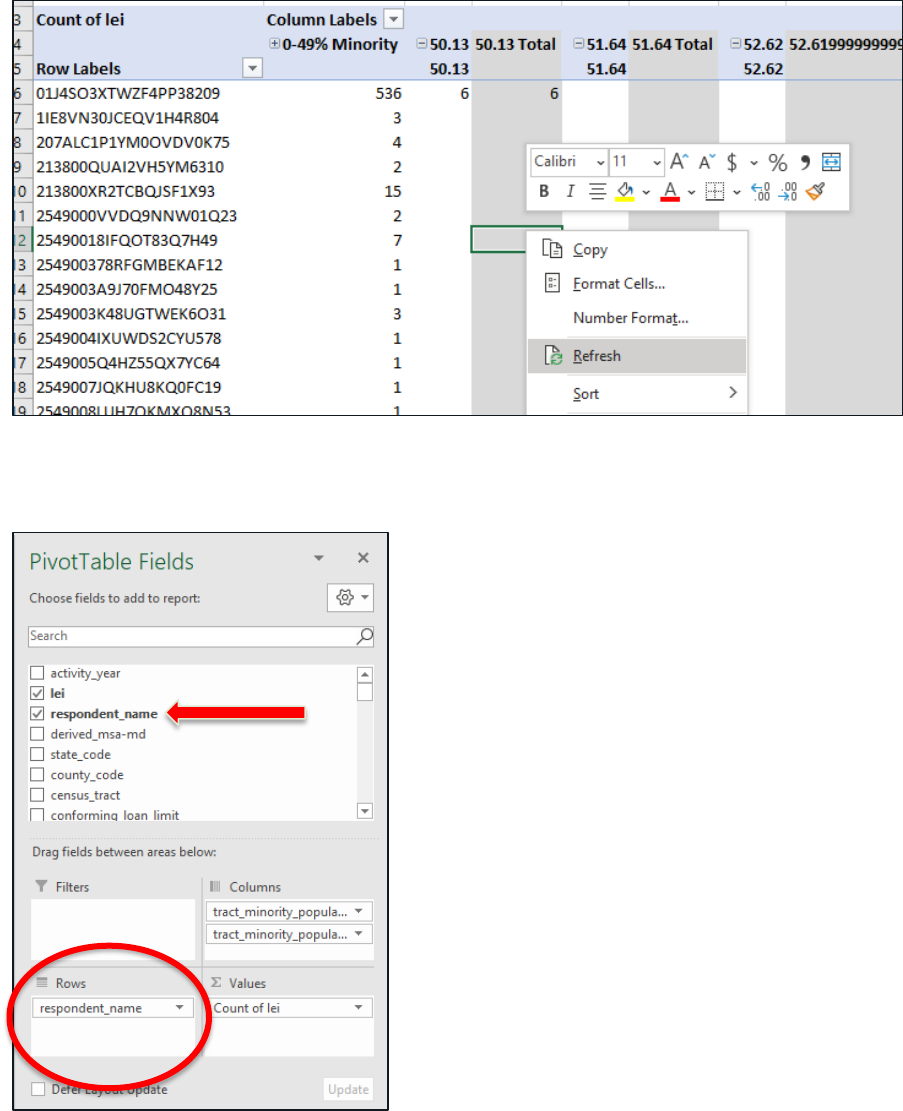

STEP 10: To update your pivot table so that the names of the institutions appear in place of the

LEIs, go to the pivot table sheet (here called “Sheet1”). Right click anywhere on the table and

select “Refresh.”

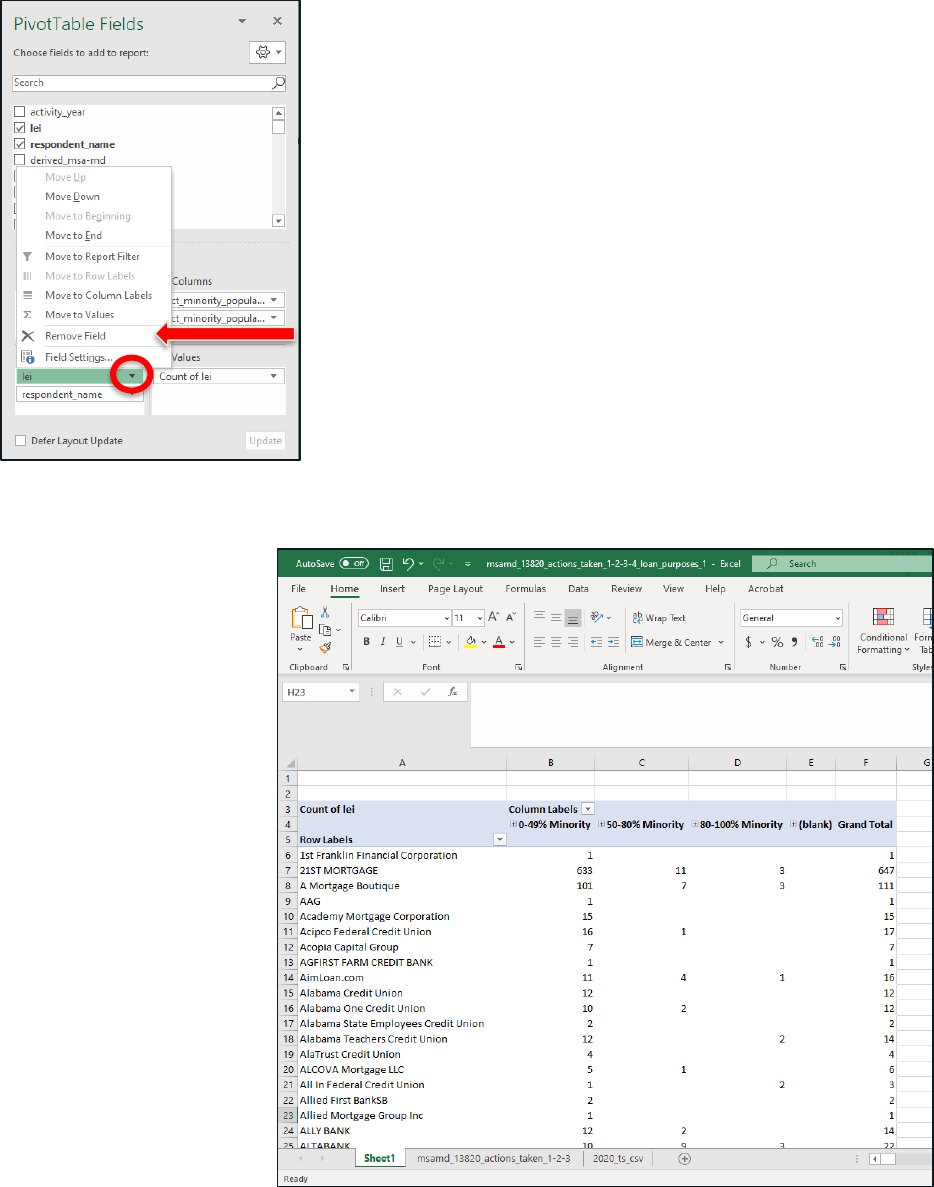

STEP 11: Click on your new “name” field (called “respondent_name”) and drag it to the “Rows”

box to replace the LEI with the institution names.

27 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

You may need to click on the small black arrow next to “lei” in

the Rows box and select “Remove field” in order to remove the

“lei.”

Your final pivot table should look something like the below.

This table may be more

user-friendly than the one

downloaded originally.

The rows of the table

represent each HMDA-

reporting financial

institution with mortgage

lending activity in the

Birmingham MSA during

2020. The grouped

columns are low-,

majority-, and high-

minority census tracts,

and the table numbers

represent the number of

mortgage applications and

originations in each group

of tracts.

28 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

4. Conclusion

We hope users have found this guide useful in understanding how HMDA data may be accessed

and analyzed using widely available technology tools. In addition to the techniques described

here, we encourage users to explore the many resources provided for HMDA reporters and users

alike. FFIEC’s HMDA Maps tool

allows you to explore and visualize online subsets of HMDA

data, filtered by popular variables. The CFPB also has an array of webinars for HMDA data users

available on YouTube at

https://www.youtube.com/user/cfpbvideo/videos.

Given the importance of accurately reported HMDA data to the CFPB’s fair lending mission, the

CFPB maintains a comprehensive suite of resources on its public website to help filers fulfill

their reporting requirements under HMDA and Regulation C and allowing others to evaluate

and study mortgage lending. These resources include: an Executive Summary of HMDA rule

changes;

9

Small Entity Compliance Guide;

10

Key Dates Timeline;

11

Institutional and

Transactional Coverage Charts;

12

Reportable HMDA Data Chart;

13

sample data collection

form;

14

and FAQs,

15

in addition to downloadable webinars,

16

which provide an overview of the

HMDA rule. The CFPB also provides on its website an interactive version of Regulation C that is

easier to access and navigate than the printed version of Regulation C.

17

9

Consumer Fin. Prot. Bureau, Executive Summary of the 2020 Home Mortgage Disclosure Act (Regulation C) Final

Rule (Apr. 16, 2020),

https://files.consumerfinance.gov/f/documents/cfpb_hmda_executive-summary_2020-

04.pdf.

10

Consumer Fin. Prot. Bureau, Home Mortgage Disclosure (Regulation C) Small Entity Compliance Guide (May

2020), https://files.consumerfinance.gov/f/documents/cfpb_hmda_small-entity-compliance-guide.pdf.

11

Consumer Fin. Prot. Bureau, HMDA Rule Key Dates Timeline, January 1, 2020 to December 31, 2022,

https://files.consumerfinance.gov/f/documents/cfpb_hmda-key-dates-timeline-2020-2022.pdf.

12

Consumer Fin. Prot. Bureau, HMDA Institutional Coverage Chart,

https://www.consumerfinance.gov/documents/9568/cfpb_2020-hmda-institutional-coverage_03-2021.pdf

;

Consumer Fin. Prot. Bureau, HMDA Transactional Coverage Chart,

https://www.consumerfinance.gov/documents/8724/cfpb_2020-hmda-transactional-coverage.pdf.

13

Consumer Fin. Prot. Bureau, Reportable HMDA Data: A Regulatory and Reporting Overview Reference Chart for

HMDA Data Collected in 2021, https://files.consumerfinance.gov/f/documents/cfpb_2021-reportable-hmda-

data.pdf

14

Consumer Fin. Prot. Bureau, Sample Data Collection Form,

https://files.consumerfinance.gov/f/documents/201708_cfpb_hmda-sample-data-collection-form.pdf.

15

Consumer Fin. Prot. Bureau, Home Mortgage Disclosure Act FAQs,

https://www.consumerfinance.gov/compliance/compliance-resources/mortgage-resources/hmda-reporting-

requirements/home-mortgage-disclosure-act-faqs/.

16

Consumer Fin. Prot. Bureau, HMDA Webinars, https://www.consumerfinance.gov/compliance/compliance-

resources/mortgage-resources/hmda-reporting-requirements/webinars/.

17

See, Interactive Bureau Regulations, Regulation C, https://www.consumerfinance.gov/rules-

policy/regulations/1003/.

29 A BEGINNER’S GUIDE TO ACCESSING AND USING MORTGAGE LENDING DATA

Together with the FFIEC, the CFPB also routinely updates its HMDA resources throughout the

year to ensure HMDA reporters have the most up-to-date information. The agency also works

with the FFIEC to publish data submission resources for HMDA filers and vendors on its

Resources for HMDA Filers

website.

In addition, HMDA users and reporters can ask questions about HMDA and Regulation C,

including how to submit HMDA data, by emailing the CFPB’s HMDA Help at

HMDAHelp@cfpb.gov. The agency also offers financial institutions, service providers, and

others, informal staff guidance on specific questions about the statutes and rules the CFPB

implements, including ECOA and Regulation B and HMDA and Regulation C, through its

Regulation Inquiries platform.